Euro-Zone Crisis Delay and Pray, Stock Market Not Bearish Enough to Support a Rally

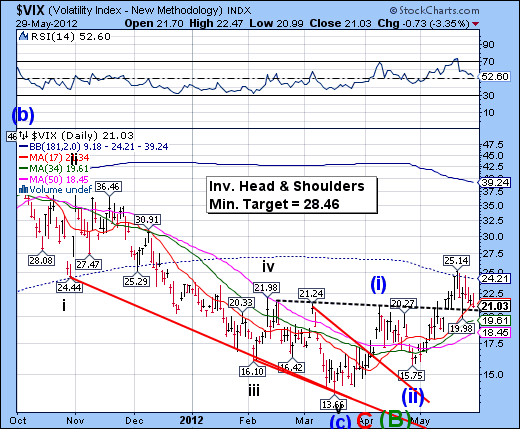

Stock-Markets / Financial Markets 2012 May 30, 2012 - 03:13 AM GMT -- The VIX remains beneath Mid-Cycle resistance at 24.21 but above its Head & Shoulders neckline today. It overshot the neckline on the first pullback and the second one is not as deep, but we would not like to see it go beneath the neckline. Tomorrow is the next pivot day, so it is possible that we may have seen the last of the correction today. This action seems to be saying that the rally in equities may be short-lived.

-- The VIX remains beneath Mid-Cycle resistance at 24.21 but above its Head & Shoulders neckline today. It overshot the neckline on the first pullback and the second one is not as deep, but we would not like to see it go beneath the neckline. Tomorrow is the next pivot day, so it is possible that we may have seen the last of the correction today. This action seems to be saying that the rally in equities may be short-lived.

-- SPY broke above the neckline of the lesser Orthodox Broadening Top formation, but remained beneath short-term trend resistance at 133.75. This is where I suggested having a partial stop loss for our short positions. I say only partial, since this is only the first Cyclical measure of the downtrend. So far, no stop loss has been generated.

At the close SPY has spent 43 trading hours in this correction. That, and the fact that SPY closed beneath short-term resistance strongly suggests the correction may be over, or very nearly so. May the low volume tom-foolery be at an end. Meanwhile, investor sentiment isn’t bearish enough to support a rally.

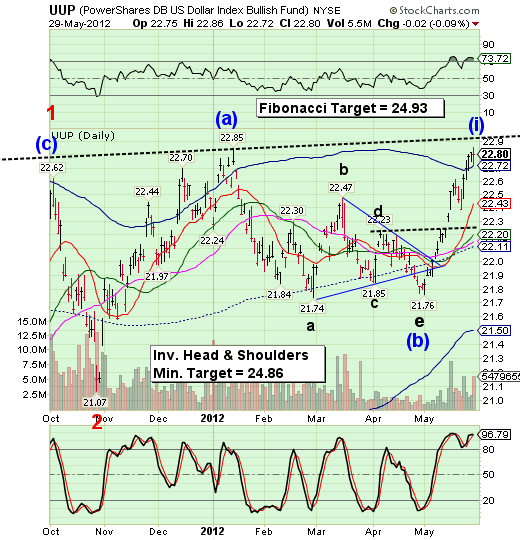

--UUP may be making a late Primary Cycle high today or tomorrow, after having exceeded its minor Head & Shoulders target. It still may need to touch the new neckline at 22.93 before it makes a brief consolidation. After a test of the neckline, it may pull back to Cycle Top support at 22.72 or short-term trend support at 22.43 before moving above the neckline and a new wave (iii).

