Gold Bubble? Demand Data Continues To Show No Bubble

Commodities / Gold and Silver 2012 May 23, 2012 - 09:31 AM GMTBy: GoldCore

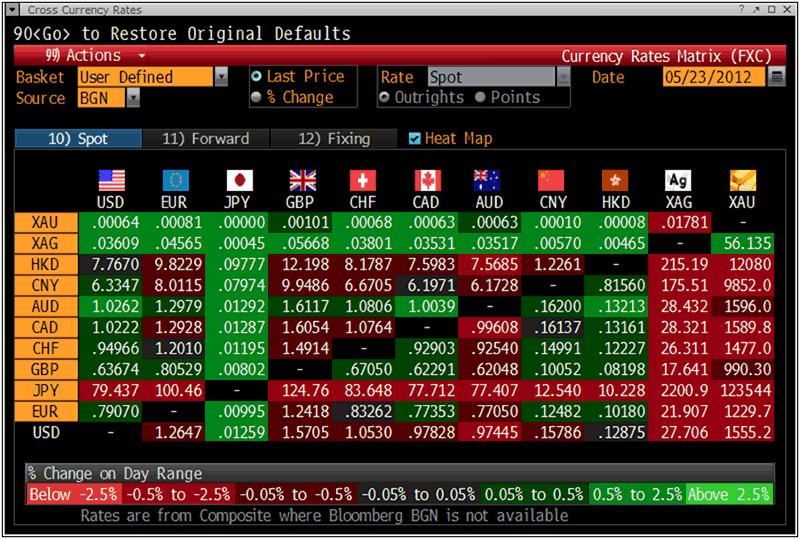

Gold’s London AM fix this morning was USD 1,555.00, EUR 1,229.44, and GBP 989.56 per ounce. Yesterday's AM fix this morning was USD 1,575.75, EUR 1,233.95, and GBP 998.76 per ounce.

Gold’s London AM fix this morning was USD 1,555.00, EUR 1,229.44, and GBP 989.56 per ounce. Yesterday's AM fix this morning was USD 1,575.75, EUR 1,233.95, and GBP 998.76 per ounce.

Gold fell $26.20 or 1.64% in New York yesterday and closed at $1,566.80/oz. Gold fell in Asia and those falls continued in Europe where gold has been trading in a $16 range.

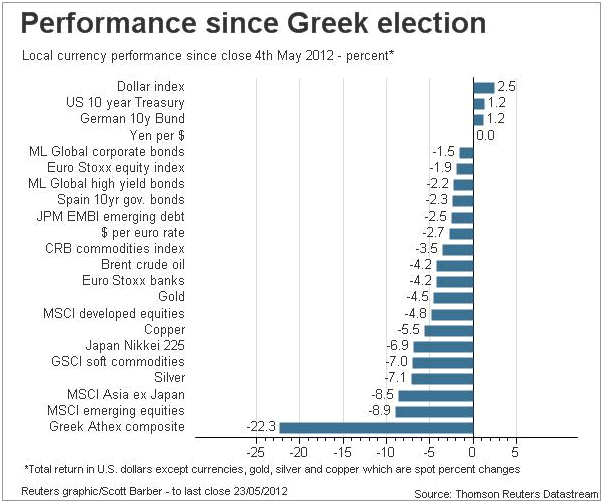

Asset Class Performance Since Greek Election– Thomson Reuters

Gold edged down again this morning despite fears that the European Union's umpteenth meeting later today will not take clear steps to solve the area's debt debacle. Even more worrisome is the showdown that could ensue between Hollande and Merkel about mutualised European debt which could create new obstacles and delay any means of a quick solution.

Gold hit $1,555.03 early in the day, its lowest level in nearly a week but gold in euro terms remains robust well above strong support at €1,200/oz.

Greece’s exiting the EU financial bloc and monetary union could see further short term gold weakness but is gold bullish and should lead to higher prices in the long term.

Meanwhile the euro is at a 4 month low against the dollar, and the dollar index is at its highest level since September 2010. This dollar strength is not sustainable due to the appalling fiscal and monetary situation in the U.S.

