U.S. Bond Market, The Greatest Hoax Ever Perpetrated on Mankind

Interest-Rates / US Bonds Jun 15, 2012 - 03:44 AM GMTBy: Rob_Kirby

A few years ago, when J.P. Morgan grew their derivatives book by 12 Trillion in one quarter [Q3/07] – I did some back of the napkin math – and figured out how many 5 and 10 year bonds the Morgue would have necessarily had to transact on their swaps alone – if they are hedged. The bonds required to hedge the growth in Morgan’s Swap book were 1.4 billion more in one day than what was mathematically available to the entire domestic bond market for a whole quarter?

A few years ago, when J.P. Morgan grew their derivatives book by 12 Trillion in one quarter [Q3/07] – I did some back of the napkin math – and figured out how many 5 and 10 year bonds the Morgue would have necessarily had to transact on their swaps alone – if they are hedged. The bonds required to hedge the growth in Morgan’s Swap book were 1.4 billion more in one day than what was mathematically available to the entire domestic bond market for a whole quarter?

Put simply, interest rate swaps create more settlement demand for bonds than the U.S. issues.

This is why U.S. bonds “appear” to be “scarce” – which the bought-and-paid-for mainstream financial press explains to us is “a flight to quality”. Better stated, it’s a “FORCED FLIGHT [or sleight, perhaps?] TO FRAUD”.

Assertions that netting “explains” this incongruity are a NON-STARTER. Netting generally occurs at day’s end – the math simply does not even work intra-day.

Further Evidence of Gross Malfeasance in the U.S. Bond Market

Back in 2008, at the height of the financial crisis, folks are reminded how the Fed and U.S. Treasury were unsuccessful in finding a financial institution to either acquire or merge with Morgan Stanley. Unfortunately, Morgan Stanley’s financial condition has continued to deteriorate:

Analysis: How Morgan Stanley sank to junk pricing

REUTERS | June 1, 2012 at 5:45 pm |

(Reuters) – The bond markets are treating Morgan Stanley like a junk-rated company, and the investment bank’s higher borrowing costs could already be putting it at a disadvantage even before an expected ratings downgrade this month.

Bond rating agency Moody’s Investors Service has said it may cut Morgan Stanley by at least two notches in June, to just two or three steps above junk status. Many investors see such a cut as all but certain.

Many U.S. banks are at risk of a downgrade, but ratings cuts could affect Morgan Stanley most because of the severity of the cut and because of its relatively large trading business…..

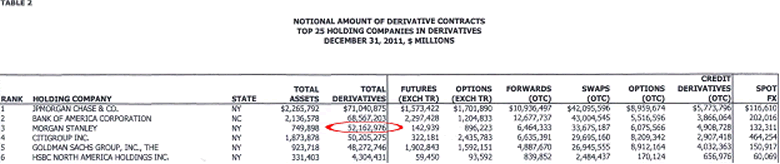

The “take-away” from the article above is that Morgan Stanley is not a particularly good credit and the trajectory of their “credit” has been “negative” for some time – particularly since the financial crisis of 2008 when the Fed/U.S. Treasury could not find anyone willing to acquire them. The Reuter’s scribe also pointed out something highly relevant when she said Morgan Stanley has a “relatively large trading business”. Let’s explore this a little bit deeper. According to the U.S. Office of the Comptroller of the Currency [OCC] Morgan Stanley’s derivatives book stood at 52.2 TRILLION at Dec. 31/2011. So to say that Stanley’s trading business is “relatively large” is perhaps a gross understatement [or maybe an intentionally misleading statement?] – since it is currently the third largest “known” derivatives book in the world:

Source: OCC

Swaps Require/Consume Credit

In the chart above, I’d like to draw your attention to the category SWAPS (OTC) – with are interest rate swaps traded over-the-counter, or, not on an exchange. What is important for people to realize is that interest rate swaps have two-way counterparty risk – meaning both sides of the trade must have adequate/available credit lines for each other before they can transact.