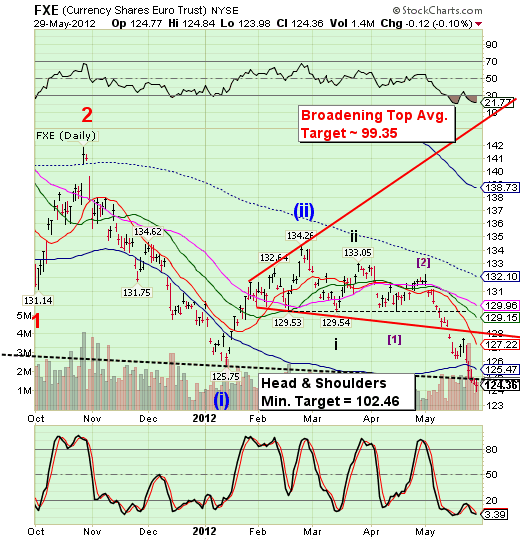

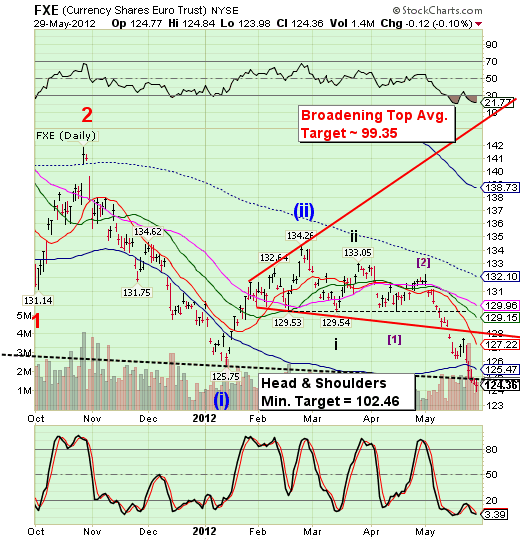

-- FXE has been testing the underside of its Head & Shoulders neckline at 124.85. The probability of a waterfall decline is extraordinarily high. There just doesn’t seem to be any bounce in FXE, even though it remains oversold. The next major pivot low may arrive by June 15. The Orthodox Broadening Top agrees with the target for the massive Head & Shoulders at target, which portends a decline to parity.

(ZeroHedge) …It is becoming clearer and clearer that some new policy option is required in Europe - but as JPMorgan's Michael Cembalest excellent cartoon description of the never-ending circular arguments among European leaders would put it - you would have to be a wide-eyed optimist to believe it will be a decisive one.

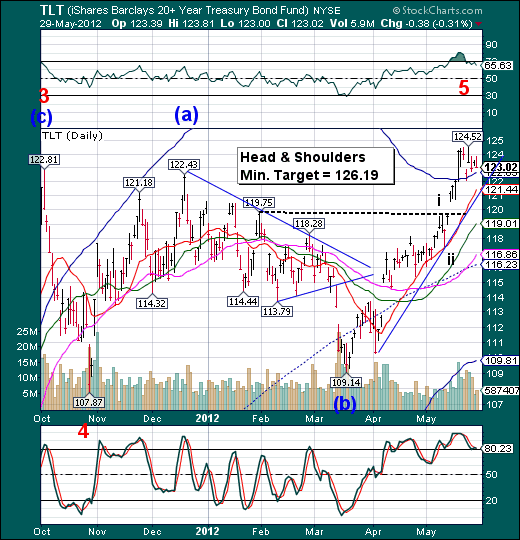

-- TLT seems to be retesting its Cycle Top support at 122.65. It appears that it may have completed its first thrust in a wave iii of (c) as it marches parabolically higher. The correction may be over, but an alternate view is that we may see TLT drop to its trendline and short-term support at 121.44 before moving higher. If TLT is still within a wave iii, it may not touch the trendline until after it has reached its minimum target. In either event, the trendline will be the governing tool to determine whether the final rally is still intact.

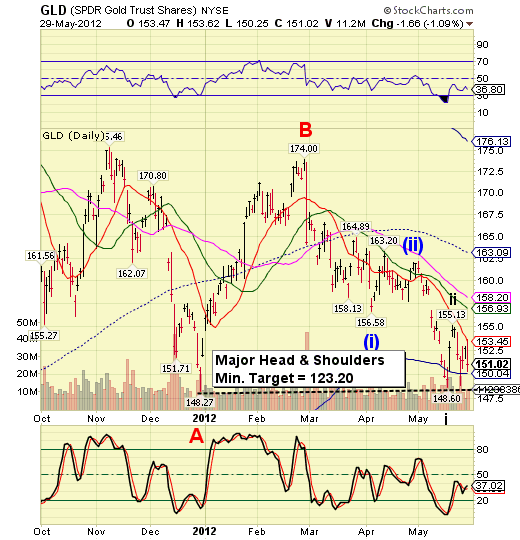

-- The bounce in GLD was repelled by short-term trend resistance at 153.45. The correction appears to be over. What seems to be happening now is that GLD may be setting up for a massive wave iii of (iii) once it falls through the neckline. This gives GLD less than three weeks to decline into a Primary Cycle low expecting a bottom in mid-June.

