Toronto Venture Exchange Technical Update

Stock-Markets / Canadian Stock Market May 24, 2012 - 03:43 AM GMTThis is an update on the technical comment regarding the Toronto Venture Exchange (symbol: TSX-V).

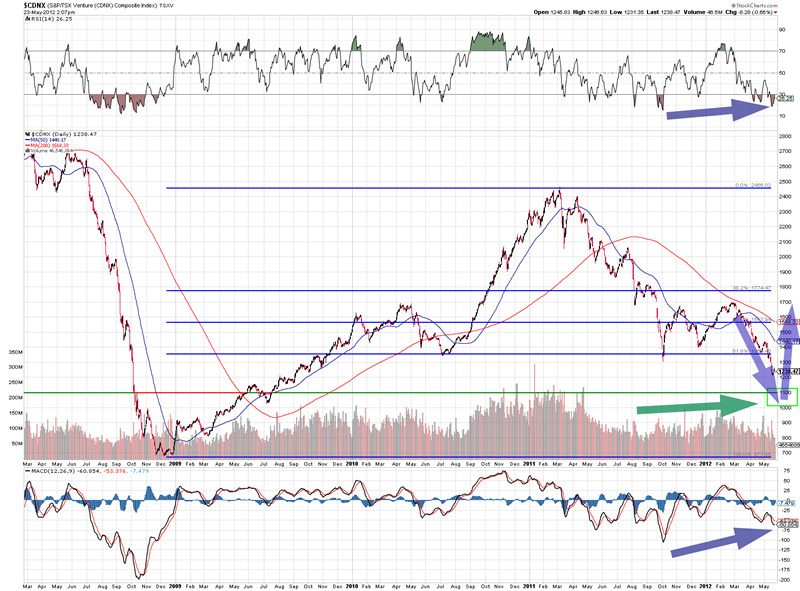

- Unlike the other stock indices the TSXV has been subject of a severe decline since a full year now. The “New High – New Low” trend line shows a particular nasty decline since the beginning of May, which seems to be of climactic nature, very much like in a stock market crash. The TSXV is severely oversold and is due for a bounce.

- As always in technical interpretation the prudent investor needs to keep an eye also on the fundamental factors possibly influencing the general technical picture. While the technical parameters are calling for a multi-month bounce, the investor needs to be cognizant of the fact that the dull summer months are in front of us and with it the usual lack of drive in the TSX-V. This leads me to believe that it will take possibly up to early September to hammer out a bottom in the TSX-V index.

- Another fundamental aspect is a further significant increase in money supply to be expected by the Fed and the European Central bank in Q3 of 2012. This should give the TSX-V in addition a desperately needed boost for a new uptrend.

- CONCLUSION: the current year long decline in the TSX-V looks ugly but appears to be in its final leg down. The 1100ish area is long term support, a 72% retracement of the decline and a good starting point for a sustainable rally. Expect a turnaround in the target zone marked by the green rectangle, followed by a significant rally (later this year). See the purple arrows for a first indication.

- I will update this technical comment as needed. I will comment on commodities and particular gold in the next couple of days whenever I have time.

- DISCLAIMER: all the usual disclaimers apply, in particular do your own research please and don’t rely on me for investment decisions. I am using mathematical FEM methods not depicted here to come to certain conclusions and while these work for me most of the time, they may not be suitable for everyone.

By Volkmar Hable

volkmar@hable.ca

If you would like to send me a message please use the contact form on www.samariumgroup.com

Dr. Hable is a physicist and geoscientist by training and in addition holds a B.Sc. in Agriculture and Agronomics. In 2011 he has been appointed Consul for the Republic of Guinea.

From 1996 to the beginning of 2001, he was the CEO for a part of the European operations of Adecco, a Swiss $20 billion dollar Fortune 500 Company where he managed its offices in Europe and some parts of Asia comprising of 6,000 employees. From 2001 to 2009 he was a fund manager and asset advisor for STG Ltd, a private Swiss 700 million Euro fund focusing on energy, commodities and resources; during this time Dr. Hable managed to achieve an annual average net return of 19.8% with no down year. In December 2011 the Swiss group awarded him with the Liftetime Fund Manager Award. Previously he held senior executive positions in the oil exploration industry, the Diplomatic Corps, and a global Engineering Consulting Company.

Copyright © 2012 Dr. Volkmar “Marc“ G. Hable - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.