Facebook IPO May Break the Stock Market and Initiate a Free Fall Crash

Stock-Markets / Financial Crash May 18, 2012 - 03:04 AM GMTBy: Steven_Vincent

Let me start by clarifying something. I am not saying that the market could crash spectacularly in the next few days and that in that event the Facebook IPO would be a major contributing factor. I am not saying that. The market is saying it.

Let me start by clarifying something. I am not saying that the market could crash spectacularly in the next few days and that in that event the Facebook IPO would be a major contributing factor. I am not saying that. The market is saying it.

Facebook boosts IPO size by 25 percent, could top $16 billion

NEW YORK/SAN FRANCISCO (Reuters) - Facebook Inc increased the size of its initial public offering by almost 25 percent, and could raise as much as $16 billion as strong investor demand for a share of the No.1 social network trumps debate about its long-term potential to make money.

Facebook, founded eight years ago by

Mark Zuckerberg in a Harvard dorm room, said on Wednesday it will add about 84 million shares to its IPO, floating about 421 million shares in an offering expected to be priced on Thursday.

http://finance.yahoo.com/news/facebook-expands-ipo-size-aims-011714...

This mammoth dumping of shares onto the market is coming at the exact moment that global financial markets are teetering on the brink of disaster. Technically and psychologically this market is as weak and poorly positioned to absorb a new float of this size as it could possibly be. As every market across all asset classes breaks major bearish technical levels, as the fundamental news flow accelerates and worsens by the hour, Wall Street if fixated upon "the biggest IPO ever". Few ask why Facebook owners are rushing for the exits now. Few observe that the markets began their current crash on the day of the Carlyle IPO. Even fewer wonder what the potential effect will be of sucking the remaining air out of the room even as the markets gasp for breath.

Bulls will presently argue that the market is very oversold and positioned to rally. Under conditions of a healthy bull market, they would be correct. Every indicator you could think of is positioned for a rally in the context of a real bull. The trouble is that the last bull phase ended in February of 2011 and the market has been falling apart internally for over a year. In fact, technical deterioration has run far ahead of price declines in much the same way in 2011. The result then, as now, is that market price sprints to catch up to the technicals and the result is a crash.

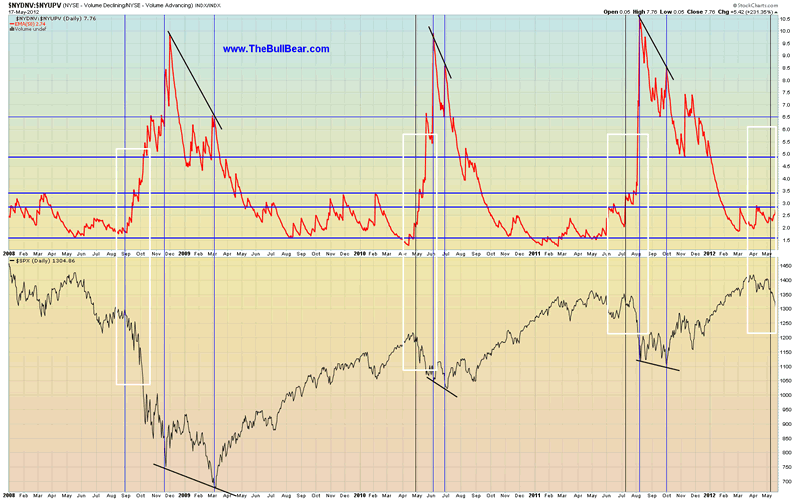

Here's just one example of many. Prior to the 2011 crash, the ratio between Down Volume and Up Volume began to expand dramatically even as the market made new highs, creating a divergence between market price and the indicator:

Take note that if this pattern repeats itself for a fourth time (and there are many compelling reasons to think it will as we will see later in this posting), then we are yet very early in the process. This suggests that although we could be considered "oversold" at this time, a market crash is pending. And it is important to further note that serious market crashes come from deeply oversold, deteriorated technical conditions such as those prevailing right now. When comparing 2011 and 2012 levels, the indicator also made a higher low while the market made a higher high which is a divergence.

