What If California Were Greece? Is Europe Coming Together or Flying Apart?

Economics / Global Debt Crisis 2012 May 26, 2012 - 11:55 AM GMTBy: John_Mauldin

It is simply hard to tear your eyes away from the slow-motion train wreck that is Europe. Historians will be writing about this moment in time for centuries, and with an ever-present media we see it unfold before our eyes. And yes, we need to tear our gaze away from Europe and look around at what is happening in the rest of the world. There is about to be an eerily near-simultaneous ending to the quantitative easing by the four major central banks while global growth is slowing down. And so, while the future of Europe is up for grabs, the true danger to global markets and growth may be elsewhere. But, let’s do start with the seemingly obligatory tour of Europe.

It is simply hard to tear your eyes away from the slow-motion train wreck that is Europe. Historians will be writing about this moment in time for centuries, and with an ever-present media we see it unfold before our eyes. And yes, we need to tear our gaze away from Europe and look around at what is happening in the rest of the world. There is about to be an eerily near-simultaneous ending to the quantitative easing by the four major central banks while global growth is slowing down. And so, while the future of Europe is up for grabs, the true danger to global markets and growth may be elsewhere. But, let’s do start with the seemingly obligatory tour of Europe.

What If California Were Greece?

David Zervos is the managing director and chief market strategist of Jefferies and Company. He is an astute observer of Europe and brings a very interesting perspective to the trade, with his Greek heritage. I got an email this morning from him that I wish I had written. It is hard for many of us in the US to understand just how deeply flawed the structure of the European Monetary Union is (as opposed to the actual political union which, for all its flaws, seems to work quite well). David came up with a very fun analogy that makes the problem readily apparent. What if California behaved like Greece and the rest of the US was asked to pay for its debts and other obligations? What would ensue? So, rather than paraphrase what is already a very solid if short essay, let’s turn to David:

The Separation of Bank and State

By David Zervos

“The euro monetary system is flawed. It is a system that was cobbled together for political purposes; and sadly it was set up in such a way that each member state retained significant sovereign powers – most importantly the ability to exit the system and default on debts in times of stress. There is virtually NO federal power in the Union, as witnessed by the complete breakdown of the Maastrict and Lisbon treaties. In fact, what we are seeing today is that the structure of the monetary system is so poorly designed, it actually creates perverse fiscal linkages across member states that incentivize strategic default and exit. Our new leader of the Greek revolt, Mr CHEpras, has figured this one out. And in turn he is holding Angie hostage as we head into June 17th!

[JFM note: CHEpras is David’s tongue-in-cheek name for the 37-year-old leader of the Syriza Party, Alexis Tsipras, whose rhetoric does indeed resemble Che Guevara’s from time to time.]

“To better understand these flaws in the Eurosystem, let's assume the European monetary system was in place in the US. And then imagine that a US ‘member state’ were to head towards a bankruptcy or a restructuring of its debts – for example, California.

“So let's suppose California promised its citizens huge pensions, free health care, all-you can-eat baklava at beachside state parks, subsidized education, retirement at age 45, all-you-can-drink ouzo in town squares, and paid 2-week vacations during retirement. And let’s assume the authorities never come after anyone who doesn’t pay property, sales, or income taxes.

“Now it's probably safe to further assume that the suckers who bought California state and municipal debt in the past (because it had a zero risk weight) would quickly figure out that the state’s finances were unsustainable. In turn, these investors would dump the debt and crash the system.

“So what would happen next in our US member-state financial crisis? Well, the governor of California would head to the US Congress to ask for money – a bailout. Although there is a ‘no-bailout’ clause in the US Constitution, it would be overrun by political forces, as California would be deemed systemically important. The bailout would be granted and future reforms would be exchanged for current cash. The other states would not want to pay unless California reformed its profligate policies. But the prospect of no free baklava and ouzo would then send Californians into the streets, and rioting and looting would ensue.

