What Is Volume Telling Us about Gold Stocks?

Commodities / Gold & Silver Stocks May 22, 2012 - 01:06 PM GMTBy: Jeff_Clark

Jeff Clark, Casey Research writes:

I've read articles from more than one analyst claiming that gold stocks are down on low volume, implying there's a lack of interest in precious metals. While on the surface that seems like an obvious statement, their point is that most of the recent volume has been coming from sellers and thus exaggerating the recent decline.

Jeff Clark, Casey Research writes:

I've read articles from more than one analyst claiming that gold stocks are down on low volume, implying there's a lack of interest in precious metals. While on the surface that seems like an obvious statement, their point is that most of the recent volume has been coming from sellers and thus exaggerating the recent decline.

I decided to test this hypothesis, because if correct, it has investment implications, starting with the fact that at some point you run out of sellers; and if and when buyers return, the ensuing rise could be spectacular.

I also wanted to compare volume now to the waterfall decline in 2008. If volume is starting to spike now like it did then, it might give us some additional clues about our current environment and what to expect going forward.

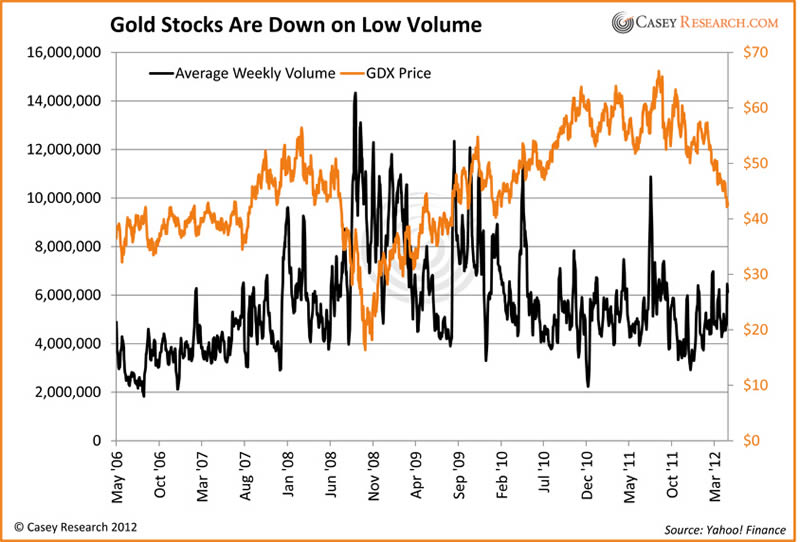

So let's take a look. The following chart shows the average weekly volume of the 10 largest gold producers that trade in North America, along with the daily price movements of GDX, the Gold Miners Index.

While the number of shares trading hands every day fluctuates a great deal, the first thing that jumps out is that the current correction in gold is indeed occurring on relatively low volume. You can see how GDX has sold off since its peak last May, but also that, in the larger scheme of things, volume hasn't really changed.

This fact indirectly confirms the premise that it's been mostly sellers providing the recent volume. If there were equal interest from buyers, prices would be flat; or if they were pushing harder, prices would be rising.

The second thing that sticks out is how low the volume is now compared to the selloff in 2008. It's roughly half what it was then, signaling that equities aren't being dumped en masse like they were four years ago. This meshes with a recent observation by Doug Casey, that as steep as the current correction is, we're not seeing the raw panic we saw in 2008.

So what might this mean going forward?

First, at some point the sellers will tire or we'll run out of them – especially if gold prices hold up at or near current levels. At that point, even without any major changes in our market fundamentals, interest from buyers could swamp out the sellers; this is what is meant by a "consolidation phase" or a "regrouping" before the next surge upward. And if buyers become the dominant player in the market, which could easily occur once gold heads north again, stock prices could push dramatically higher.

Second, regardless of the sellers' reasons, they've managed to make gold equities incredibly cheap. The stocks of the better gold miners have become nearly as undervalued as they were during the worst of the financial crisis – without the same level of crisis and uncertainty. Stock prices are not at the same level they were in 2008, but relative to the price of gold they are. These facts point to an extraordinary opportunity. Unless you think gold has peaked for this cycle and it's downhill from here, this disconnect cannot and will not last.

Here's another way of looking at it. Caesar Bryan, portfolio manager of the Gabelli Gold Fund and speaker at the Casey Research Recovery Reality Check Summit last month, recently relayed an interesting point he'd heard from Don Coxe. For a $1,000 investment right now, you can get about 0.6 ounces of gold. However, for the same $1,000, you'd get four ounces of gold by buying shares of Goldcorp… or more than five ounces buying Eldorado Gold.

This represents incredible value if you're a gold equity investor. These kinds of opportunities only come along rarely in a bull market. The last time was four years ago – with a lot more risk amidst the crash. That didn't last forever, and neither will this window of opportunity.

When this imbalance between gold and gold stocks corrects itself, the returns will be positively smile-inducing, perhaps life-changing.

Are you hearing the message that volume is sending right now?

[For any investment to pay off, it must keep ahead of the US government's unceasing efforts to rob citizens of their savings. Several traditional vehicles are losing this battle… but gold and gold stocks continue to shine. Now may be the ideal time to get properly positioned in them.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.