Gold: The World's Friend for 5,000 Years

Commodities / Gold and Silver 2012 May 22, 2012 - 02:53 AM GMTBy: Frank_Holmes

Facebook's highly anticipated initial public offering today helped the company raise $16 billion, a record for tech IPOs. It's refreshing to see investor excitement rally around the stock, as the U.S. needs innovative businesses to thrive and attract capital. However, as behavioral finance warns, be cautious of a herd mentality.

Facebook's highly anticipated initial public offering today helped the company raise $16 billion, a record for tech IPOs. It's refreshing to see investor excitement rally around the stock, as the U.S. needs innovative businesses to thrive and attract capital. However, as behavioral finance warns, be cautious of a herd mentality.

Last November, the IPO deal of the day was Groupon. On the first day of trading, shares rose to a high of $31 from an initial offering price of $20.

By Thanksgiving, the stock had fallen below the IPO price, and only a few months later, uncertainty popped up around the company's accounting methods and financial controls. The stock fell further, with the market devaluing Groupon by about 50 percent in only six months. How's that for a group buy?

By Thanksgiving, the stock had fallen below the IPO price, and only a few months later, uncertainty popped up around the company's accounting methods and financial controls. The stock fell further, with the market devaluing Groupon by about 50 percent in only six months. How's that for a group buy?

It's interesting to note that the value of Groupon's stock has lost more than $13 billion since the peak on the first trading day through April 30. For comparison, if you look at the total net assets in Lipper's precious metals mutual fund peer category, assets fell $8.3 billion over the same timeframe. Investors lost more than $5 billion more in one tech stock alone than in all of the precious metals funds combined.

Gold -- A Reality Check

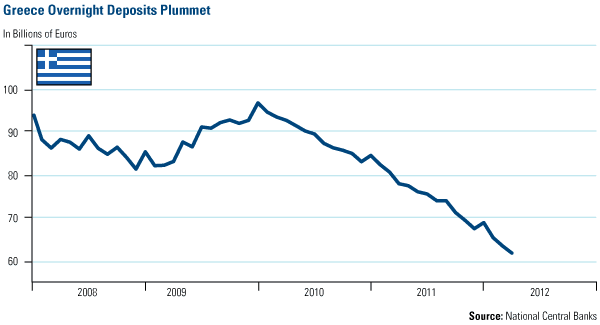

Investors have "defriended" gold recently in favor of the dollar, as Greek and French voters rejected austerity measures. Greeks have been responding to their escalating debt issues for a while by steadily pulling money from overnight deposits. I often say, money goes where it is best treated, and these deposits will need to find a safe haven.

It's not only Greece the market is worried about, says BCA Research. In a special report aptly named, "In Case of Emergency Grexit," the firm says there's extra pressure on Spain and Italy, "which imminently needs a large bailout of its banking system." The 10-year yields for each country have reached 6 percent today, and while there are funds to sufficiently cover Spain, there aren't enough funds for Italy, too, says BCA.

So if the European Union (EU) stops the flow of bailout funds, Greece, unable to pay wages, would invoke social unrest, according to BCA.

More importantly, without funds from the EU, Greece would default on its bonds. Looking at what the country owes this year alone, $1 to $7.6 billion is due each month, says BCA. The European Central Bank would then most likely stop providing funds to Greek banks, causing more individuals to pull money. "With deposit flight, and no injections from the ECB, the banks would be bust and Greece would be hemorrhaging money," says BCA.

It's also important to look at the investors of Greek debt. According to the London Evening Standard earlier this year, French banks are the largest holders of Greek government bonds and private-sector debt in the eurozone, with $47.9 billion exposure to Greece.

In the end, I believe governments in Europe lack the courage to be fiscally disciplined. Earlier this week, I told Aaron Task and Henry Blodget on The Daily Ticker that when push comes to shove, Europe will likely continue to print money. This should be positive for gold.

At the Hard Assets Conference earlier this week, Greg Weldon compared the money printing situation to a sink. In an interview he gave with The Gold Report, Greg said:

"It's going to be very difficult to see how economies in Europe, the U.S. and Japan can stand on their own two feet without the assistance of central banks debasing currency through debt monetization. I liken it to filling the sink halfway up with water and pulling the plug out of the drain. Of course, the water level will recede unless you turn the faucet on and start more water pouring into the sink. The level of water represents asset prices, the water flowing out of the faucet represents liquidity provided by global central banks and the drain represents the real macro economy, which has not been fixed.

"At the end of the second round of qualitative easing, when the Fed shut off the faucet, the water level (asset prices) started to go down. But now the water is running again -- particularly with some of the measures instituted by the European Central Bank, with its three-year loan program, the federal liquidity swaps and the back-ended way that it's managed to involve the International Monetary Fund.

"The problem with all of this is it does nothing to fix the underlying problem, which is too much debt. This is not sustainable. Central banks turning on the water faucet is good for asset prices. The real solutions of fiscal austerity, which are probably not palatable to most politicians in Europe, are the real struggle as we go forward. This problem is not going to go away."

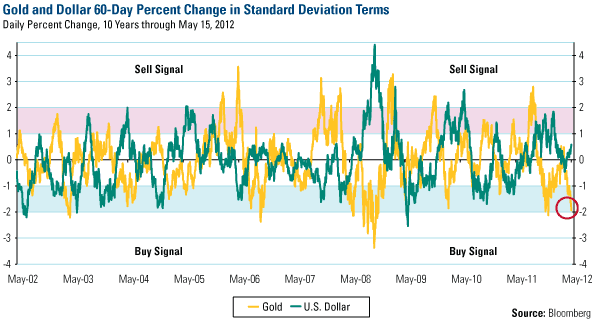

So, during times like we've had recently, when the dollar is chosen over gold, I apply math. The chart below shows the 60-day percentage change of the gold price and the U.S. dollar. Gold's recent weakness has triggered a -2.2 sigma event in standard deviation terms. Over the past 10 years, this has happened less than 2 percent of the time. Historically, each time gold has touched the -2 sigma mark, the precious metal has rallied.

This bounce is exactly what we saw on Thursday and Friday this week.

See more slides from my Hard Assets Investment Conference.

While gold may not go up vertically from here -- as frequent readers know, the yellow metal historically has fallen in June and July -- with the extraordinary events occurring in Europe, I believe investors will soon "friend" gold once more. As we wait for the central banks around the world to act, I encourage investors to consider dollar-cost averaging. It's a way to stay invested, and more importantly, to avoid making emotional investment decisions.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.