Who's Winning and Who's Losing from Facebook's Botched IPO

Companies / Tech Stocks May 25, 2012 - 02:50 PM GMTBy: Casey_Research

Adam J. Crawford, Casey Research writes:

In less than a week's time, the Facebook IPO has gone from the most-hyped technology event since Google went public into "blame-storming" mode. Details concerning the stock's sudden drop, the market's inability to process orders, and the (mis)behavior of insiders are starting to emerge. And it doesn't look good.

Adam J. Crawford, Casey Research writes:

In less than a week's time, the Facebook IPO has gone from the most-hyped technology event since Google went public into "blame-storming" mode. Details concerning the stock's sudden drop, the market's inability to process orders, and the (mis)behavior of insiders are starting to emerge. And it doesn't look good.

The Scandal

When any stock drops as much out of the gate as Facebook has – down as much as 25% peak to trough in the days since the public premier of the stock – people start asking big questions... even more so when that stock carries a $50-billion-plus market cap, meaning the loss triggered billions in paper losses. Add on the fact that the Nasdaq market computers crumbled under the activity, and the scrutiny is intense.

What's been uncovered so far is painting a picture of poorly managed expectations and questionable ethics. The key event behind the drop appears to be a massive shift in expectations from institutional investors at the last minute.

Evidently, a Facebook executive – at this stage we can only guess who – alerted analysts that previously issued revenue estimates were a bit optimistic. Shortly thereafter, the analysts took the unusual step of slashing revenue estimates during Facebook's IPO roadshow. The information was then relayed to a select few potential institutional buyers. The financial community calls this "selective disclosure." I call it BS.

To make matters worse, Morgan Stanley (the lead underwriter and one of a select group of banks privy to the lower estimates) actually raised the offering price and issued more shares publicly, despite cutting the revenue estimate behind closed doors. Initially, Facebook shares surged due in large part to robust retail demand. However, once gravity took hold, Morgan Stanley chose to step in and provide some temporary support at the original offering price of $38 a share. The bank stepped into the market and bought millions of shares back from the public. It was able to do so without risking much capital thanks to the massive "greenshoe" allotment it took at the IPO – a gift of nonexistent shares the bank can sell risk free to the public if they have the demand. Stock goes up, and Morgan Stanley can force Facebook to cough up more shares, diluting investors and pocketing the profit. Stock goes down, and Morgan Stanley can buy them back below the IPO price, wiping out the excess volume and pocketing the price difference. Not bad deal, eh? Thankfully, most banks do exercise some level of ethical caution with those overallotment shares and use the process to instead stabilize the market, as happened with the over 60 million shares Morgan Stanley bought back from investors.

Consequently, Facebook shares stabilized and ended the trading day flat.

Facebook's humdrum opening-day performance was a minor disappointment for speculative investors hoping to flip shares for a quick profit. The minor disappointment soon morphed into a major disappointment for all shareholders, once rumors spread about the behind-the-scene shenanigans mentioned above. One look at the stock chart will show you the unpleasant Monday-morning surprise shareholders arose to the next trading day.

(Click on image to enlarge)

Facebook shares have since settled near $32 a share but remain exceedingly temperamental. A skilled trader could probably make a few bucks off this volatility (but a day trader I am not, so I can't help you there). As far as Facebook's long-term potential goes, I can offer a quick analysis.

The Future Outlook

Despite our decrying of the trading practices of Wall-Street banks, when dealing with a company of this size and whose relationships with the banks run this deep, one of the best sources of data on the company will remain the consensus opinion of their research arms. Below are their earnings-per-share growth estimates for the next three years:

As you can see, earnings growth is projected to slow to 21% by 2014. That's exactly the growth rate Google – a company with nearly 10 times the annual revenue of Facebook – is estimating for 2012. And for that kind of projected growth, the market places a value of 18.5 earnings on Google's stock. Let's be generous and award Facebook a 25 multiple for 21% growth. A little back-of-the-envelope math suggests that would place its value at about $20/share ($.80 EPS x 25) three years from now!

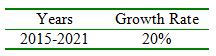

Coming at this from another direction, let's assume that cash flow and net income will be the same in the years ahead. Let's further assume the same growth rates shown above for 2012-2014 and add these rates for subsequent years:

When we apply a 10% discount rate to these data, we come up with a discounted cash flow valuation of $27.

With either approach, Facebook appears to be overvalued based on the ultimate arbiter of value, profitability. But the picture may be even worse than we've painted. Every assumption depends on tremendous – yes, slowing, but still on the "billions of dollars per year" scale – growth; and there are red flags popping up all over the place in that regard. Here are a few:

- General Motors, questioning their effectiveness, recently withdrew its display ads on Facebook. (Speaking of General Motors, Facebook's market cap is bigger than GM's and Ford's combined!)

- Revenue from advertising on mobile devices is likely to disappoint; the screens are simply too small and commerce activities less common and for lower value, to be as effective at advertising.

- In his IPO letter, founder Mark Zuckerberg wrote: "We don't build services to make money; we make money to build services." In other words, maximizing revenue is not his priority. He is reluctant to extend ads beyond a certain point because he believes they become intrusive and compromise the experience. Noble as this may be, it will hamper the growth needed to justify the stock's lofty valuation. Of course, Zuckerberg is a billionaire still at $27, $20, even $5 for the stock…

The Winners and Losers

With the company's stock dropping, retail investors getting the hose, and profit opportunities coming, did any of the stakeholders win in the IPO process?

The primary loser in Facebook's market debut appears to be the retail investors, because they were sold shares at an inflated price, based on inflated estimates that the investment banks making them knew to be wrong. However, it's possible that Facebook will turn out to be a profitable investment still; and if it is, my hat's off to you for taking the leap – we were busy focusing on opportunities with the odds more in our favor.

A close second in the loser category is Nasdaq. The exchange lacked the technology to properly handle the massive order flow, an ironic twist for the de facto "technology exchange," and the original electronic trading platform that once decried the failures of the NYSE to meet customer demand. As a result, many orders were either delayed or altogether failed to process. Obviously, the botched job could cost the exchange future business.

The primary winner is Mr. Zuckerberg for numerous reasons… 19.1 billion or so little green ones.

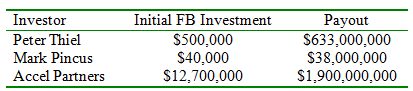

His cohorts also did fairly well, too. Here are just a few examples:

Facebook employees made out well on the deal, too… at least the ones there early enough to get sizable grants. We'll know pretty soon just how many millionaires the event created, we're sure – but it's safe to assume quite a few. Let's just hope for their sakes that the reality of earnings potential doesn't hit too hard before their lockout periods expire.

In addition, some savvy traders apparently got in near the offering price and jumped ship in the $40s – probably a high-frequency trading firm or two.

The underwriters (e.g., Morgan Stanley) go into the "yet to be determined" category. Sure, they made a mint on the deal, but they also have drawn the attention of the busybodies in Washington, D.C. And any time Washington busts out the red tape, we all lose.

[Sometimes the best investment advice is not to jump on a bandwagon – not only to avoid a drop such as Facebook's stock continues to experience – but also because that allows the savvy investor to deploy capital where it's more likely to reap rewards. Facebook's face-plant is a potent reminder for tech investors: the tech wars are ongoing and may get even bloodier. Don't let your portfolio be splattered by them.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.