The No Economic Growth Paradigm

Economics / Economic Theory Jun 07, 2012 - 12:05 PM GMT Western developed economies have been resorting to almost every possible trick they can conjure up to maintain financial stability and economic growth over the last few years. And while stimulus, interest rate cuts, monetary easing, currency swaps, liquidity operations, bailout/austerity programs, bank "re-capitalizations", loan guarantees, entitlement/welfare programs, data manipulation, etc. have kept them muddling through so far, the undeniable truth is that there will SOON come a time when none of those things makes the least bit of difference anymore.

Western developed economies have been resorting to almost every possible trick they can conjure up to maintain financial stability and economic growth over the last few years. And while stimulus, interest rate cuts, monetary easing, currency swaps, liquidity operations, bailout/austerity programs, bank "re-capitalizations", loan guarantees, entitlement/welfare programs, data manipulation, etc. have kept them muddling through so far, the undeniable truth is that there will SOON come a time when none of those things makes the least bit of difference anymore.

For instance, Morgan Stanley just produced a report which concluded that the euphoric market effects of quantitative easing, the most potent monetary weapon possessed by CBs, may only last a few HOURS or DAYS, rather than weeks or months. This concept should be so familiar to readers of TAE by now that I don't even need to link to any of our articles for reference. Here's the bottom line - the U.S. population is still saturated with consumer, housing and business debts, as well as unserviceable public debts at the local/state level, and the deleveraging cycle is once again gaining momentum on the back of the Eurozone crisis.

And that means no amount of cheap liquidity will be able to substitute organic economic growth with artificial growth on paper. If monetary easing cannot even manage to temporarily juice housing data, jobs data, retail sales data, consumer sentiment data, manufacturing data, etc., then the big market players no longer have anything to hang their hats on. Without support for asset prices and corporate profits on paper via leveraged market speculation, most people in the the corporate AND consumer worlds will not feel wealthy, happy and complacent anymore. Thus, the panicked spiral of debt deflation picks up steam once again.

Zerohedge: Morgan Stanley Sees QE3 Rally Lasting Hours Not Weeks

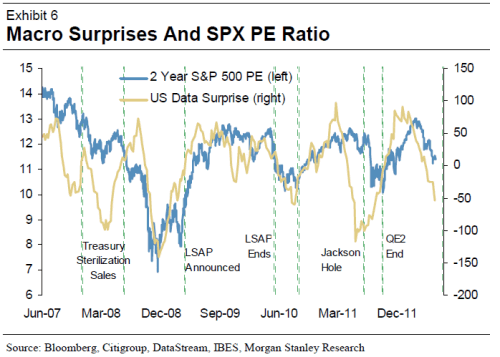

Global macro weakness seems set to trigger another round of global monetary easing. Prior aggressive policy action has coincided with risk asset rallies. However, those policy actions also corresponded with improving macro data, which we think was the critical factor. There will be a Pavlovian reaction from markets if we get further easing, particularly QE3 from the Fed. But if macro stays weak, expect any QE3 rally to last hours or days, not weeks or months.

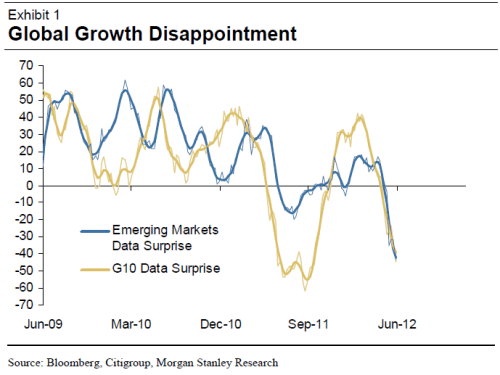

Macro news is falling short of expectations almost everywhere.

What's at issue now is whether unconventional policy either works to stimulate activity, or can directly boost risk asset prices. We're skeptical on the first point. Deleveraging cycles mute the effect of monetary policy on growth. Unconventional monetary policy may be an effective shield – can defend against systemic breakdown – but not a good sword: broadly unable to encourage a return to normal credit creation, where monetary policy can work to stimulate growth.

Having said that, the important issue for many investors is whether further unconventional easing can trigger a tradable rally in risk assets, even if there is little or no effect on the macro outlook. We're doubtful. When growth is the concern, as now, tradable rallies require better macro news.

Growth concerns, not systemic risk, are now unsettling markets. Investors, rightly in our view, are increasingly skeptical about the ability of unconventional policy to boost growth in developed economies. Certainly, it seems unlikely to counteract fiscal tightening, now under way in Europe and UK, and in prospect in the US. Further easing may trigger an initial market response – there are too many investors who think it works to think otherwise. But without macro improvement, that risk asset rally will be short-lived, in our view.

Over the course of the last year, and [not coincidentally] in concert with the inflection point of credit markets last year, the peanut gallery of pundits has shifted more and more into line with the views of the "gloom & doomers" out there. Morgan Stanley analysts, for example, are now literally telling you the same thing Stoneleigh was telling you three years ago - that QE by the world's largest central bank would eventually fail to overcome the financial and psychosocial forces underpinning the greatest debt deflation to ever occur in the history of human civilization. Three years later and that statement seems almost like a tautology, rather than a matter of opinion.

