A Different Approach to Trading Apple Stock Using Options

Companies / Options & Warrants May 18, 2012 - 04:18 PM GMTBy: J_W_Jones

Apple (AAPL) is one of the most actively traded stocks currently. For the trader who trades only stock, there are two major difficulties in executing trades in this stock:

Apple (AAPL) is one of the most actively traded stocks currently. For the trader who trades only stock, there are two major difficulties in executing trades in this stock:

1. It is breathtakingly expensive.

2. It exhibits periods of neck snapping volatility exposing the trader to substantial losses if he gauges the direction wrong and does not act quickly.

For the investor who is willing to learn an option based approach, both these problems can be easily dealt with by using structured option trades to control risk crisply and make efficient use of capital.

Because this underlying is such an actively traded stock, the options are extremely liquid and trade with very tight bid / ask spreads. These are the two essential characteristics for selecting an appropriate vehicle in which to trade options.

I thought it would be interesting to look at a high probability trade that does not depend on accurately predicting the price direction of AAPL. Let us first consider the price chart below:

The horizontal orange lines represent the price boundaries of the option trade we will consider. The lines have been placed to coincide with areas of recent support and resistance. The lines are obviously placed somewhat subjectively and can be modified to reflect the nuances of the reader’s technical analysis biases.

The point of the thought process I want to lay out here is not to debate the exact placement of these lines, but to demonstrate how a high probability trade can be constructed using whatever technical methods you wish to use to determine areas of support and resistance.

The next point we need to discuss is the concept of a “vertical credit spread”. This is, as implied by the name, an options spread in which a credit is received into the trader’s account. The spread is constructed in either calls or puts, and represents a bearish or bullish trade respectively.

An example of a bullish trade, a vertical put credit spread, would be to sell the AAPL 490 strike put in June and buy the 485 strike. The result of entering this trade would currently be a credit of $60 for each contract and the full value of this contract would be realized if AAPL closed at 490 or above at June expiration. No additional profit is possible for this trade. The position has a maximum potential loss of $440 because we own the long put.

A similar bearish trade can be established using a vertical call spread. In this example, the June 595 call could be sold and the June 600 call bought for a net credit of $45 per contract. This is the absolute maximum profit that can be made from the position.

The full value of the position would be realized if AAPL closed at 595 or below at June expiration. The position has a maximum defined risk of $455 because we own the long call.

The astute reader will now undoubtedly ask the question: Why would anyone take a trade where he could make $45 and lose $455? The answer lies in the probability of realizing the profit. At current prices, each of these credit spreads has an 88% probability of achieving its maximum profitability.

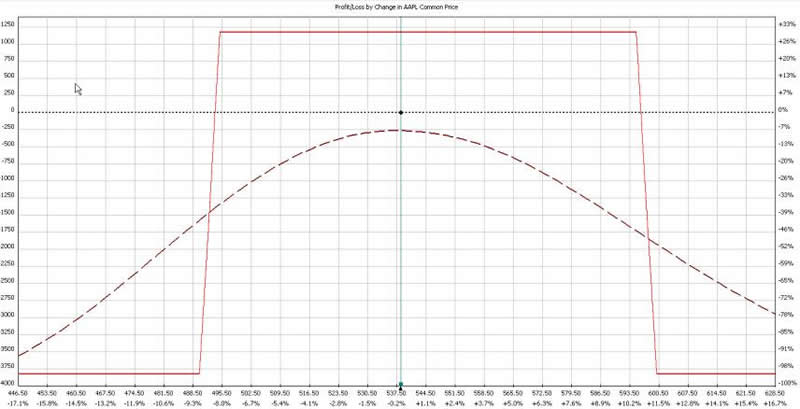

The position I would like to call to the reader’s attention is to do both trades simultaneously. The combination of a bearish call spread and a bullish put spread is termed an “iron condor”. The characteristic P&L curve is presented below:

The illustrated trade has a return of 31% on margin requirements and a probability of being profitable of 72%. Because it is a credit spread, the trade has no direct cost, but does have margin encumbrance requirements to secure the ability to enter the trade.

An important point is that only one side of the trade requires margin since it is clearly not possible to lose on both sides of the position. It is critical to confirm that your broker only requires margin on one side; a few “option unfriendly” brokers require margin on both sides.

If you find your broker is one of these dinosaurs- run, don’t walk away since that illogical requirement halves the potential return on the position.

This is but one example of using options to construct a high probability trade that is profitable over a wide range of price and uses capital efficiently. In addition, risk is crisply defined and accounts cannot be “blown up” by Black Swan events.

The use of options opens a host of potential profit opportunities beyond the simple “going long” or “going short” available to the stock trader. In missives to come we will explore more of these unique opportunities

If you are looking for a simple one trade per week trading style then be sure to join www.OptionsTradingSignals.com today with our 14 Day Trial.

If you are looking for a simple one trade per week trading style then be sure to join www.OptionsTradingSignals.com today with our 14 Day Trial.

J.W. Jones is an independent options trader using multiple forms of analysis to guide his option trading strategies. Jones has an extensive background in portfolio analysis and analytics as well as risk analysis. J.W. strives to reach traders that are missing opportunities trading options and commits to writing content which is not only educational, but entertaining as well. Regular readers will develop the knowledge and skills to trade options competently over time. Jones focuses on writing spreads in situations where risk is clearly defined and high potential returns can be realized.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.