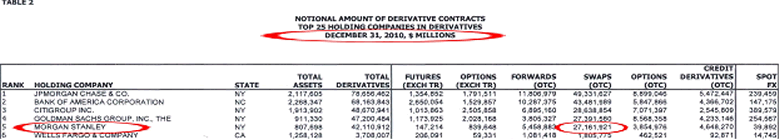

Now, with Morgan Stanley’s deteriorating credit condition in mind – let’s take a look at how they grew their swap position in a six month period - from Dec. 31/2010 to Jun. 30/2011:

Source: OCC

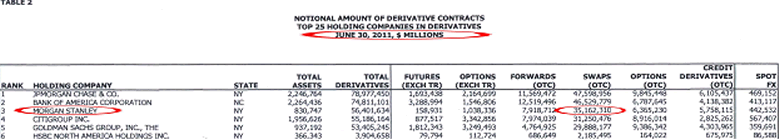

To Jun. 30/2011 – An increase of 8 TRILLION in 6 months:

Source: OCC

Ladies and gentlemen, the ENTIRE GLOBAL BANKING COMMUNITY DOES NOT HAVE SUFFICIENT CREDIT LINES, FOR MS, TO ALLOW MORGAN STANLEY TO GROW THEIR SWAP BOOK BY 8 TRILLION IN 6 MONTHS. Do remember, the Federal Reserve has purview over Bank Holding Companies – so the Fed necessarily knows “who” the other side of these trades really is – and they are implicitly “comfortable” with the counter-party risk.

Ergo, Morgan Stanley necessarily had a NON-BANK counterparty for this 8 Trillion increase in the SWAPS component of their book. The counter-party for Morgan Stanley’s swaps book is, by-and-large, the same counter-party as J.P. Morgan, Citi, B of A and Goldman.

Now, you have to think about “WHO” or “WHAT” would have the motivation to do this business with Morgan Stanley et al? In light of the psychedelic, incomprehensibly large amounts of swaps being consummated between Morgan Stanley and this “unidentified” counterparty – it is most likely that the counterparty is none other than the U.S. Treasury’s Exchange Stabilization Fund [ESF] – an entity that is accountable to NO ONE, has absolutely ZERO oversight and operates above ALL LAWS. It is HIGHLY probable that these trades are being used as a means of undeclared stealth bailout / recapitalization of Morgan Stanley on the public teat in conjunction with arbitrarily controlling the long end of the interest rate curve.

It’s all about national security/preservation of U.S. Dollar Standard. The following underscores what lengths the governing apparatus will go to – to ensure the perpetuation of actual/perceived U.S. Dollar hegemony:

First reported by Dawn Kopecki back in 2006 when she reported in BusinessWeek Online in a piece titled, Intelligence Czar Can Waive SEC Rules,

"President George W. Bush has bestowed on his [then] intelligence czar, John Negroponte, broad authority, in the name of national security, to excuse publicly traded companies from their usual accounting and securities-disclosure obligations. Notice of the development came in a brief entry in the Federal Register, dated May 5, 2006, that was opaque to the untrained eye."

What this means folks, if institutions like J.P. Morgan, Citi, B of A, Goldman or Morgan Stanley are deemed to be integral to U.S. National Security - can be "legally" excused from reporting their true financial condition – including KEEPING TWO SETS OF BOOKS. The entry in the Federal Register is described as follows:

The memo Bush signed on May 5, which was published seven days later in the Federal Register, had the unrevealing title "Assignment of Function Relating to Granting of Authority for Issuance of Certain Directives: Memorandum for the Director of National Intelligence." In the document, Bush addressed Negroponte, saying: "I hereby assign to you the function of the President under section 13(b)(3)(A) of the Securities Exchange Act of 1934, as amended."

A trip to the statute books showed that the amended version of the 1934 act states that "with respect to matters concerning the national security of the United States," the President or the head of an Executive Branch agency may exempt companies from certain critical legal obligations. These obligations include keeping accurate "books, records, and accounts" and maintaining "a system of internal accounting controls sufficient" to ensure the propriety of financial transactions and the preparation of financial statements in compliance with "generally accepted accounting principles."

Conclusion:

The U.S. Bond market has been “gamed” beyond belief and the only institution in the world with the means and motive to conduct this business is the U.S. Treasury [ESF] in conjunction with/acting through the New York Federal Reserve. As such, U.S. bond pricing and interest rates are set 100 % arbitrarily and today represent the BIGGEST FINANCIAL HOAX ever perpetrated on mankind.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2012 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.