The Right Regulatory Formula for Markets

Companies / Market Regulation Jun 17, 2012 - 02:17 AM GMTBy: Frank_Holmes

Last weekend, I had the chance to experience the thrill of Formula 1 Grand Prix du Canada in Montreal. Seeing the incredible fluidity and flexibility of every race car, it got me thinking about how F1 has evolved over the past 60 years. Cars are now aerodynamic like a jet fighter, designed with wings that use the same principle as an aircraft and tires that withstand tremendous forces. Even with all these incredible advancements in technology, rules and regulations have been streamlined to reduce costs and improve safety. Since 1994, there hasn't been a fatal accident in the motorsport.

The ever-evolving rules seem to have improved competition as well. This year, the first seven races have resulted in a different winner each time, breaking a historical trend of only a few drivers dominating the track. When asked about this phenomenon, Peter Sauber, the team boss of Sauber-Ferrari, says he thinks fans are "delighted with the unpredictability, the sheer variety and the unbelievably close competition."

F1's fine-tuning of regulations to respect the risks and rewards of racing is the formula government policies should strive for when regulating businesses. Instead, as The Economist pointed out a few months ago, excessive regulations are acting as speed bumps today. Not only is the financial industry burdened with Sarbanes-Oxley and Dodd-Frank, companies in the telecommunications, materials and utilities are also highly regulated.

Thoughtful regulation in moderation is needed to maintain healthy competition. Sporting events need referees and officials to keep the game fair and exciting -- no spectator wants them to control the outcome.

Excess regulation, on the other hand, can dilute the efforts of entrepreneurs and result in fewer innovations, lower profitability and less job creation. Compare, for example, the performance of the telecom, materials and utilities sectors to Apple. The company has been the "winning driver" of the market over the past decade and its business operates in a less regulated environment.

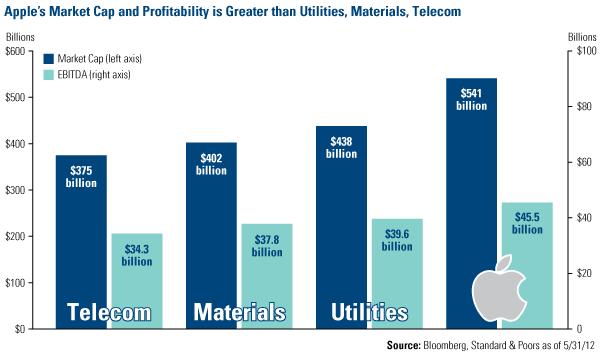

Shortly after his death, Bloomberg wrote that Steve Jobs was "not just a techie visionary, but the virtuoso executive who built the world's second-most valuable company after Exxon Mobil." As you can see below, Apple's market capitalization has grown so significantly that J.P. Morgan declared the company a "sector unto itself." AAPL is now bigger than all of the companies in the telecom sector, all of the materials stocks, and all of the utilities companies combined, generating more profit on an earnings before interest, taxes, depreciation and amortization (EBITDA) basis than any of those sectors.

Bloomberg says Jobs "embodied the Silicon Valley entrepreneur," with an intensity and ingenuity that changed how people interacted with technology. How innovative could Steve Jobs be if Apple operated under an excessive regulatory environment?

Apple's success is a great example of what can be accomplished in a free market with sufficient regulation. Rules and regulations are unquestionably needed, yet there shouldn't be more officials than players, or more rules than plays. Sporting -- and business -- is at its best when there's fluidity and flexibility.

I believe with policies that pursue a balance between prudent regulation and capitalistic risk-taking, America can maintain its competitive edge and create jobs for more Americans even in a challenging global economy like we have today.

This week I appeared on Bloomberg and CNBC to discuss oil, gold and precious metals. Head to bloomberg.com and cnbc.com to see the interviews.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The following security mentioned was held by one or more of U.S. Global Investors Funds as of 3/31/12: Exxon Mobil.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.