Gold Deposits Of USD 1 Billion To Be Collected By Turkish Bank

Commodities / Gold and Silver 2012 Jun 12, 2012 - 07:11 AM GMTBy: GoldCore

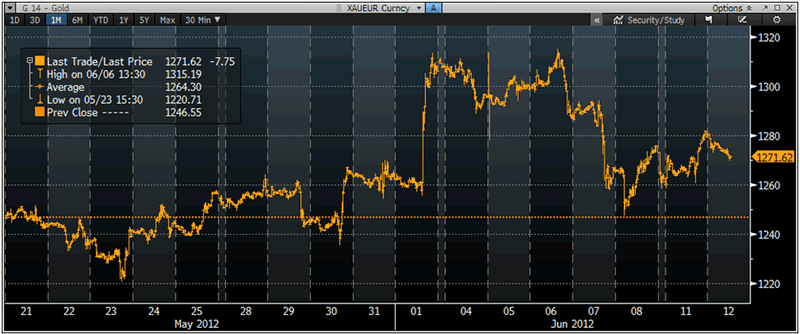

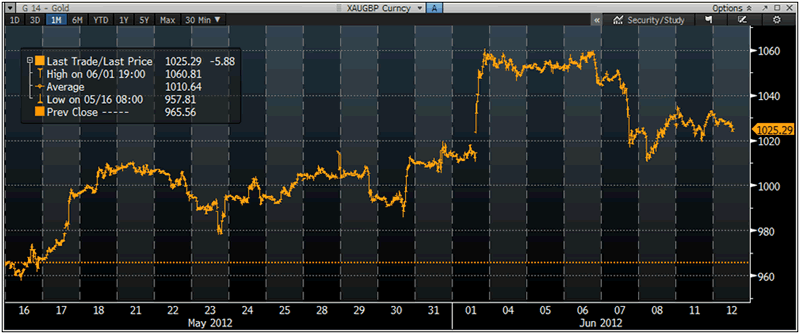

Today's AM fix was USD 1,589.25, EUR 1,271.40, and GBP 1,025.65 per ounce.

Today's AM fix was USD 1,589.25, EUR 1,271.40, and GBP 1,025.65 per ounce.

Yesterday’s AM fix was USD 1,593.00, EUR 1,264.79, and GBP 1,023.45 per ounce.

Silver is trading at $28.67/oz, €22.92/oz and £18.52/oz. Platinum is trading at $1,448.00/oz, palladium at $618.00/oz and rhodium at $1,200/oz.

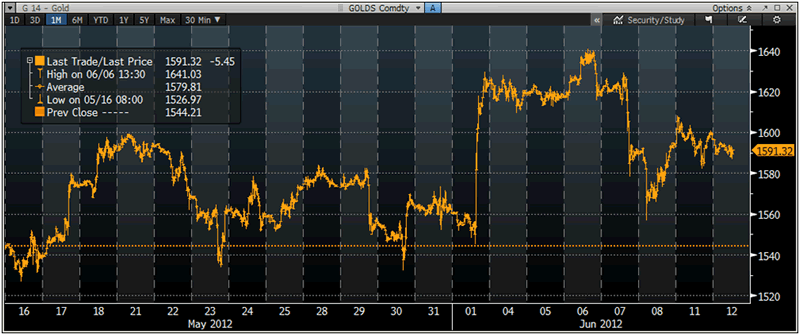

Gold 1 Month Chart – (Bloomberg)

Gold climbed $5.60 or 0.35% yesterday in New York and closed at $1,600.20/oz despite stock markets giving up early gains on misguided optimism regarding the Spanish “bailout”.

Gold fell initially in Asia before trading sideways and this range trading has continued in European trading.

Gold edged higher Tuesday after hopes were dashed that Spain's bank bailout would be the panacea that would lead to alleviating the eurozone debt crisis.

XAU/EUR 1 Month Chart – (Bloomberg)

Gold is consolidating near $1,600/oz as investors are concerned that the sovereign debt of Spain will still be stretched to the breaking point and Greece’s possible departure from the euro will unleash more instability in the region.

The risk of contagion remains real and European finance officials have discussed limiting the size of withdrawals from ATM machines, imposing border checks and introducing euro zone capital controls as a worst-case scenario should Athens decide to leave the euro.

While the technicals are poor, the fundamentals remain sound with the euro zone debt crisis far from resolved. Indeed, the euro zone debt crisis will likely morph into the global debt crisis in the coming months when markets turn their attention to the Chinese property bubble and the poor fiscal position of Japan, the UK and the US.

Market watchers are waiting for the Greek elections on June 17, and also the Group of 20 financial summit plus the US Fed’s policy meeting next week.

Turkiye Is Bankası AS, Turkey’s biggest bank by assets, plans to collect $1 billion of gold in its deposit accounts by the end of the year, citing deputy chief executive officer Erdal Aral.

As much as 5,000 metric tons of gold is stored “under the mattress” in Turkey, Aral said, according to the Istanbul-based newspaper. Gold deposit accounts have surged to 13.6 billion liras ($7.4 billion) from 3.1 billion liras within the past year, according to data released by the banking regulator, Aral was quoted as saying.

Gold has always been seen as money and as a store of wealth in Turkey and now the country is leading the way with regards to the remonetisation of gold in the 21st Century.

XAU/GBP 1 Month Chart – (Bloomberg)

Turkey remained the world's number one minter of gold coins in 2011. There is an increasing tendency for gold bars to be retail investors' vehicle of choice – although gold coins still retain a majority market share.

Turkish people can pay in gold in certain foreign exchange houses and most jewellers will accept gold as payment. Turkish banks are is now offering digital gold saving accounts.

Turkey expanded its gold reserves by 29.7 metric tons in April. Turkey’s bullion reserves climbed to 239.3 tons last month meaning that Turkey increased their gold reserves by 14% in April.

The central bank on March 27 doubled the share of lira reserves banks can hold in gold to 20%, saying it would provide 6.1 billion liras ($3.3 billion) of extra liquidity.

"This addition," the WGC says, "was the result of a policy change under which the central bank will now accept gold in reserve requirements from commercial banks to help the banks utilize their gold in managing their liquidity."

Some analysts have suggested that the increase in Turkish gold reserves, as reported by the IMF, may actually be a form of “double accounting”. Whereby the gold held in Turkish banks client’s gold account is transferred from the local bank as a reserve to the central bank, from where it then figures as gold reserves.

Besides massive domestic holdings and robust demand in Turkey, the country is also importing and then exporting huge quantities of gold into Iran and ‘Arab spring’ countries with some $1.2 billion of precious metals exported into Iran in April alone.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.