“Next, the reforms agreed by the Governor fail to pass the state legislature. And as the bailout money slows to a trickle, the fed-up Californians elect a militant left-wing radical, Alexis (aka Alec) Baldwin, to lead them out of the mess!

“When Alexis takes office, US officials in DC get very worried. They cut off all California banks from funding at the Fed. But luckily, the "Central Bank of California" has an Emergency Liquidity Assistance Program. This gives the member-state central bank access to uncollaterized lending from the Fed – and the dollars and the ouzo keep flowing. But the Central Bank of California starts to run a huge deficit with the other US regional central banks in the Fed's Target2 system. As the crisis deepens, retail depositors begin to question the credit quality of California banks; and everyone starts to worry that the Fed might turn off the ELA for the Central Bank of California.

“Californians worry that their banks will not be able to access dollars, so they start to pull their funds and send them to internet banks based in ‘safe’ shale-gas towns up in North Dakota. Because, in this imaginary world, there is no FDIC insurance and resolution authority (just as in Europe), the California banks can only go to the Central Bank of California for dollars, and it obligingly continues to lend dollars to an insolvent banking system to pay out depositors. In order to reassure depositors, California announces a deposit-guarantee program; but with the state's credit rating at CCC, the guarantee does nothing to stem the deposit outflow.

“In this nightmare monetary scenario, with the other regional central banks, ELA, and Target2 unable to stop the bleeding – and no FDIC – the prospect of a California default FORCES a nationwide bank default. The banks automatically fall when the state plunges into financial turmoil, because of the built-in financial structure. A bank run is the only way to get to equilibrium in this system.

“There is sadly no separation of member-state financials and bank financials in our imaginary European-like financial system. So what's the end game? Well, after Californians take all their US dollars out of California banks, Alexis realizes that if the Central Bank of California defaults, along with the state itself and the rest of its banks, the long-suffering citizens can still preserve their dollar wealth and the state can start all over again by issuing new dollars with Mr. Baldwin's picture on them (or maybe Che's picture). This California competitive devaluation/default would leave a multi-trillion-dollar hole in the Fed’s balance sheet, and the remaining, more-responsible US states would have to pick up the tab. So Alexis goes back to Washington and threatens to exit unless the dollars and ouzo and baklava keep coming.

“And that’s where we stand with the current fracas in Europe!

“Can anyone in the US imagine ever designing a system so fundamentally flawed? It’s insane! Without some form of FDIC insurance and national banking resolution authority, the European Monetary System will surely tear itself to shreds. In fact, as Target2 imbalances rise, it is clear that Germany is already being placed on the hook for Greek and other peripheral deposits. The system has de facto insurance, and no one in the south is even paying a fee for it. Crazy!

“In the last couple days I have spent a bit of time trying to find any legal construct which would allow the ELA to be turned off for a member country. I can't. That doesn't mean it won't be done (as the Irish were threatened with this 18 months ago), but we are entering the twilight zone of the ECB legal department. Who knows what happens next?

“The reality is that European Monetary System was broken from the start. It just took a crisis to expose the flaws. Because the member nations failed to federalize early on, they created a structure that allows strategic default and exit to tear apart the entire financial system. If the Greek people get their euros out of the system, then there is very little pain of exit. With the banks and government insolvent, repudiating the debt and reintroducing the drachma is a winning strategy! The fact that this is even possible is amazing. The Greeks have nothing to lose if they can keep their deposits in euros and exit!

“Let's thank our lucky stars that US leaders were smart enough to federalize the banking system, thereby not allowing any individual state to threaten the integrity of our entire financial system. There is good reason for the separation of the banking system and the member states. And Europe will NEVER be a successful union until it converts to a state-independent, federalized bank structure. The good news is that our radical Greek friend Mr CHEpras will probably force a federalised structure very quickly. The bad news (for him) is that he will likely not be part of it! I suspect this Greek bank run will be just the ticket to precipiate a federalized, socialized, stabilized Europe. Then maybe we can get back to the recovery and growth path everyone in the US is so desperately seeking.

