Gold Protection As Bank Holidays, ATM and Deposit Withdrawal Restrictions, Capital Controls Loom

Commodities / Gold and Silver 2012 Jun 13, 2012 - 09:05 AM GMTBy: GoldCore

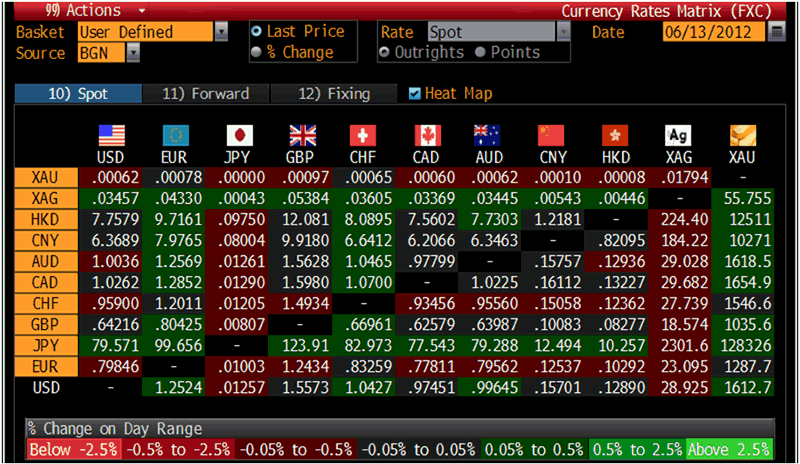

Today's AM fix was USD 1,612.75, EUR 1,286.19, and GBP 1,034.94 per ounce.

Today's AM fix was USD 1,612.75, EUR 1,286.19, and GBP 1,034.94 per ounce.

Yesterday’s AM fix was USD 1,589.25, EUR 1,271.40, and GBP 1,025.65 per ounce.

Silver is trading at $28.90/oz, €23.16/oz and £18.65/oz. Platinum is trading at $1,455.20/oz, palladium at $617.60/oz and rhodium at $1,200/oz.

Gold rose $11.40 or 0.71% yesterday in New York and closed at $1,611.60/oz. Gold started out trading sideways in Asia and then edged up in early European trading.

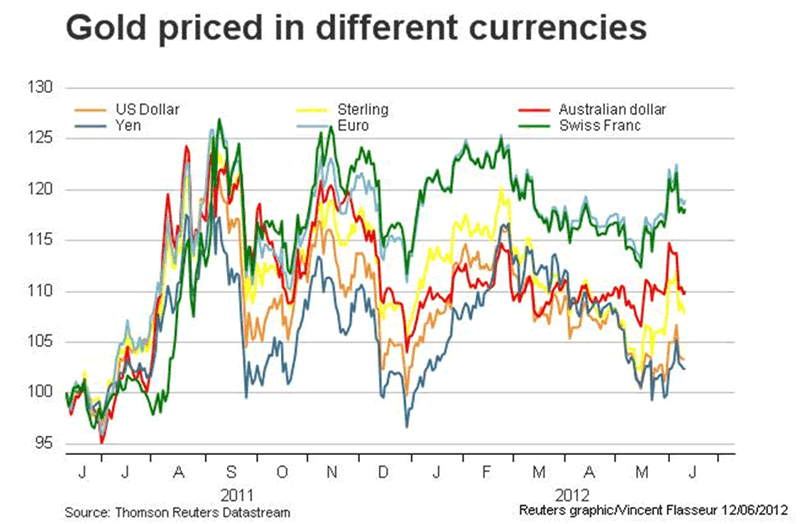

Chart shows huge period of consolidation in all currencies since record highs in late August. Such long periods of consolidation can often be followed by sharp moves to the upside and fundamentals suggest this likely

Gold edged up again today as Spain’s 10 year bond yield’s hit a euro-area high nearing the 7% level, which led investors to question Madrid’s access to the bond markets. Italy’s bond sale is scheduled for Thursday.

