Silver Offers A Golden Opportunity To Convert Soon To Be Destroyed Value

Commodities / Gold and Silver 2012 Jun 12, 2012 - 01:39 PM GMTBy: Hubert_Moolman

The fundamentals for silver and gold are very strong, and with all the massive bailouts, which are increasing debt levels, they are just getting stronger. Until a significant portion of these debts is repaid or defaulted on, it would be foolish to talk about a top in precious metals.

The fundamentals for silver and gold are very strong, and with all the massive bailouts, which are increasing debt levels, they are just getting stronger. Until a significant portion of these debts is repaid or defaulted on, it would be foolish to talk about a top in precious metals.

The repayment of debt (or default on debt - which is more likely) will result in significantly reduced economic activity. Significantly reduced economic activity will have a negative effect on the stock market, which in this case, will likely result in a huge crash. It is these conditions (a deflating debt bubble) that will drive gold and silver prices significantly higher.

Why? Because this will not just be a normal type of reduced economic activity, but one in which the monetary system as a whole is questioned or collapses (due to the excessive debt levels).

In a crisis like this, it will be all about preserving value, which will make gold and silver the most wanted goods. The excessive debt levels we have currently, mostly represent artificial value, or value that will never be realised. We now have a great opportunity to convert that soon to be destroyed value into real value, by buying gold and silver, with fiat currency.

In my opinion, silver bullion presents the better opportunity, when compared to gold. Silver bullion is still trading much lower than its 1980 high, and also at relatively historic lows against gold.

Silver Flag

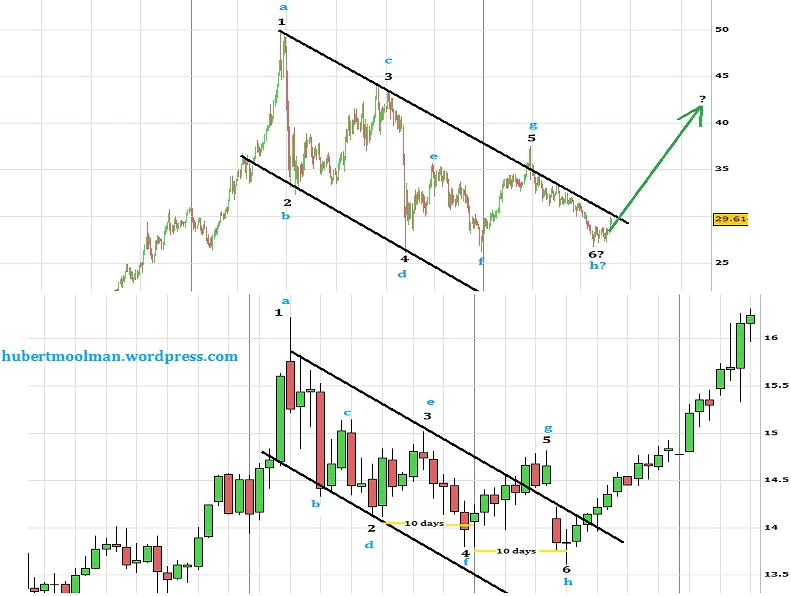

Here, is a follow-up on my previous article about the similar flag formations on the silver chart. Below is a graphic which compares the current pattern on silver (from about the beginning of 2011 to present) to a 2007 pattern:

On both charts, I have suggested how the flag patterns might be similar, by marking similar points, from 1 to 6 (and alternatively from a to f). Based on this comparison, it appears that the silver price might now have found that point 6 or h, and is about to increase significantly. See my latest video on my website for more details of this analysis.

Warm regards,

"And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved"

For more silver and gold analysis and guidance, see my Long-term Silver Fractal Report or subscribe to my Premium Service.

Warm regards and God bless,

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2012 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.