Will the Fed Provide New Financial Accommodation Soon?

Interest-Rates / US Interest Rates Jun 07, 2012 - 07:18 AM GMTBy: Asha_Bangalore

The economic scene has changed in many ways since the April 24-25 FOMC meeting. Labor market data for May have been disappointing with a paltry 69,000 increase in payrolls and an 8.2% unemployment rate in May. Auto sales slowed slightly to an annual rate of 13.8 million units during May from a 14.4 million sales pace in April, real GDP eked out only a 1.9% increase in first quarter, and the financial crisis of the eurozone presents a significant downside risk not only to the US but also to the entire global economy. Market participants will be watching closely Chairman Bernanke’s testimony tomorrow at the Joint Economic Committee and Vice-Chair Janet Yellen’s remarks tonight.

The economic scene has changed in many ways since the April 24-25 FOMC meeting. Labor market data for May have been disappointing with a paltry 69,000 increase in payrolls and an 8.2% unemployment rate in May. Auto sales slowed slightly to an annual rate of 13.8 million units during May from a 14.4 million sales pace in April, real GDP eked out only a 1.9% increase in first quarter, and the financial crisis of the eurozone presents a significant downside risk not only to the US but also to the entire global economy. Market participants will be watching closely Chairman Bernanke’s testimony tomorrow at the Joint Economic Committee and Vice-Chair Janet Yellen’s remarks tonight.

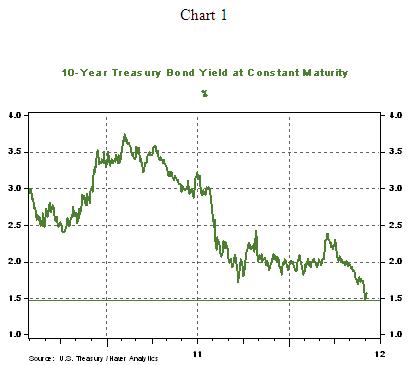

The Fed has three paths it can adopt in the near term: stand pat, extend Operation Twist, which expires this month, or announce another round of bond purchases. The recent Treasury market rally which pushed the 10-year Treasury note yield to a low of 1.47% last week has been erased partly, with the 10-year Treasury note trading at 1.62% as of this writing. The rally has given the Fed time to ponder, particularly if it persists past June 19-20 FOMC meeting dates. However, if the authorities in Europe could swing a compromise and establish that woes of the eurozone are being addressed meaningfully, the safe haven rally should be largely reversed. If eurozone issues persist, partly due to inconclusive Greek election results, interest rates are most likely to hover around current levels, allowing the Fed to watch from the sidelines.

A third round of quantitative easing is justifiable only if economic conditions are significantly weak and/or a deflationary situation is viewed to be around the corner. The nature of latest economic data has lowered the bar to make a case for additional financial accommodation compared with the situation at the April FOMC meeting. But, there is ample room for the Fed to only warn markets they stand ready to act at the close of June FOMC meeting and postpone actions for another day. That said, Bernanke’s testimony and Vice Chair Yellen’s speech will offer further guidance.

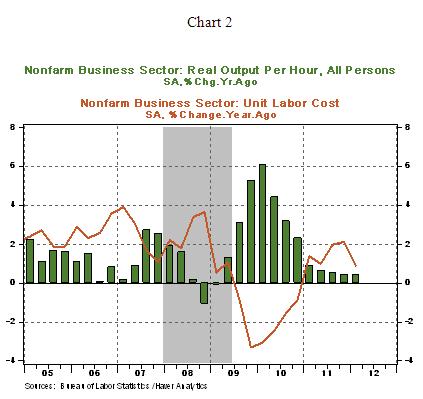

2012:Q1 Productivity and Unit Labor Costs Revised Down

Nonfarm productivity of first quarter of 2012 is revised to -0.9% from -0.5%. Productivity during the first quarter grew only 0.4% from a year ago. The revision of productivity reflects the downward revision of GDP estimates published last week. Unit labor costs advanced 1.3% in the first quarter, putting the year-to-year increase at only 0.9%. Hourly earnings numbers and data of unit labor costs suggest that wage inflation is not at the top of the Fed’s list of concerns.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.