ZeroHedge writes, “…While hardly discussed broadly in the mainstream media, the top news of the past 24 hours without doubt is that in addition to losing its fiscal sovereignty, and numerous other things, the Greek population is about to lose its gold in a perfectly legitimate fashion, following amendments to the country's constitution by unelected banker technocrats, who will make it legal for Greek creditors - read insolvent European banks - to plunder the Greek gold which at last check amounts to 111.6 tonnes according to the WGC. And so we come full circle to what the ultimate goal of banker intervention in the European periphery is - nothing short of full gold confiscation.

-- USO tested the neckline of the larger Head & Shoulders pattern with a new target at 26.50 and closed beneath it. This suggests that there is no support to stop a further decline when it happens. What appears to be taking place, is that USO is about to enter wave (iii) of 3, which may be stronger than the Head & Shoulders pattern indicates. Fibonacci relationships suggest a decline to 22.00 in wave (iii).

-- I have moved the Head & Shoulders neckline with a new, lower target to Friday’s low. Today’s spike from the low suggests that the correction may be over and wave iii is about to begin. The Cycles Model suggests that we may see the decline continue through the second week of June, when a Master Cycle low is due. It has some subdividing yet to do between now and its target low date, but the consolidations will likely be compressed into shorter periods.

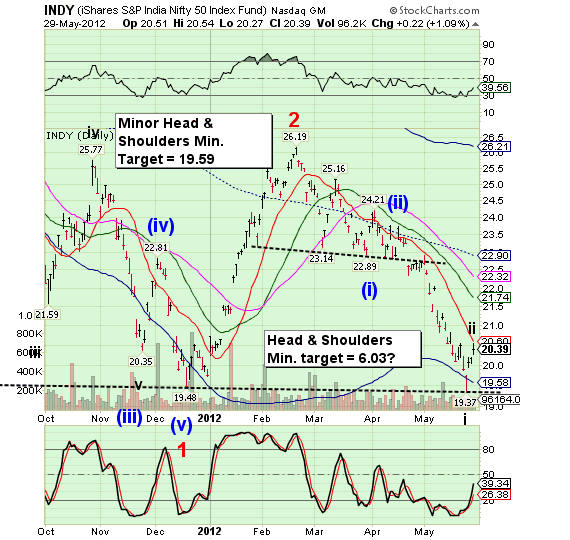

-- INDY may have completed its wave ii bounce from its major Head & Shoulders pattern today. It is now preparing to break the massive Head & Shoulders neckline below 19.37. It is due for a Master Cycle low in mid-June. This pattern has become complex, but Head & Shoulders patterns launch wave threes. This pattern may be an interesting one to watch unfold.

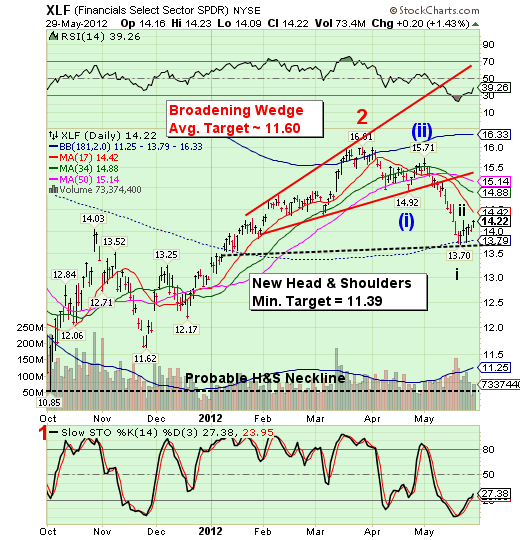

XLF appears to have finished its bounce before piercing its Head & Shoulders neckline at 130.70. The Broadening Wedge no longer has the deeper target, but it is good to have a “second opinion” on the extent of the decline. The current decline should take XLF to its November low or possibly to the massive “probable” neckline at the bottom of the chart. It appears now that XLF shares a virtually identical cycle with FXE. Both are expected to reach their respective Master Cycle lows in mid-June.

(ZeroHedge) Earlier today we reported of an instance of fiduciary impropriety so gross and abhorrent - namely the director of insolvent and nationalized Bankia preparing to receive €14 million in severance - that the public outcry was furious and instantaneous. The result: less than 12 hours later Expansion reports that according to Bankia president Jose Ignacio Goirigolzarri, the management of the the firm will waive their pension rights, and the infamous Aurelio Izaquierdo will not get his accrued pension when leaving the firm.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.