The Best Stock Trading Pattern For Profits In A Downtrending Market

InvestorEducation / Learn to Trade May 31, 2012 - 02:20 AM GMTBy: David_Grandey

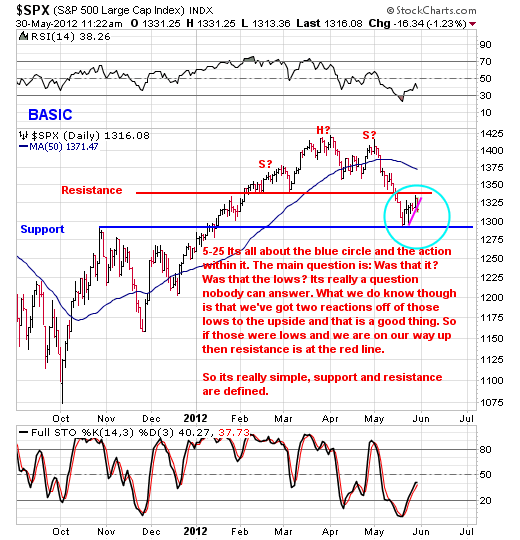

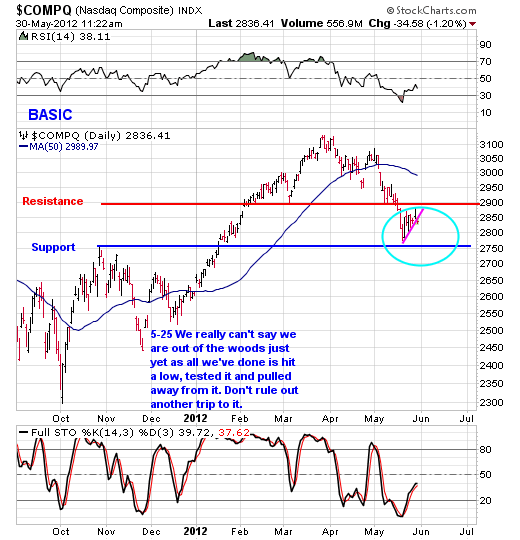

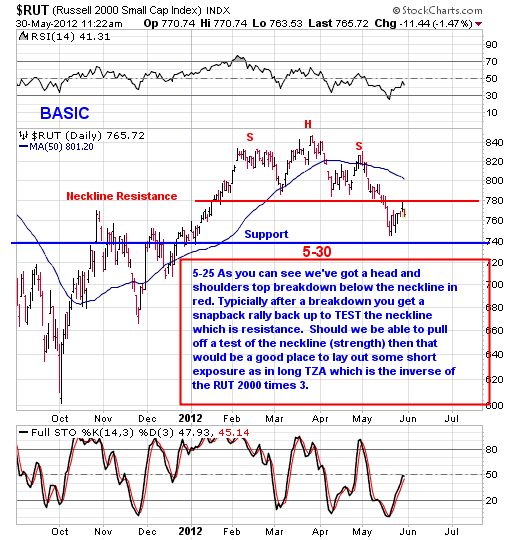

As we go through the charts of the daily indexes and individual names we see a lot of Pullback Off Lows (POL) patterns emerging. Much like in uptrending markets Pullback Off Highs (POH) patterns are the only pattern you need to know the opposite applies in downtrending markets where POL patterns are all you need to know for shorting. Those POL’s are also the what to watch out for if you are long. That all said below are the daily charts of the indexes.

As we go through the charts of the daily indexes and individual names we see a lot of Pullback Off Lows (POL) patterns emerging. Much like in uptrending markets Pullback Off Highs (POH) patterns are the only pattern you need to know the opposite applies in downtrending markets where POL patterns are all you need to know for shorting. Those POL’s are also the what to watch out for if you are long. That all said below are the daily charts of the indexes.

As you can see from a daily chart perspective each of the above has broken the Pink POL, Snapback rally, D wave, Bear channel call it what you will to the downside. Does that automatically mean this is it? Meaning a retest of recent lows? No, at this point all it means is that its initially broken to the downside and it’s all about follow through from here. We’ll take it a step at a time as usual.

The Russell 2000 shown below tagged its neckline (resistance) of its head and shoulders top and one could say and rolled right back over.

This all said? So far so good.

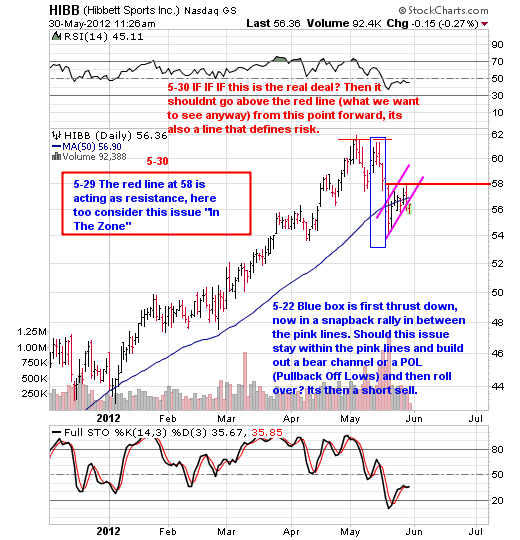

Now let’s take a look at HIBB. It triggered a short sell trade today by breaking below the pink POL channel. The notes in the chart say it all

By David Grandey www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2012 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.