Greek Election Result Fails to Help Silver

Commodities / Gold and Silver 2012 Jun 20, 2012 - 07:30 AM GMTBy: Clive_Maund

The outcome of the Greek vote at the weekend was not favorable for the markets, or for Precious Metals in particular. This is because it did not precipitate an immediate worsening of the acute crisis in Europe, and thus did not create the pressure needed to bring forward the major QE that must eventually come in order to delay Europe's eventual complete collapse. Why then have markets not caved in already? - because investors are "smoking the hopium pipe" and waiting for the Fed to pull a rabbit out of the hat at Wednesday's FOMC meeting, by making positive noises to the effect that QE3 is ready to be rolled out. What is likely to happen instead is that they will come out with the same old line about "being ready to act when the SHTF" but other than that remain vague and non-commital. If this is what they do then markets are likely to throw a tantrum and sell off, and the charts are indicating that it could be hard.

The outcome of the Greek vote at the weekend was not favorable for the markets, or for Precious Metals in particular. This is because it did not precipitate an immediate worsening of the acute crisis in Europe, and thus did not create the pressure needed to bring forward the major QE that must eventually come in order to delay Europe's eventual complete collapse. Why then have markets not caved in already? - because investors are "smoking the hopium pipe" and waiting for the Fed to pull a rabbit out of the hat at Wednesday's FOMC meeting, by making positive noises to the effect that QE3 is ready to be rolled out. What is likely to happen instead is that they will come out with the same old line about "being ready to act when the SHTF" but other than that remain vague and non-commital. If this is what they do then markets are likely to throw a tantrum and sell off, and the charts are indicating that it could be hard.

How does this square with our bullish stance toward silver in the recent past? - well, it doesn't. We have been strongly positive on silver in the recent past for 2 big reasons. One is the proximity of a very strong support level that has reversed the price to the upside twice since last September, and the other is the highly favorable COT picture. However, pattern development has been unfavorable in recent weeks, with key support at the key $26 - $27 continuing to be eroded and the COTs have started to deteriorate noticably. These developments put us on notice that a nasty surprise may be just around the corner.

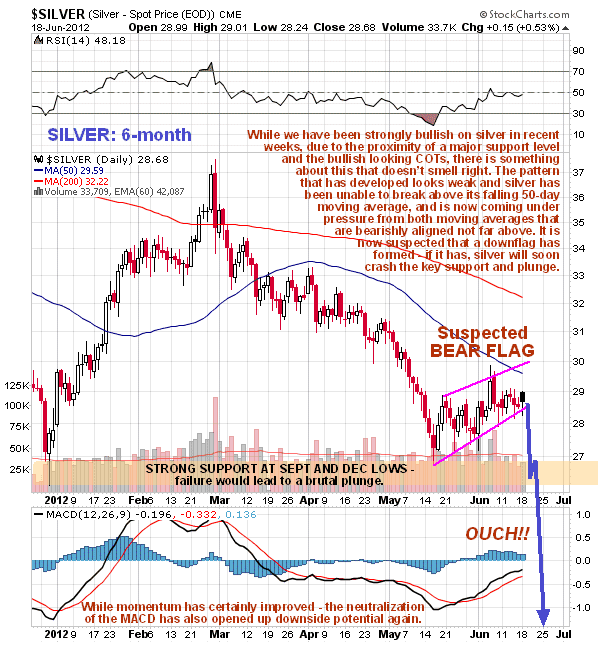

On silver's 6-month chart we can see that it has failed to gain traction and establish itself above its 50-day moving average and thus get away from the danger zone, and now this average and the 200-day, which are bearishly aligned, are descending on the price from above and pressuring it increasingly to crash the key support - the pattern that has formed since the mid-May low now looks like a potential bear Flag, and if this is what it is then a sudden severe downleg is likely to occur soon that will crash the key support, and given the huge importance of this support, such a development can be expected to lead to a vertical plunge. How far will silver drop if this support fails? - let's now look at the 3-year chart to see.

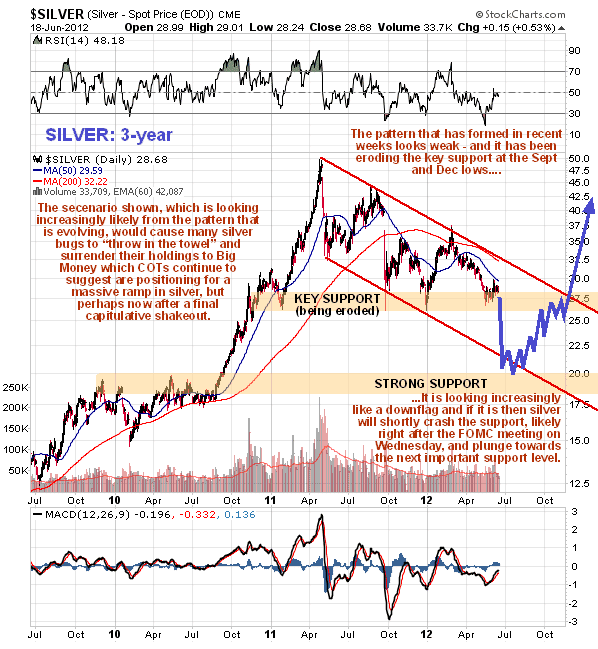

The 3-year chart for silver shows that since the April - May 2011 blowoff top, it has been in a quite orderly major downtrend, and we can readily see that the downside target on failure of the nearby key support is defined by the lower boundary of this downtrend at about $20 - $21, which fits nicely with the next zone of major support arising from the extensive trading just below $20 in 2009 and 2010 coming into play as $20 is approached. From all this we can reasonably conclude that the downside target for silver on failure of the nearby support is about $20 - $21, although a vertical plunge may briefly take it below this level - if it does jump in with both feet, for this should be the final bottom, as QE is not off the table at all, just delayed.

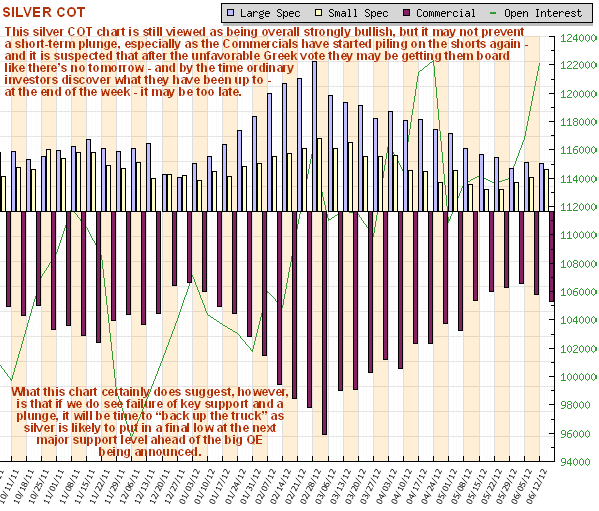

The recent silver COT has been hugely bullish, although it didn't end up producing much of a rally. However, over the past couple of weeks it has gotten less so as the Commercials have started to build up short positions again - and it is suspected that early this week, after the unfavorable (for markets) Greek vote, they may well be piling them on ahead of the FOMC meeting this Wednesday. This does not augur well at all for the short-term. Nevertheless it is important to keep in mind that overall this silver COT is still strongly bullish, so the scenario that now looks likely is a near-term failure of support and plunge into what should prove to be a final bottom in the $20 - $21 area ahead of the major uptrend that will be activated by the mega QE that must occur to save Europe from collapsing into total chaos.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.