Yet, we still cannot rule out the ability of central authorities to extend and pretend with certainty. Let's say that the Fed decides to defy all expectations and announce the purchase of $2 trillion in MBS and municipal bonds as a part of QE3 in June, and then, on top of that, the ECB announces that it is actively considering the possibility of directly monetizing Eurozone sovereign bonds with Germany's unconditional blessing. This is an extremely unlikely scenario, but there is no denying that it will boost the markets and maintain artificial economic growth for at least a few months (more likely a year).

What then? Has all of the gloom and doom over the future of economic growth finally been put to rest? No, not at all. Just as it took the pundits a few years to finally hone in on the dire reality of our global financial situtation, it will take them a few more years to hone in on the dire reality of our global energy situation. The fact is that Western economic growth over the last few decades has been fundamentally underpinned by access to cheap oil. Sometimes, we would engage in hard-handed "negotiations" to secure oil in other parts of the world, and, other times, we would just steal it.

I ran across an interesting statistic on Business Insider today, although I'm not sure the author of the article has any idea why the statistic is interesting. The article noted that Norway's oil exports as a percentage of GDP had peaked at 17.5% in 2000, and has come down significantly to 12% in recent years. It then goes on to argue that countries above the 12% ratio, or "the Norway threshold", are "some of the nastiest, most dangerous places on Earth, while those below it lead a relatively sanguine existence". Let's ignore that ridiculously simplistic description for a moment, and take a look at the countries above 12% (data sourced from the IMF; my commentary in brackets):

The Norway Threshold: The Most Dangerous Statistic In The World

- Brunei Darussalam: 78.65% [colony of U.K. until 1984]

- Republic of Congo: 73.41% [colony of France until 1960]

- Equatorial Guinea: 69.8% [colony of Spain until 1968]

- Iraq: 66.83% [U.S. supplied with aid/intelligence/weapons in 1980s war with Iran, invaded in 1990 Gulf War, invaded and overthrew government in 2003 Iraq War]

- Angola: 62.37% [colony of Portugal until 1975]

- Turkmenistan: 57.42%

- Kuwait: 57.1% [occupied by U.S. in Gulf War to allegedly defend against Iraqi incursions]

- Qatar: 56.34% [colony of U.K. until 1971, currently has strong ties with U.S. military]

- Gabon: 53.44% [colony of France until 1960]

- Azerbaijan: 52.38%

- Saudi Arabia: 52.34%

- Libya: 50.53% [repeated attempts by U.S. to assassinate leader Gaddafi in 80's, effectively invaded in 2011 - Gaddafi assassinated]

- Bahrain: 49.47%

- Chad: 43.88% [colony of France until 1960]

- Oman: 43.73%

- Singapore: 41.85% [colony of U.K. until 1960]

- Nigeria: 38.44% [colony of the U.K. until 1960]

- Algeria: 37.63% [colony of France until end of French-Algerian War in 1962]

- United Arab Emirates: 30.99% [colony of U.K. until 1971]

- Kazakhstan: 30.91%

- Venezuela: 27.9%

- Belarus: 25.37%

- Republic of Yemen: 24.35%

- Islamic Republic of Iran: 23.42% [Western forces deposed democratically-elected leader in 1953, constant sanctions and threats to attack over past decade]

- Trinidad and Tobago: 22.59% [colony of U.K. until 1962]

- Ecuador: 19.32%

- Lithuania: 16.65%

- Russia: 14.9%

- Sudan: 14.22% [colony of U.K. until 1954]

The sheer level of 20th-21st century economic, political and military intervention by Western powers in countries that exceed the 12% "Norway threshold" is clear, and most of the time these forms of intervention lasted well beyond WWII. Even countries that were never technically colonized or invaded, such as Saudi Arabia, Bahrain and Oman, have operated with very strong ties to Western powers for many years. Most of the the other countries, of course, were part of the equally imperialistic Soviet Union until its demise around 1990.

Who could have known that a continuous imperialistic presence in these regions over the course of decades would leave some of the "nastiest, most dangerous" countries in its wake?? Perhaps the same people who could have known that decades of reckless credit creation would destroy the internal organs of developed economies. BUT, now, we are approaching the end game of Western finance and imperialism. Just like the former Soviet Union, the Western imperial powers are now over-leveraged, over-indebted, over-extended and over-developed.

These powers were given a little shove and now we can watch them topple. First, we witness the wrath of a banking crisis that makes 0-1% annual economic growth seem like a miracle, and makes the combined central authorities of the Western world seem impotent. That is exactly where we are now. Next, we watch the energy/resource conveyor from the 12% nations to the rest of the West break down. To be perfectly clear, though, this coerced flow of energy will not be halted overnight, and the tactics used to preserve this flow will make quantitative easing look like amateur hour, with much greater consequences for every country involved.

At the same time, the flow will be under constant threat of disruption and its velocity will slow, leaving the vast Western infrastructure built from decades of imperial energy/resource extraction unable to sustain itself. Those factories, planes, cars, highways, skyscrapers and other monuments to industrial excess will become much bigger liabilities than assets on the "books" of Western populations. They will form a practically impenetrable wall to further economic growth - fiscal and monetary policies be damned. Welcome to the end of our "relatively sanguine existence".

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.