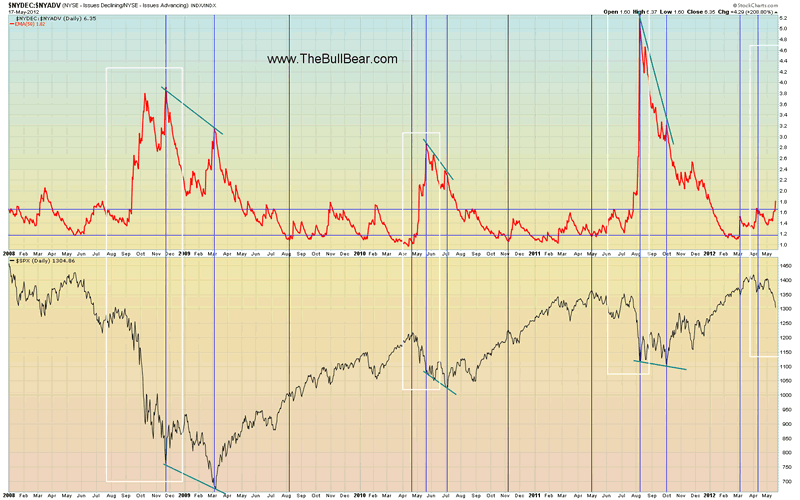

The ratio between Advancing and Declining issues is set up very similarly and is also highly suggestive of a pending crash with a breakout move just beginning:

This indicator also created a divergence at the 2011 and 2012 price highs. Keep in mind that both of these indicators are just now beginning their big moves.

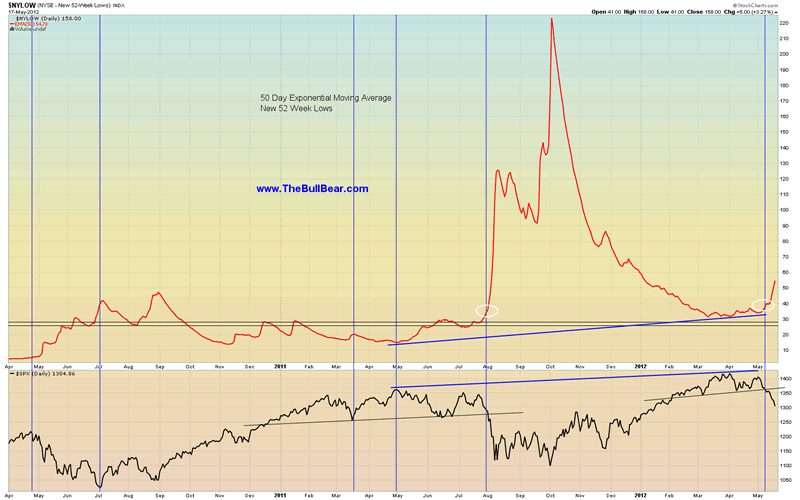

One of the hallmarks of a crash is a rapid expansion of New 52 Week Lows:

Note the huge divergence between 2011 and 2012 as more New Lows were being registered at a higher price level in 2012. Also notice the rapid expansion of New Lows as price breaks the neckline of Head and Shoulders tops in both 2011 and 2012.

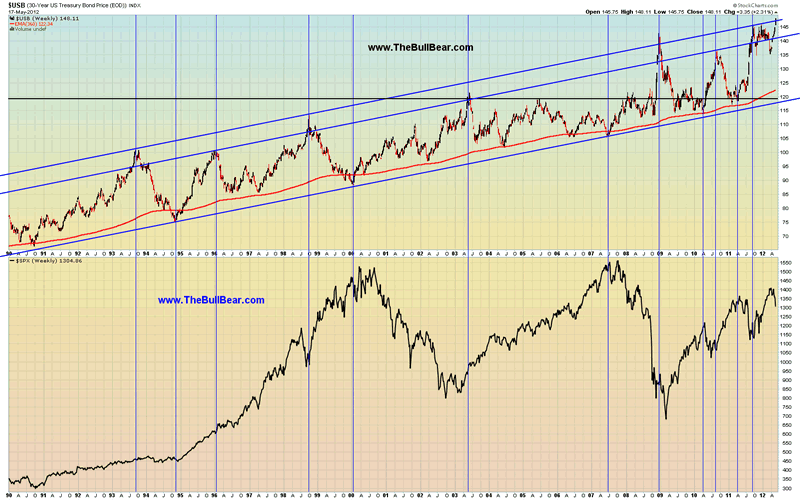

Many will argue that the price of the 30 Year Treasury Bond is "too high" and that the recent flight of capital to the perceived safety of that market is "irrational" or even "stupid" and that it "must reverse". Right now, the long bond is blasting through the upper resistance band that has contained it for several decades:

Note that this very long term breakout move is coming after a six month long consolidation. Also note that this is the first time ever that this market did not return to support after visiting its upper resistance band. Traders should respect the intelligence of the market. Clearly it is saying that there is a real need for safety and that the need is so urgent that a multi-decade technical level needs to be completely taken out. Also note that this breakout move is only just beginning.