“Good luck trading.”

Coming Together or Flying Apart?

The debate among very knowledgeable individuals and institutions as to the future of Europe is intense. There are those who argue that the cost of breaking up the eurozone, even allowing Greece to leave, is so high that it will not be permitted to happen. Estimates abound of a cost of €1 trillion to European banks, governments, and businesses, just for the exit of Greece. And that does not include the cost of contagion as the markets wonder who is next. Keeping Spanish and Italian interest-rate costs at levels that can be sustained will cost even more trillions, as not just government debt but the entire banking system is at stake. Not to mention the pension and insurance funds. If the cost of Greece leaving is €1 trillion, then who can guess the cost of Spain or Italy?

A total Greek default wipes out more than twice the ECB balance sheet. That means the remaining countries will have to put twice as much into the ECB as their present commitment, just to get the ECB back to where it technically stands today (because theassumption is still that Greek debt is good, and so the ECB is still lending money to the Greek Central Bank).

Then there are those who argue there is no way Greece can stay in the eurozone. The political costs are just too high, not only to the Greek people but to the rest of Europe. How long can Greece demand that Europe cover its government deficits, when its own citizens are not diligent in paying taxes? Listen to Alexis Tsipras, the leader of Syriza, at a campaign rally:

“There's one real choice in these elections: the bailout or your dignity…

“We want all the peoples of Europe to hear us, and we want their leaders to hear us when we say that no [country] chooses to become servile, to lose their dignity or commit suicide... We are the political party that with the help of the people will fulfill our campaign promises and cancel this bankrupt bailout deal.”

The Syriza Party appears to be ahead in the polls as I write, but that has shifted several times this week. Not only do European leaders not know what will happen, apparently even the Greeks cannot make up their minds, if we are to believe the polls. They want to stay in the eurozone but don’t want to have to endure the cuts in spending that simply moving toward a balanced budget will requirs. This is a classic case of wanting to have your cake and eat it too.

I simply don’t know what the eurozone will do in the next year, or even the next month. If Syriza wins the elections and forms the government, how can Europe back down and give them what Tsipras is demanding? And if the Greeks continue to pull their money from Greek banks (and it is now billions a week), then it will not be very long before they have their euros everywhere but in Greece, and they will in fact have little reason to stay in the eurozone, as Zervos points out.

This latter fact will not be lost on Spanish and Italian voters. If there is not that great a cost to Greece for leaving; and especially if Greece, after a period of severe recession/depression, starts to rebound; then voters all over Europe will be paying close attention. Some will ask why they should not default as well, and others will wonder why they are paying taxes to support other countries that might leave.

Even if European leaders have no real idea what will actually happen, there are some things that are more likely than others. I think the whole idea of eurobonds is dead on arrival. Who would be responsible for paying that bond structure, which would soon be in the trillions of euros? Some European authority? The EU itself, which would then need to levy taxes and set national budgets? I can’t really see any country giving up control of its budget to Brussels, let alone give the EU the power to raise taxes. And if the eurozone has a problem raising a relatively paltry €400 billion for the ESM, etc., from the various governments, how can it expect to get the authority to raise trillions? Does anyone really think the German Bundestag will agree to their share of that?

That then leaves the options of either designating the ESM or some other entity as a bank that can borrow relatively unlimited amounts from the ECB, or having the ECB monetize the debts of various governments in trouble and saddling them with a program of budgetary reforms (which are clearly not popular if you are the one being reformed!).

I still think it is likely that Greece will leave the eurozone. It makes sense if you are Greece; and even though it will cost the other eurozone members huge sums of money, I think they are getting “Greek fatigue.” But let’s stay tuned, as they say.

