Labor Market Issues Hold Down U.S. Consumer Confidence Index in May

Economics / US Economy May 29, 2012 - 12:40 PM GMTBy: Asha_Bangalore

The Conference Board’s Consumer Confidence Index slipped in May to 64.8 from 68.7 in the prior month. The sub-components of the index measuring the present situation (45.9 vs. 51.2 in April) and expectations of consumers (77.6 vs. 80.4 in April) declined in May. The current level of the Consumer Confidence Index is back to the mark seen in December. The Conference Board’s index is running counter to the improvement of the University of Michigan Consumer Sentiment Index (79.3 vs. 76.3 in April). Labor market indicators play a big role in the Conference Board’s Consumer Confidence Index compared with the University of Michigan consumer optimism gauge.

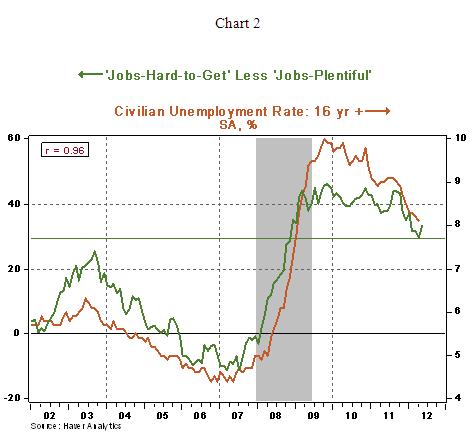

Speaking about labor market indicators, the percentage of respondents indicating that “jobs are hard to get” rose to 41 from 38.1 in April, while the percentage of respondents viewing “jobs as plentiful” dipped to 7.9 from 8.4 in the April. The net of these two indexes moved up to 33.1 from 29.7 in April. Historically, the net of these two indexes has a strong and positive relationship with the jobless rate. Based on this relationship, the unemployment rate for May could turn out higher than the 8.1% rate of April.

Our research shows that relationship between consumer spending and consumer optimism measures has changed over a period of time with the ties more tenuous in recent years. Nevertheless, the Fed frequently cites consumer optimism measures among the list of indicators used to assess the status of the economy.

Asha Bangalore — Senior Vice President and Economisthttp://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.