EUvs.USA markets – Inflation vs. Deflation: #1

Stock-Markets / Financial Markets 2012 Jun 08, 2012 - 03:41 AM GMTBy: Brian_Bloom

Author Note: This is the first of three articles that examine the threats and opportunities facing the world economy. It looks at the European crisis – and its potential impact on the world economy – through the eyes of the financial authorities and the banking community. The next article will look at the opportunities flowing from a now serious commitment by the oil companies to embrace natural gas as an alternative to oil. The third will articulate and examine the risks that the financial/political authorities may be underestimating, or may even have missed because the issues lie outside their areas of expertise or focus.

Author Note: This is the first of three articles that examine the threats and opportunities facing the world economy. It looks at the European crisis – and its potential impact on the world economy – through the eyes of the financial authorities and the banking community. The next article will look at the opportunities flowing from a now serious commitment by the oil companies to embrace natural gas as an alternative to oil. The third will articulate and examine the risks that the financial/political authorities may be underestimating, or may even have missed because the issues lie outside their areas of expertise or focus.

Summary of the series of three articles

From the central bankers’ perspective, the sovereign debt crisis can be managed by placing a firewall between the toxic sovereign debt and the world economy, by corralling the non-toxic but potentially dangerous debt, and by keeping interest rates – payable by sovereign borrowers – low. On balance, whilst the Eurozone is coming under extreme threat of dissolution, the ultimate outcome seems likely to be that the weaker nations will exit and the stronger nations will band together, with Germany at the centre of a reorganised EU.

From a commercial banking perspective, the economic system can be kept on an even keel (and a 1930s style Depression can be avoided) if the banks can shore up their balance sheets, avoid crystallising sovereign bad debts, keep profit margins robust; and focus on financially supporting the growth of low risk economic activity.

From the perspective of the politicians (who are predominantly responsive to lobby groups) the lowest risk and highest strategically relevant economic activities will be “energy” related. The most powerful of the lobby groups is the oil industry, which is now committed to building a natural gas infrastructure and reducing the world economy’s dependence on oil in general and on a politically volatile Middle East in particular.

Investors can therefore expect the global financial system to hold together whilst the politicians support the repositioning – first, of the US economy and ultimately the world economy – to embrace a natural gas infrastructure including associated industries, that will radiate outwards like the ripples caused by a stone thrown into a pond; for example, the transport industry and the gas processing and distribution industries.

The gold price will be the barometer of how successful this approach will be. So far, the gold price is signalling an abatement of fear of economic implosion, notwithstanding the US Industrial equity markets having re-entered a confirmed Primary Bear Trend and notwithstanding the “seemingly” inevitable breakup of the EU. In this context, the hyperinflation outcome is looking less likely. More likely is a slow and chronic deflation of the money supply (debts reducing faster than new money created) that grinds the instabilities away until, within the next 10 to 15 years, the world economy starts to grow again as the momentum of the next generation of employment driving industries gains ascendency over deflationary forces.

Unfortunately, all the above will merely serve to buy time. There are looming issues - exogenous to the economic system – that absolutely need to be addressed if humanity is to survive beyond the 21st Century.

**********

Introduction

For the past few weeks there has been a building cognitive dissonance between what the charts have been saying and what “conventional wisdom” espoused by many financial market analysts has been anticipating, based on subjective (perhaps selective?) perceptions of the fundamentals.

For example, many private investors – who cannot see alternative solutions to what they perceive to be an unravelling world economy – have been anticipating a skyrocketing gold price as central governments, with large public debt burdens relative to their countries’ GDPs, man the money printing presses in an uncontrolled manner.

But it’s not as simple as that. The breakdown below the steeply rising trend line on the weekly gold chart below is signalling that the US$ gold price may have peaked – for the foreseeable future.

Logic dictates that only one “pure” outcome can prevail. Either there will be uncontrolled manning of the printing presses – leading to a skyrocketing gold price – or there will not. The clear signal of a possible trend reversal in the US$ denominated gold price chart cannot sensibly be ignored or rationalised away, just because, uncomfortably, it doesn’t fit investor expectations. If the trend has changed from up to down (even temporarily) then the implication is that the central banks will not be manning the printing presses in an uncontrolled manner – for the time being.