While the gold price has not surged as expected and appears to be consolidating near the $1,600/oz level (€1,300/oz and £1,000/oz), there has been a definite increase in demand in recent days , particularly this week and this morning, as the crisis is again leading to safe haven demand – particularly from European buyers.

There is a slow but creeping realisation that this crisis is soon to escalate and that financial contagion with risks to bank deposits (often guaranteed by insolvent states) and payment systems. Indeed, the entire modern financial system is at risk.

There are silent runs on banks in Spain, Greece and Italy. The Bank of Italy authorized the suspension of payments by Bank Network Investments Spa (BNI) without communicating anything to depositors. The BNI, a large Italian bank, suspended operations and clients with bank accounts could not write checks, pay bills, make mortgage payments, use ATMs or debit and credit cards.

The European Union is making preparations to contain the effects of panic if Greece was to exit from the Euro. Among the measures they are considering imposing are a limit on the amount of money that can be withdrawn from cashpoints or ATMS, imposing border checks and introducing currency controls to stop a flight of capital from countries.

As well as limiting cash withdrawals and imposing capital controls, they have discussed suspending the Schengen Agreement, which allows for visa-free travel among 26 countries, including most of the EU, though not Britain and Ireland.

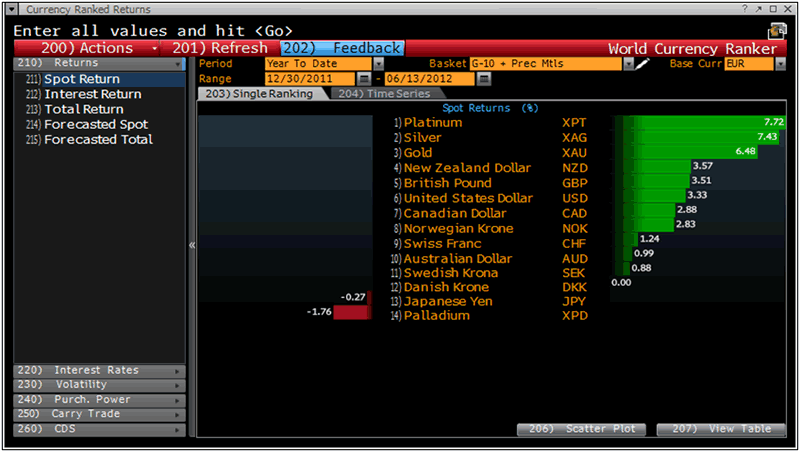

Currency Ranked Returns – (Bloomberg)

EU officials are examining whether there is a legal basis for such extreme measures.

While EU officials may manage to patch things up and delay having to implement such extreme measures they seem inevitable in the long term. Especially, as Japan, the UK and US are set to suffer their own debt crisis in the coming months.

These are risks that we have long warned of and it gives us no pleasure to see them come to pass.

However, people who own physical bullion in their possession and in safe storage internationally remain positioned and prepared for these looming real threats.

These real risks have huge implications for us all and ramifications that most have yet to fully consider and comprehend.

The silly debate as to whether gold is a safe haven or not or a bubble or not will be seen for what it is very soon.

Those who have continuously suggested gold is a “barbaric relic”, is a bubble and is not a safe haven will have some explaining to do. As will those who have said that spam is a better hedge against inflation than gold.

They will no doubt engage in some furious back pedalling and claim that “nobody saw this coming” when indeed many of us have and have been warning about exactly these risks for years.

Cross Currency Table – (Bloomberg)

Markets await with trepidation the Greek elections over the weekend and the Fed’s policy meeting next week. Today US retail sales figures are released at 1230 GMT.

Rather than sitting nervously and passively and awaiting the coming financial ‘dislocations,’ investors and savers need to be prepared for the uncertain financial scenarios that seem increasingly likely.

Hoping for the best but preparing for less benign scenarios remains prudent.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.