Since the Greek elections on May 6, just about every asset class has fallen in value.

With the exception of U.S. 10-year Treasuries, German 10-year Bunds (both up 1.2%) and the Dollar Index (up 2.5% against its basket of currencies), just about everything else has fallen and many quite sharply.

As has been seen in sudden and elevated risk off periods in recent years, gold has again fallen but importantly it has fallen by less than other riskier assets.

For the month of May, gold is down 6.4% in USD terms. While the S&P 500 is down 5.8% and the much touted tech stock, Facebook is down 30%.

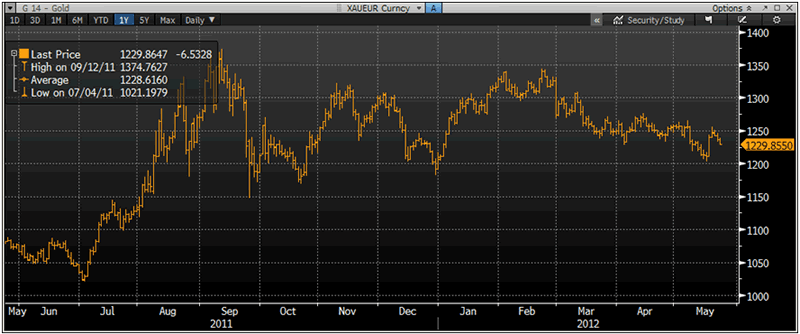

XAU/EUR Currency 1 Year – (Bloomberg)

For euro investors, gold has again out performed risk assets and proved a safe haven, with euro gold down just 2.15% in May and still up 2% YTD. The euro gold chart looks particularly bullish with strong support at €1,200/oz.

The massive consolidation since September should provide the base and springboard to sharply higher prices in the coming months.

The CAC and the DAX are down 5.9% and 6.5% respectively. Periphery stock markets have fallen by as much if not more.

Greece’s Athex composite index is down more than 22% since the close of business on May 4, and almost all others -- including many you might have assumed to be immune to the euro zone crisis have slumped.

MSCI Asia ex-Japan down 8.5 percent, MSCI emerging equities down almost 9 percent.

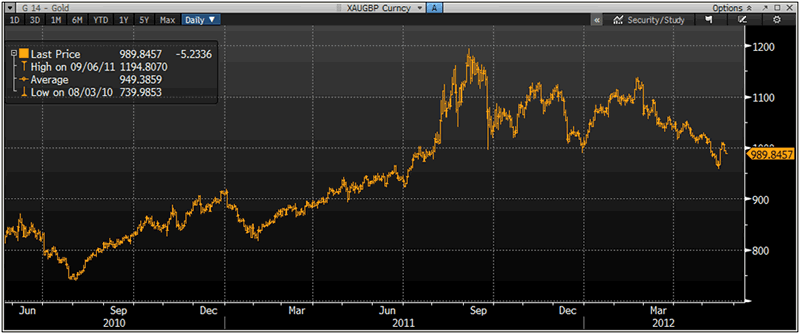

XAU/GBP Currency Daily –( Bloomberg)

The FTSE is down 7.5% so far in May and down 5% YTD.

While gold in sterling is down by just 3.5% in May and 1.7% YTD.

This once again shows the importance of gold as a diversification in a portfolio.

Gold Bubble? Demand Data Continues To Show No Bubble - Dr. Constantin Gurdgiev

Q1 2012 global gold demand figures were published last week and, surprise, surprise, there has been some decline in investment components of demand. Predictably. What is surprising, however, are the dynamics. For some time now we've been hearing about the gold bubble and about recent price moderations being the sign of the proverbial 'hard landing'. Sorry to disappoint you, not yet.

Let's chart some data and discuss:

• Jewellery demand increased from 476 tons in Q4 2011 to 520 tons in Q1 2012 - a rise of 9.24% q/q, but a drop of 6.3% y/y. This contrasts price movements (see below). More significantly, peak Q1 jewellery demand was in Q1 2007 and Q1 2012 demand is only 8.1% below the peak level. Not the fall-off you'd expect were jewellery buyers exercising their option to stay away from higher priced gold.