Chart #1 (Courtesy DecisionPoint.com)

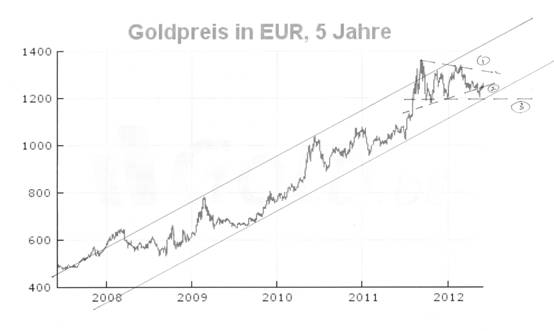

The chart below is a five year chart of the gold price in Euros. By contrast to the above chart, whilst it also shows a declining right-angled triangle and a break below the rising support of an earlier manifesting triangle (line #2), it is still trading above the equivalent trend line below which the US$ price of gold has broken. Implicitly, this has more to do with the Euro:US$ exchange rate than the gold price. i.e. It is quite possible that the Euro price of gold might continue rising if the European Central Bank engages in aggressive monetary stimulation.

So, one implication being signalled by the charts is that European investors may be viewing the inflation/deflation scenario differently from American investors. Implicitly, the markets may be anticipating money printing in Europe and budget balancing in the US.

Chart #2

(source: http://www.gold.de/kostenloser-goldkurs.html )

By way of another example of a logical disconnect: Whilst the charts of the US equity market are certainly bearish (a Dow Theory bear signal was given two week ago and last Friday saw a strong fall in the Dow), the longer term charts of the $SPX, for example, are showing ambivalence between entering a trading range and commencing outright collapse; with the bias being towards ambivalence.

Yes, the US equity market’s internals are very weak. Yes, the US equity market has recently experienced a record number of down days, but the chart below – courtesy DecisionPoint.com – is not calling for a market “rout”. It is quite clear from this chart that the 10,000 level offers significant technical support. A fall to 10,000 will represent a 20% pullback from its current level. Whilst serious (if it happens) it will not be catastrophic. If the 10,000 level is to hold then this would be a significantly different outcome from what the doomsayers are anticipating.

Chart #3

Of course, if the 10,000 level were to be penetrated on the downside then all bets would be off. But that possibility is a long way away from being of real concern.

Flowing from these disconnects, I went to see two friends, both of whom are highly placed executives in large financial institutions. Their views are broadly representative of the institutional markets’ views, for reasons that will become self evident.

One friend happens to be employed by a currency dealing organisation. However, he does not sit in front of a trading screen. His role is more strategic. He effectively lives on an airplane and travels tens of thousands of kilometres every few weeks, to meet with central bankers, amongst others, to obtain their views first-hand. The second friend may be described as a sort of “gatekeeper” who spends his days liaising with and talking to senior executives of funds managers about their historical performances and about their views of the investment future. Suffice it to say that these two men are at the coal face of institutional decision making. That doesn’t make their opinions necessarily right, but it does offer a window into the thought processes of fund managers who are managing multiple billions of dollars.

This is what I discovered:

My currency expert friend is of the view that even if it seems inevitable that European governments will turn to printing money, the reality is that there is no mechanism to allow individual countries to print Euros. The European Central Bank has a monopoly on this activity. One “loophole” lies in what is known as the LTRO (Long Term Refinancing Operation) that was an initiative of the ECB, which allows the Spanish and Italian (and, presumably, other European) central banks to buy their countries’ government bonds – both from owners of these bonds who are domiciled outside those countries and from banks inside their countries’ borders. This is having a two-fold effect:

- It is facilitating a (slow) disintermediation and a purification of the sovereign debt situation, where the individual central banks within Europe will land up owning the sovereign debts of their own countries, and the previous owners will own Euros lent by the ECB.

- It will also allow domestic banks to shore up their balance sheets by shifting risky assets off their balance sheets and onto the balance sheets of their countries’ central banks.

