Mining Stocks Booms, Busts and Bargains

Commodities / Metals & Mining Jun 05, 2012 - 06:03 AM GMTBy: Submissions

David Dittman writes: The S&P/ASX 200 Materials Index comprises a wide range of commodity-related manufacturing industries, including companies that manufacture chemicals, construction materials, glass, paper, forest products and related packaging products as well as metals, minerals and mining companies. It forms the basis of the basic materials stocks in my coverage universe.

David Dittman writes: The S&P/ASX 200 Materials Index comprises a wide range of commodity-related manufacturing industries, including companies that manufacture chemicals, construction materials, glass, paper, forest products and related packaging products as well as metals, minerals and mining companies. It forms the basis of the basic materials stocks in my coverage universe.

Until mid-March this index was widely outperforming the broader S&P/ASX 200 Index and the world’s most-watched index, the S&P 500, year to date. But then new worries about a potential Europe contagion as well as suggestions that China’s rate of growth would no longer support the lofty levels materials stocks had found prior to mid-2008 and then again following the March 2009 bottom for global equities.

We’ve seen strong rallies and serious selloffs in this particular market in what still qualifies as the “aftermath” of the Great Financial Crisis, in mid-2009, in mid-2010 and again in mid-2011. Since maxing out post-March 2009 above 15,000, though, the corrections have come within a longer, more sustained downtrend. In fact the S&P/ASX 200 Materials Index is off about 30 percent since Apr. 11, 2011, a correction by any measure.

The question on many minds now is, is the materials and mining boom over?

The simple answer to this question–“yes,” “no,” “I don’t know”–is not of any particular utility. As a dividend-focused investor I’m not interested in “booms,” or “busts,” for that matter. My only interest is in identifying high-quality companies capable of generating easily identifiable cash flows, managing costs, maintaining a solid balance sheet and generating a solid and growing stream of income.

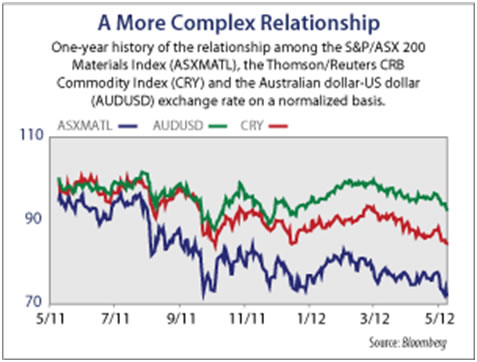

One of the more interesting aspects of the steep decline for the S&P/ASX 200 Materials Index over the past year is the decoupling of the mining stocks from both the Australian dollar and commodities prices. The aussie is also trading apart from commodities, which suggests that the currency is now looked at as a safe haven that global investors desire because of its favorable underlying fundamentals.

Factors supporting the currency include relative global interest rates and investor risk appetite. The Australian dollar hasn’t traded below parity with the US dollar since December, though a recent and unexpected 50 basis point cut to the Reserve Bank of Australia’s benchmark rate as well as the central bank’s downgrade of its domestic growth forecast have it headed below USD1 as of this writing.

The S&P/ASX 200 Materials Index has now retraced a significant chunk of its post-March 2009 rally, save the earliest rush back into such stocks that took it from a low around 6,700 in November 2008. It reached a closing level Friday, May 11, 2012, in Sydney that it last saw in July 2009. The real question now is one of value, as in, are there opportunities in the resources space in the aftermath of this correction?

Assuming we don’t experience a global-demand-destroying event such as occurred with the September 2008 implosion of Lehman Brother and all that followed, we’re looking at favorable entry point for well-placed, high-quality, dividend-paying Australian materials stocks such as BHP Billiton Ltd (ASX: BHP, NYSE: BHP). If you’re going to buy one materials/resources stock right now, this is the place to start.

BHP Billiton is one of the biggest companies in the world, with unrivaled diversity of assets that includes iron ore, coal, base metals including copper, lead, zinc, silver and uranium and petroleum resources such as oil, natural gas and natural gas liquids. This diversity allows it to ride out weakness in any one commodity or for the broader market and global economy unlike any other capital-intensive company.

The stock is down 26.1 percent over the trailing year, only slightly better than the Materials Index, which is off 27.4 percent in US dollar terms. But as a business BHP continues to hold up, and it remains extremely well positioned to benefit from China’s transition from an investment-based growth story to one driven by domestic demand.

By: David Dittman

© 2012 Copyright David Dittman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.