Financial Gurus Bullish On Gold

Commodities / Gold and Silver 2012 Jun 14, 2012 - 06:46 AM GMTBy: GoldCore

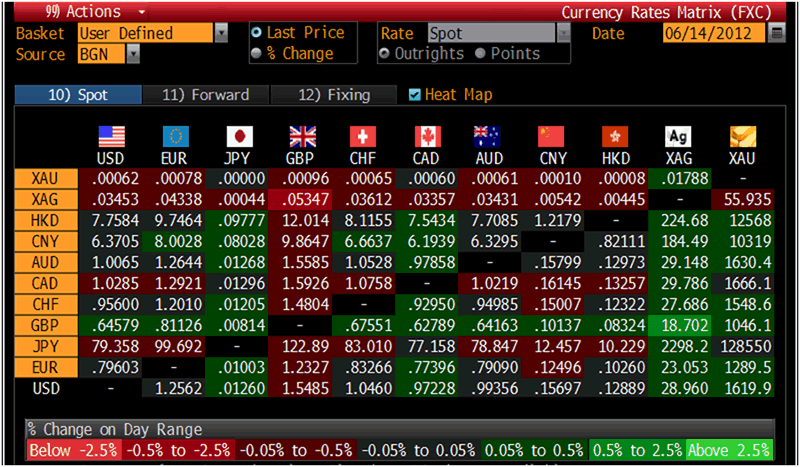

Today's AM fix was USD 1,619.00, EUR 1,289.83, and GBP 1,044.65 per ounce.

Today's AM fix was USD 1,619.00, EUR 1,289.83, and GBP 1,044.65 per ounce.

Yesterday’s AM fix was USD 1,612.75, EUR 1,286.19, and GBP 1,034.94 per ounce.

Silver is trading at $28.86/oz, €22.93/oz and £18.57/oz. Platinum is trading at $1,479.00/oz, palladium at $622.00/oz and rhodium at $1,225/oz.

Gold climbed $7.20 or 0.45% yesterday in New York and closed at $1,618.80/oz. Gold traded sideways in Asia prior to a sudden buying bout which saw gold rise from $1,618/oz to $1,625/oz. Those gains have gradually been given up in European trading where gold is now trading near yesterday’s close.

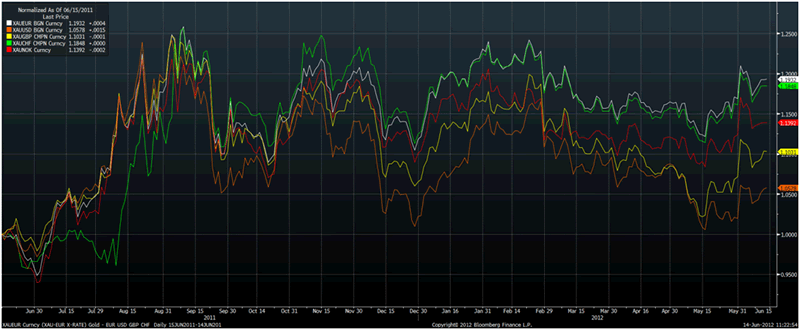

White – XAU/EUR, Orange – XAU/USD, Yellow – XAU/GBP, Green – XAU/CHF, Red – XAU/NOK – (Bloomberg)

Gold appears to be consolidating after hitting its 4th session of gains, when weak US economic data, in the form of poor retail sales, led to renewed QE chatter.

Gold is likely also being supported by real concern about the outcome of Greece’s elections on Sunday. This has led to one major foreign exchange provider suspending all trading in the hours around the announcement of the results of the Greek election.

Cash gold has gained 1% this week and appears to be reasserting its safe haven status due to the deepening debt crisis and near term risk of contagion.

Spain’s sovereign debt rating was cut 3 notches by Moody’s and market watchers feel they will need a ‘bailout’ soon even though they just received eurozone financing to bail out their troubled banks.

While superficial analysis has recently again questioned whether gold is a safe haven and has suggested it is not due to its recent performance, gold is again acting as a safe haven for those who need a safe haven.

Gold has risen by more than 6.3% in euro terms so far in 2012, while FTSE and CAC are down by 2.4% and 4.9% year to date. While the DAX has risen by 3.3%, most European indices are down sharply.

Therefore, European holders of gold are again being protected from the market and monetary volatility.

Anthony Robbins Bullish On Gold - Faber and Bass His Financial Gurus

Tony Robbins (Anthony Robbins), one of the world's leading performance coaches and motivational speakers has recently warned about the risk of dollar devaluation and spoke about the opportunities in gold which is "exploding" and "is in a bull market".

At Robbins, recent event in London (May 18th to 21st), he spoke about the importance of getting good financial advice from the people who predicted this crisis and have made money for their clients in recent years.

Cross Currency Table – (Bloomberg)

He spoke about investment experts who he respects and specifically mentioned Marc Faber and Kyle Bass.

Robbins is one of most positive and optimistic people in the world. Nevertheless, he recently produced a YouTube video warning of an impending economic collapse.

Faber and Bass are extremely bearish on paper currencies and government debt and are very bullish on gold and silver bullion due to the euro zone debt crisis and looming global debt crisis due to the appalling fiscal state of Japan, the UK and the US.

Dr Marc Faber is a Swiss financier who predicted the Wall Street Crash in 1987. He is the editor and publisher of the “Gloom, Boom & Doom Report,” author of many books including the best selling 'Tomorrow's Gold: Asia's Age of Discovery'.

Faber advised investors to buy gold in 2001 and he is still extremely bullish on gold and silver and believes that gold will rise in all economic circumstances - a global inflationary economic boom, stagflationary environment or even in a global deflationary recession or Depression.

Kyle Bass is the erudite Texan investor who saw the financial crisis coming and made a fortune in the sub-prime collapse - first from America's sub-prime mortgage crisis and then from betting that Greece would default. Now he’s positioned and ready for the collapse of entire countries, having bought credit default swaps on Greece, Ireland, Italy, Spain, Portugal and, interestingly, Switzerland.

Robbins shares the concerns of Faber and Bass regarding sovereign defaults and Robbins is very concerned about the risks of a US debt crisis and the risks that it poses to the US dollar.

A recent video 'The National Debt and Federal Budget Deficit Deconstructed' by Robbins is well worth a watch: www.youtube.com/GoldCoreLimited

Gold and indeed those who own it are often accused of being 'barbaric', 'uncivilised' and 'bugs.'

Indeed, there is often a suggestion that those who own gold are negative ‘doom and gloom merchants’ who hope that the world financial and monetary system will collapse so that their gold holdings will surge in value and they will be 'rich as Croesus.'

Anthony Robbins and indeed most who are positive about and advise owning gold very much contradict this silly view. Indeed, many of them have been warning about these fiscal challenges for years in an effort to protect family, friends, clients and the public.

The majority of people who buy gold are rational economic people who realise that there is macroeconomic, geopolitical, monetary and systemic risk in the world and they buy gold as a store of value.

They buy gold as they simply wish to protect themselves and their families from these risks by owning the financial insurance that is gold.

Robbins has a massive following internationally – especially amongst business owners but also in the sporting, media, music and entertainment industries and his endorsement of the importance of owning gold is significant

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.