• Technology-related demand came in at 108 tons in Q1 2012, up on 104 tons in Q4 2011 (+3.8%), but down 6.1% y/y/ Peak Q1 demand for technology gold was in Q1 2008 and Q1 2012 demand came in 11.5% below that. Again, no serious drama here - some substitution away from higher priced gold, but also much of the effect due to global slowdown in production of white goods and electronics, plus price moderation in substitutes on the back of a global economic slowdown and crises.

• Bar & Coin Investors' demand (more longer-term physical investment demand) was down from 356 tons in Q4 2011 to 338 tons in Q1 2012, a fall off of 5.06% q/q and 16.75% y/y - virtually in line with price movements, but in the opposite direction. Substitution and other factors (see below) suspected. Incidentally, Q1 2011 was also the peak quarter in total demand for Bar & Coin investors.

• ETFs - more volatile demand source - reduced their demand for gold to 51 tons in Q1 2012, down from 95 tons in Q4 2011. These funds tend to have exceptionally volatile net demand, including negative readings in some quarters.

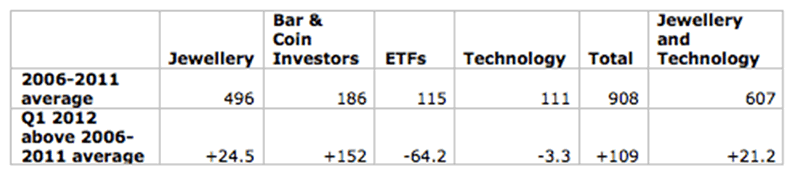

Here's a handy table comparing demand levels by investment/use type as follows:

1. First I compute Q1 average demand for 2006-2011

2. Second I report by how many tons Q1 2012 demand was different from the above average:

Source: Author calculations based on Gold Council data (same for charts below)

Conclusion out of the table: no drama. As expected - physical demand is still ahead of average, but moderating gradually. Jewellery demand is above average - a massive surprise for those who use this demand component to argue that decline in jewellery demand shows that gold is a bubble driven solely by investment objectives. Within investment gold: ETFs are becoming less relevant (more speculative component) while gold bars and coins (less speculative, more 'long-hold' component, especially on coins side) becoming more important.

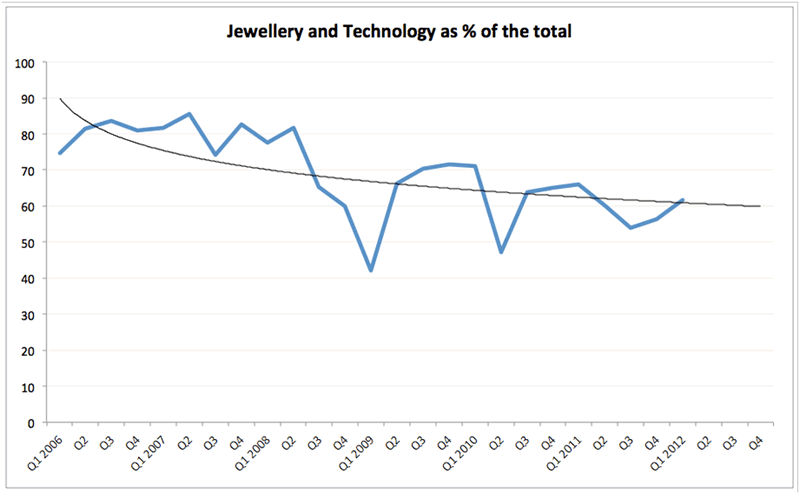

To show decline in Jewellery and Technology (non-investment) gold relative role, here's a chart:

In Q1 2012, non-investment gold demand accounted for 61.8% of all demand (excluding Central Banks) - Q1 2006-2011 average share is 67.3%, which is above the current share. However, the current share is the highest since Q1 2011.

Now, end-of-quarter prices in USD: Q1 2012 ended with gold priced at USD 1,662.5/oz - the highest quarter-end price on record and up 8.6% on Q4 2011 and 15.53% on Q1 2011.

