Gold Price Surgers Higher, Safe Haven "Tipping Point"?

Commodities / Gold and Silver 2012 May 31, 2012 - 12:58 PM GMTBy: GoldCore

Gold’s London AM fix this morning was USD, EUR, and GBP per ounce.

Gold’s London AM fix this morning was USD, EUR, and GBP per ounce.

Yesterday's AM fix was USD 1,548.75, EUR 1,244.98, and GBP 995.41 per ounce.

Gold rose 0.38% or $6.00 in New York yesterday and closed at $1,564.80/oz. However the 0.38% gain does not convey the positive price action. This saw gold fall initially in unison with risk assets such as equities and commodities - including oil.

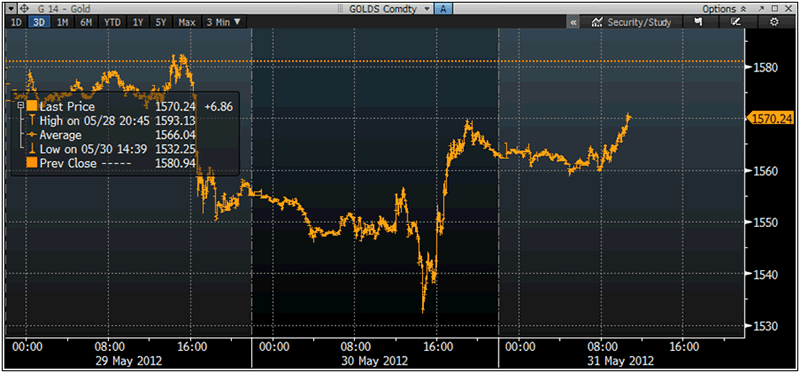

Gold in USD - 3 Day (Tick) - Bloomberg

Gold fell and tested support at $1,530/oz but then bounced very sharply and rose by nearly $40 from $1,532/oz to $1,570/oz. US stocks and commodities remained under heavy pressure and the benchmark S&P 500 ended down 1.43%.

Gold consolidated on yesterday’s gain in Asia and during European trading it is challenging resistance at $1,570/oz.Gold is set to incur its 4th month of losses which has not been seen in nearly 13 years. Interestingly while gold in dollar term is off 6% in May, the sharp fall in the euro means that gold has again risen in euro terms and is up 0.3% in euro terms in the month.

Meanwhile, stocks and commodities have had a torrid month with sharp falls seen and gold outperforming nearly all major equity indices.

Thus despite the continuing questioning of gold’s safe haven status by the less informed, gold was again a safe haven to investors in May – especially those in the Eurozone who are currently most in need of a safe haven.

Yesterday may have been a form of ‘tipping point’ for gold whereby it again starts to display its safe haven status as it did soon after the initial price falls at the time of the Lehman financial crisis.

The trading fundamentals look increasingly sound. The COT data is very bullish from a contrarian perspective with the net long position extremely low. Also, the large commercial traders are aggressively covering their gold and silver shorts which is always a good indication that the precious metals are close to bottoms.

Gene Arensberg of the Got Gold Report says that the COT data “suggests that dips for gold and silver should be exceedingly well bid just ahead. Indeed, the structure of the COT is about as bullish as we have seen it for silver futures.”

The supply demand fundamentals remain very sound with gold demand expected to exceed supply again this year, according to the World Gold Council who have said that gold has bottomed or close to bottoming.

Gold will extend annual gains for a 12th year as bullion is “near” a bottom and demand will keep exceeding mine output, according to the World Gold Council.

Mine production will grow 3% this year from last year’s 2,800 metric tons, while demand may be unchanged or slightly lower from a record 4,400 tons, said Marcus Grubb, managing director of the WGC in an Bloomberg interview in Tokyo.

Mine supplies will remain in a deficit “for a foreseeable future,” Grubb said.