Of course, this will add to the Euro based money supply and create some inflationary pressures; and it will also take time. But it will not result in “hyperinflation” across the EU because the process will not be a Zimbabwe-like confetti-money parade. It will be constrained by double entry bookkeeping. For every new Euro created by the ECB there will be a concomitant debt owing by the borrowing central bank of the particular country to the ECB.

My currency expert friend also emphasised that the financial markets have been anticipating emerging European problems since 2008 and that whilst a collapse of (say) Greece or Spain or Italy or even all three, might be disastrous for Europe, the banking world outside Europe would be able to withstand the shock. To paraphrase his comment “This [a European crisis] would not be as systemically serious as a Lehman collapse, for example.”

By way of illustration, if Greece were to leave the EU and begin to behave like Zimbabwe then, whilst it will likely become another Zimbabwe, the global financial system will likely remain intact. If Italy were to leave the EU (after its own central bank has disintermediated Italian sovereign debt) then it might print Italian Lira to lend to its central government, without the Italian banking system collapsing, and Italian inflation could be confined to Italy.

Thinking about all this, I researched what some of the world’s top commentators/analysts were saying about the EU’s chances of survival, and the following are relevant quotes from three of these commentators:

- From George Soros (source: http://www.georgesoros.com/interviews-speeches/entry/remarks_at_the_festival_of_economics_trento_italy/ )

“In retrospect it is now clear that the main source of trouble is that the member states of the euro have surrendered to the European Central Bank their rights to create fiat money.”

In summary, Mr Soros believes that the EU is coming under enormous strain and that there are forces working towards its dissolution which only Germany has the ability to stave off. He argues that if the EU dissolves, the individual European countries would be worse off than before.

“Unenforceable claims and unsettled grievances would leave Europe worse off than it was at the outset when the project of a united Europe was conceived.”

His bottom line view appears to be that the EU will go to the brink of total dissolution, at which point the individual members will not have the courage to follow through and will opt to stay in – resulting in Europe becoming something of a German Empire with wealth at its centre and impoverished outlying regions.

Note: It is recommended that the reader take the trouble to read Mr. Soros’ entire speech.

- From Tony Boeckh of the Boeckh Investment Letter, Volume 4.07:

“Deflation and high unemployment has ripped the social fabric [of Europe] apart and has led to extremist policies”

“This commitment [of Spain, Italy, Portugal, Ireland and Greece, among others, to deleverage] is now crumbling everywhere and it is being replaced with extremist ideology”

“The trend will make it very difficult to keep the euro from disintegrating”.

- From John Mauldin ‘s weekly E-Letter dated June 2nd, 2012:

“Buying German bonds, even at a slightly negative rate, is actually a cheap call option on the eurozone breaking up. A German bond that became a new Deutschemark-denominated bond would rise in value at least 40-50% almost overnight. If you are a pension fund, for instance, with a lot of sovereign debt from a variety of European peripheral countries and you think a break-up of the eurozone is possible, it is a way to hedge your investment portfolio.”

Conclusion

Whilst these three commentators are unanimous that the EU is under enormous pressures which might force it towards disintegration and, indeed, some investors are even betting that it will disintegrate – by buying negative yield German and Swiss treasury bonds – Mr Soros is of the view that it will ultimately be in the interests of the individual members to remain in the fold; even if this means that they have to give up some sovereignty rights. By contrast, the ECB seems to be putting into place a mechanism to allow some rogue countries to withdraw if that is their decision – whilst still ensuring that the banking systems of those who remain will be insulated from the fallout. The growing extremist political views seem likely to be socially disruptive, leading to a deterioration in the quality of life for the average citizen within the Eurozone, but with the Eurozone still remaining largely intact. Weaker countries will likely exit and step onto a Zimbabwe-like treadmill. Stronger countries will perforce band together and continue to play by the rules of the international financial game. The global financial system will likely hold together, which is why the gold price is unlikely to explode upwards in parabolic fashion.

Author Note: The next article in this series of three articles will take a closer look at the energy industry developments within the USA in particular, that – as it ripples outwards across the globe – might have the capacity to drive the world economy forward.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.