Good News for Gold Prices: Commodities are Wounded, But Far From Dead

Commodities / Gold and Silver 2012 May 24, 2012 - 07:20 AM GMTBy: Money_Morning

Peter Krauth writes:

Greece is frozen in a political stalemate. Youth unemployment is running at over 50%. And there has been a $1 billion run on Greek banks.

Peter Krauth writes:

Greece is frozen in a political stalemate. Youth unemployment is running at over 50%. And there has been a $1 billion run on Greek banks.

From near and afar, there appears to be no easy way out, especially now that the Eurozone is heading back into a recession.

It's times like these when investors pour into the U.S. dollar for its "perceived safety."

With commodities priced in U.S. dollars, this spike in the greenback has sent commodities-including gold prices-into a tailspin since early March.

That has many doubters asking: "Has the commodities super-cycle ended?"

It's a reasonable question considering the Continuous Commodity Index (CCI) is back down to levels it last saw in September 2010.

What's more, gold prices have backed off to near $1,500/oz., and oil prices have fallen from $110 to $90/barrel.

But as you'll see, the commodities coin does have another side.

The Other Side of the Commodities Story

In fact, a recent article by Frank Holmes, CEO and chief investment officer at U.S. Global Investors, pointed out how China and other emerging nations are in better fiscal shape than much of the West.

Even if China is slowing somewhat, it is still growing at an enviable 8% per year, with only 42% debt to GDP ratio. So rather than go for more outright stimulus, it's expected that China will target new loan growth and its M2-money supply growth to around 14%.

Meanwhile, India and Australia have just lowered interest rates while other central banks are basically refusing to raise rates.

It means the world will keep turning, people will keep consuming and annual demand of raw materials is likely to remain elevated.

As for gold prices, let's cut right to the chase.

Real interest rates are running around negative 2% and thanks to ZIRP (Bernanke's Zero Interest Rate Policy), they're likely to remain so at least until late 2014.

And debt in the West (U.S., Europe, England, and Japan) has doubled in a little over three years to almost $8 trillion in a veritable monetary flood that's bullish for gold.

On top of all that, the demand for physical gold is still increasing.

According to the World Gold Council's (WGC) Q1 2012 trends review, they see record levels of Chinese demand, surging 10%, for a new quarterly high of 255.2 tonnes. They also see further growth, as the Chinese remain concerned about high inflation persisting.

The demand is so great that China has surpassed India as the world's largest gold consumer.

European demand has also held up well, with physical metals in the form of bars and coins selling at higher than historical levels.

And central banks keep doing their part, with net purchases totaling 80.8 tonnes, or about 7% of global demand. WGC believes there's been a secular shift, with central banks now set to remain net buyers of gold for the foreseeable future.

Yet, gold investors who are dismayed by its recent price action need to be psychologically prepared.

If we were to see a scenario similar to the 1970s bull market, gold could easily drop in half at any time.

That's exactly what happened when gold reversed from $200 in January 1975, and fell for 18 months to $100 in August 1976.

Certainly, a drop that big would have forced a lot of gold investors to sell. But the truth was that the best was yet to come.

From $100 in August 1976 until its peak in 1980, gold rose 8 times to over $800.

In fact, a chart of the entire current bull market shows that gold prices could easily pull back to $1,300 and still not violate its upward trend line.

A QE Boost to Commodity and Gold Prices

So yes, the markets are in a funk over Europe and less-than-stellar economic news here.

But this is déjà vu all over again. Since the financial crisis began, we've been here three times before. In fact, each time since then, the Fed has stepped in following a clear market pullback and opened the monetary spigots.

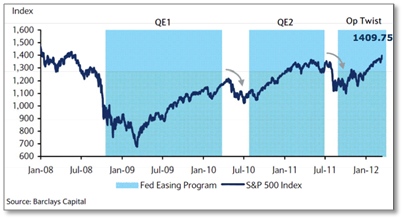

First came Quantitative Easing 1 (QE1), then QE2, then Operation Twist. Each one of these liquidity injections quickly sent the market soaring.

The Fed also promised to keep rates low until the end of 2014. Of course, Ben's been denying for months that more stimulus is coming. Yet recently released Fed minutes from its April monetary policy meeting showed more openness to another round of easing to coax the economy along.

But each time one of these injections ends (wears off), the market (junkie) goes into withdrawal, and looks for its next fix.

I've been saying for awhile that it's coming. With an election pending this November, odds are good we'll see QE3 before the end of summer.

With falling stocks, retreating commodity prices, and weak jobs reports, it'll make the QE3 sales pitch a much easier sell than your average time-share.

And based on the reaction the last three times, I'm pretty confident the commodities markets will smile at this one, too.

Still, it won't be enough. We're going to see a lot more central bank easy money. QE4, QE5, and QE-pick-a-number will not be far behind.

Get ready. Commodities and gold are about to come roaring back.

The commodities bull market is far from over.

Source :http://moneymorning.com/2012/05/24/good-news-for-gold-prices-commodities-are-wounded-but-far-from-dead/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.