Europe in Recession

Germany was able to sell €4.56 billion ($5.8 billion) of two-year bonds at a 0% coupon interest rate on Wednesday. That was not a typo. Why would people give Germany money to use for two years at no cost?

I can think of several reasons, but the one I think is most likely – and the one that will not be admitted in polite circles – is that it is basically a very low-cost call option on the possibility of Germany leaving the eurozone. If Germany left, they would likely denominate their bonds in Deutsche marks, which would rise in value over those of the countries that remained in the euro.

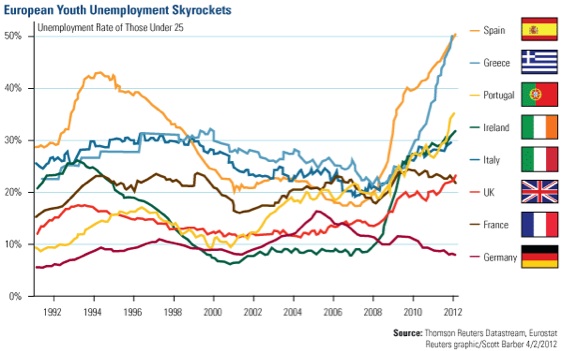

But this also points up the fact that Germany is falling into recession, hard on the heels of the rest of Europe, which is mostly already there – some countries severely so. Leading economic indicators as well as purchasing-manager indexes are down all across Europe. But the saddest statistic is that of youth unemployment. Below is a chart from Reuters (courtesy of Frank Holmes at US Global). Only Germany is seeing its youth unemployment rate fall below 10%.

Meanwhile, Back at the Ranch

This letter is translated into Chinese, Spanish, and Italian; so I have to write with an international audience in mind, and also remember that I am of a certain age. Some concepts may not translate well, either to other languages or across generations. So let me set up the theme for younger readers and those not familiar with early 20th-century American culture. In the dawn of film, cowboy movies were all the rage. These were typically low-budget, and most were shot on the same set and ranch in southern California. The same saloons, jails, large rocks, and dirt roads kept showing up in movie after movie; but no one much noticed, back then. The magic of movies was still fresh.

You would watch your hero (you knew he was the good guy, because he wore a white hat) chase bank robbers and cattle rustlers and duke it out with gunslingers; and there was usually at least one pretty girl involved. In the era of silent movies, there would literally be a title graphic that said, “Meanwhile, Back at the Ranch” when there was a segue between the action involving the hero and the bad guys and the doings of the people back home on the ranch.

So then, “meanwhile, back at the global economy,” let’s look at a few graphs and some data to see what is happening in the rest of the world.

First of all, China is really beginning to slow down from its torrid pace of growth. Thr growth of their manufacturing output has fallen for seven straight months, and it is now contracting. Media reports everywhere are talking about actual statistics or anecdotal stories from Chinese merchants and businesses. Construction is under real pressure, as are real estate prices. Just as in the US or Europe, when construction starts to slow it affects all sorts of smaller businesses that supply products to people building or remodeling their homes.

A few data points. Deposit growth in China is slowing rapidly, and money supply suggests a decelerating economy. The ratio of M1 to M2 growth suggests an even weaker economy than the contracting purchasing manager’s index. The M1-M2 ratio is now back to where it was in the last financial crisis.

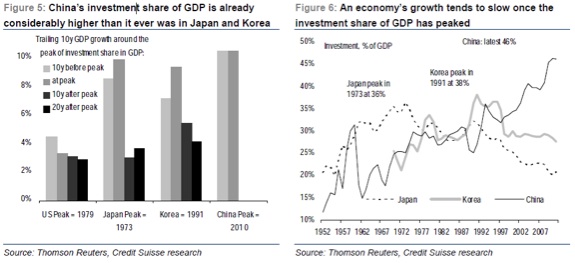

Let’s look at two charts from Credit Suisse. I have long been concerned about the very high percentage of GDP growth in China that is attributable to direct investment, bank loans, and infrastructure spending. While all of those are good things, the levels in China are without precedent anywhere in the world that I am familiar with, and have been there a long time.