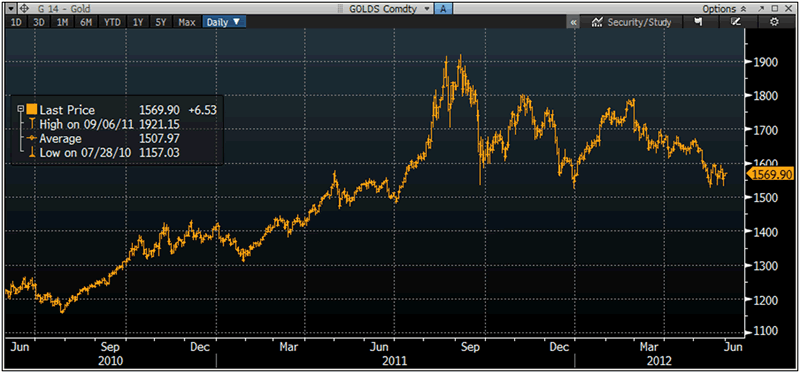

Gold in USD - 2 Year (Daily)- Bloomberg

Bullion is “near to the bottom at current prices, indicating gold will move back up again,” he said. Recycling has risen to make up for the gap between demand and mine output, he said.

“Some of the drivers of the increase in demand are structured, central banks for example, the rise of Chinese demand and the wealth increase in Asia, including India and China as well as smaller economies,” he said.

Central banks have increased gold purchases on concern about the dollar, the euro and the sovereign debts, Grubb said. The banks’ net purchases last year were the most since 1964. In 2010, they turned to a net buyer for the first time in 15 years.

About 50 percent of annual demand comes from India and China alone, Grubb said. “China is clearly the No. 1 market in 2012,” he said. Average world mine production costs are estimated at $960 an ounce, he said.

China’s demand, which rose to a record 255.2 tons in the first quarter, may gain to between 900 tons and 1,000 tons this year, from 769.8 tons in 2011, Albert Cheng, Far East managing director at the group, said May 17. Indian usage may be between 800 tons to 900 tons, from 933.4 tons, he said.

With the supply and demand fundamentals remaining sound and the trading fundamentals looking better by the day, gold’s bottom may have been seen or will likely be seen very soon.

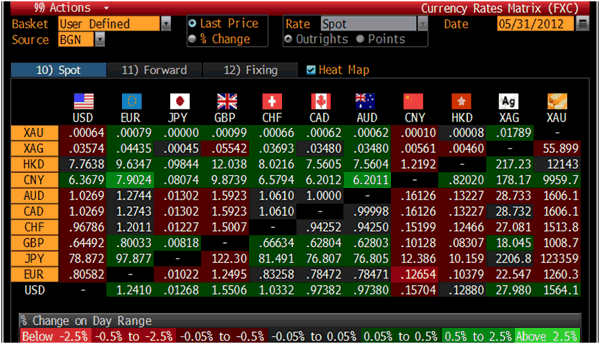

Cross Currency Table - Bloomberg

Ireland’s government is confident of victory in today’s eurozone fiscal pact referendum as secret official polling forecasts more than 60% of Irish voters will tick the Yes box.

Polling stations will close tonight after the only popular vote to be held in the 25 European Union countries that have signed up to a treaty that enshrines eurozone austerity rules into national law and cedes budgetary and economic power to the European Union.

After a quiet but bad-tempered campaign government and European Union officials are hoping that widespread Irish fears of tougher times ahead if voters say No will beat popular anger over austerity measures demanded in return for EU loans.

Campaigners against the eurozone treaty have accused the government of scare tactics, including claims that a No vote would lead to a Greek-style banking collapse, cause a tripling of the country's borrowing costs and plunge the country into national bankruptcy by 2014.

While a no vote is not expected, it is worth remembering that a no vote was not expected for the Lisbon or Nice treaties either and the Irish people voted no.

A no vote could create short term volatility in financial markets however the referendum’s outcome is of little significance to global markets as the Troika (ECB, EC and IMF) are likely to continue with their existing plans for Ireland no matter which way Ireland votes.

Ireland, like many European countries, needs to burn European and international bank bond holders if it is to have achieve financial and economic recovery. This is the real issue facing the Irish people and one which is not addressed in the Treaty.

Market watchers await China's Purchasing Manager's Index on Friday, while US Q1 GDP figures and a US employment report out today will give a clue as to the state of the two largest economies. For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.