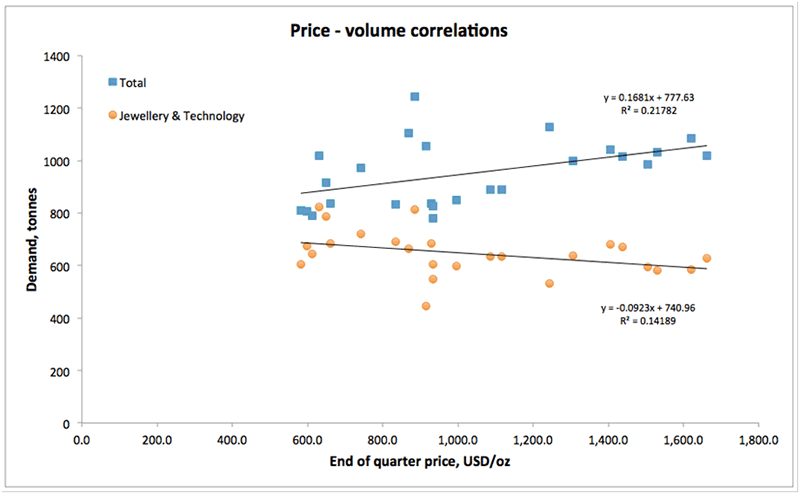

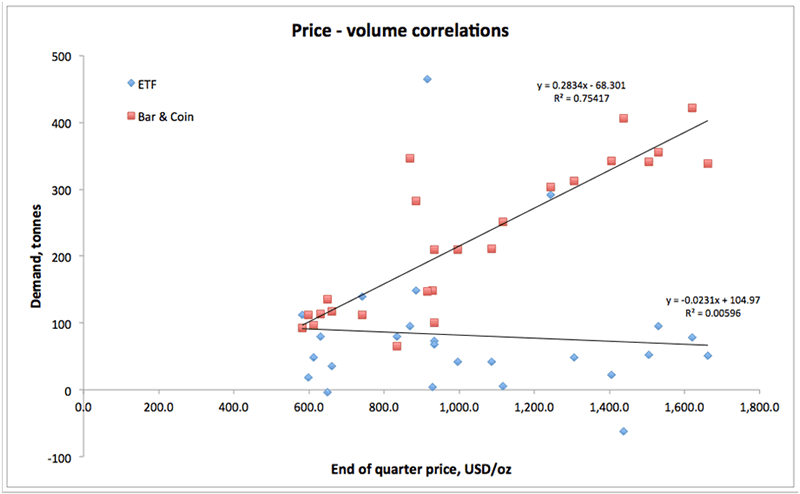

Next two charts plot relationship between price and volume demanded by specific category:

Notice the following:

1. There is a strong positive relationship between gold price and demand by gold bar & coin investors. Perverse? Not if you know that gold is an inflation / USD hedge.

2. Basically zero relationship to ETFs demand. Surprising? Not really - these are actively managed and not exactly risk-hedging entities (see below).

3. Weak negative relationship for physical non-investment demand (jewellery & technology) - suggesting some substitution effect, but not much of one. Which, in turn, implies that there is some other driver here - perhaps shorter term changes in demand for goods produced using gold and longer term technological change (think dental demand - when was the last time you fitted a gold tooth?)

4. Weak positive relationship between price and overall demand for gold. Funny thing is - if there's a bubble, you'd expect a much stronger relationship, don't you? After all, there would be hype of rapidly rising demand as prices rise?

So what is happening on the demand side of gold markets, then? Here are my views:

1. Dollar strengthening and oil price moderation are both signaling that gold price moderation should be impacting USD price more than other currencies-denominated prices. This is true, when you compare changes in USD price and Euro price;

2. ETFs are clearly suggesting a signal that some of the gold demand (primarily speculative component) is being drawn down during the 'risk-off' periods, like the one we are currently going through. Speculative demand is moderating significantly, which is good medium-term;

3. Tax changes on gold bullion in India had significant impact, including on jewellery-related gold demand from there;

Central banks demand pushes price-demand relationship out toward flatter slope and reduces price-elasticity of global demand.

Dr. Constantin Gurdgiev: Gold Demand In Q1 2012 (click to read research document)

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.