What happens when you have to slow down investment and try to become a more consumer-driven economy? The transition is generally not smooth. And what happens when you try and do that when your largest customer (Europe) is in recession? And when the bank lending from Europe that finances the spending of many of the developing nations you sell to begins to dramatically shrink?

Reports from around the world show South African and Australian mines with lower sales, growth in Taiwan slowing and Great Britain in recession. The MSCI World Index, which tracks equity markets around the globe, is down more than 9% since mid-March.

A Slowing US Economy

The US economy is also starting to slow. Job growth is getting weaker. Food stamps are at an all-time high. The effects from stimulus spending have just about gone away, and there are large numbers of people falling off extended unemployment benefits. Lakshman Achuthan, of the Economic Cycle Research Institute (ECRI), has recently reaffirmed his belief that a return to economic contraction is likely in 2012, noting that the coincident data used to officially define economic-cycle boundaries continue to signal slowing growth. Achuthan is a very sober fellow, and you have to pay attention when he makes these calls. ECRI does not make them lightly.

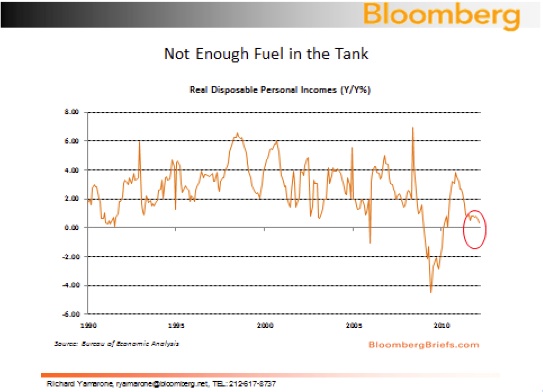

Let’s also look at a couple charts from my friend Rich Yamarone, the chief economist at Bloomberg. (We will be together at a symposium at the University of Texas in Austin, on June 7, along with David Rosenberg.) Rich has also been stating that he believes the US economy is headed for recession, for a different set of reasons.

At our dinner meeting last week (as indeed he has been for months) he was talking about the fall in real disposable personal income. It is hard to get growth when incomes are not rising .

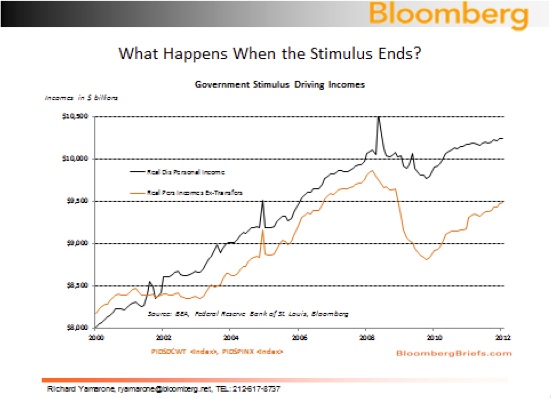

And he too is worried about the fact that government stimulus (transfer payments, unemployment benefits, welfare, food stamps, etc.) has had a major effect on consumer spending, but as people fall off extended unemployment benefits (and they are, by the hundreds of thousands each month) personal income could actually drop.

Where’s My Quantitative Easing?

The recent round of global quantitative easing is beginning to ebb. Europe, Great Britain, and the US are all wrapping up their stimulus and have not announced plans for any more. China is more or less on hold until the leadership changes in October (or that is what most observers I read seem to think).

The recent QE had provided a clear boost to commodity prices and stocks, and the anticipation of withdrawal seems to be having a depressive effect on market prices. This was the third round of global QE, and each round has resulted in less real benefit than the previous one. There is reason to believe that another round would continue that trend. While it is probable that the ECB will soon take action, as Europe is clearly in recession, there seems to be no such consensus as yet in the US. And with an election coming in November, if the Fed is going to do anything, they have just two meetings left (on June19-20 and August 1) before September, at which point the economy would have to be in very serious trouble for them to do anything before the election – which then takes us out to the December meeting.

Since the recent most QE will still be in effect at the time of the June meeting, that would leave August 1 for an announcement. We will only have two unemployment reports between now and that meeting. They will therefore be of more than usual importance. We will be watching.

Home for a Week! New York and Italy

I will be in New York the first weekend in June, then jog over to Philadelphia to speak on Monday and Tuesday at an advisor conference with partner Steve Blumenthal of CMG (619-989-9090). And then back home. As I mentioned above, I will be in Austin June 7. Then the next week it’s back to NYC for two days and then to Chicago the following week, both for events with my partners at Altegris (details later).

And then I am off to Tuscany for two weeks! I will be reading and writing, of course, but doing it under the Tuscan sun and on a more relaxed schedule. Tiffani will be there, and a number of friends are stopping by. I am really looking forward to it.

I was in Atlanta this week. I have to confess that while I love Atlanta I hate flying there, as it is a long taxi ride to wherever I seem to stay, and I always manage to get there during rush hour. This week I arrived at 5 pm, just in time to sit in traffic. As I was walking to the other side of the airport to hail a taxi, I passed a sign that read “Train.” A few questions later and I found the train, which, it appeared, would take me close to my hotel. Why not? I paid the princely sum of $2.50 and hopped on the train, which was uncrowded and quite nice. I got off in downtown, walked out, and asked directions to my hotel.

The very helpful attendant told me to go back and get on the train to the next station. “Just ask that guard over there, and he will let you back in.” And he did. And so I got off at the next station and walked out (again directed to go through the emergency exit, as my ticket had been used up), and another attendant (this time a very nice lady) told me I needed to walk to the other side of the station. No problem. I started walking.

“Wait. Not that way!” she called. “Let me get you back into the station. When you get to the other side just go through the emergency exit. And slow down, young man” (even though I was clearly her senior by a few years). It was nice to be treated in such a friendly way. Not my normal experience on trains and subways. I do so like Southern hospitality.

Which brings to mind an experience in Paris, about two years ago. I find the Paris subway quite handy at times. I was staying at a hotel right next to a station. Walking back from a meeting at the Central Bank of France, I got thoroughly lost, totally turned around and not in any district I had ever seen. Frustrated, I decided to find a subway and just take it back to the hotel. THAT I could do. So I asked a person on the street where the subway was, got directions, and started out on a rather longish hike. No subway. I asked again. More directions. And no subway station. I asked a third and then a fourth time. I was getting very upset. My experience in past years had been that even Parisians do not intentionally mislead tourists, even Texans. I simply could not understand what was going on.

Not knowing what to do, I paused and looked around. And then I saw the subway. Except that it was a Subway sandwich shop. If you want the train in Paris, you ask for the Metro.

Oh well. So much for the seasoned traveler. (I wonder how that story gets translated.)

It is time to hit the send button. I know it dates me, but this letter got me thinking about Hopalong Cassidy, Roy Rogers, The Lone Ranger, and the TV and B movies of my youth. It’s all there on the internet now. Back then, we lived for the weekend, to hear the words, “A fiery horse with the speed of light, a cloud of dust, and a hearty ‘Hi Yo Silver!’” It meant the Lone Ranger was riding into our living room.

It is quite a remove from where I am today to the country boy growing up in rural Texas. But you still remember the lessons. Sit tall, talk straight, and keep your word. Be kind to animals, polite to ladies, and do the right thing, no matter what. Good lessons then and now, only I don’t know whether the same concepts are being imparted by the video games my kids play. Different times, for sure; and I’m not sure the “good old days” were better; we just remember them that way.

Have a great week. Tomorrow is my youngest son’s 18th birthday. They are all grown up now.

Your hard-flying, straight-shooting analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.