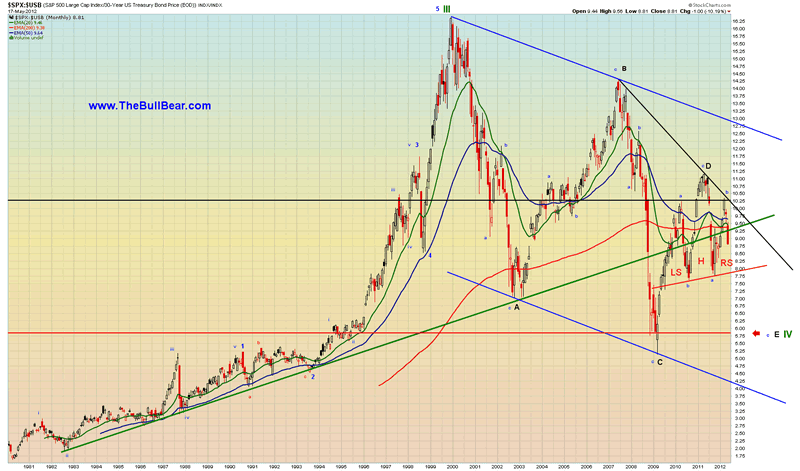

The ratio of SPX to the 30 Year Treasury Bond has very recently plunged through its multi decade uptrend while simultaneously violating its 20, 50 and 200 month exponential moving averages:

Clearly this is a move that is only just beginning. When such long term technical events occur is far more likely to mark the onset of something rather than the end of something. The presence of a clear Head and Shoulders formation suggests an immediate crash to the neckline and beyond.

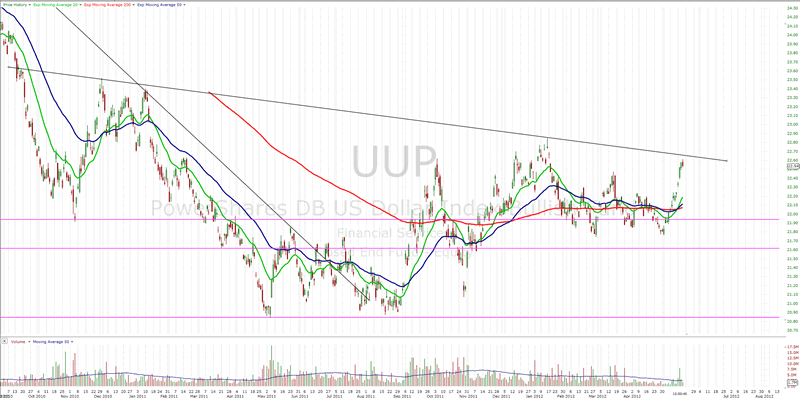

The Dollar ETF, UUP, is rapidly approaching the neckline of a clear reverse Head and Shoulders formation:

This is coincident with a triple bull moving average cross. The bull cross together with a breakout from the formation neckline would be the beginning of a very strong move.

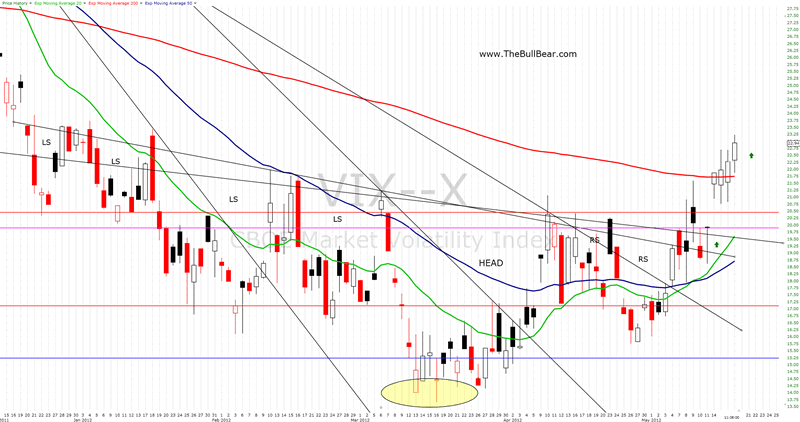

Volatility Index has broken out from a six month long inverse Head and Shoulders pattern and has closed four consecutive sessions above its 200 EMA:

This is the beginning of a very large move for VIX, which can only correlate with a significant bearish event for stocks.

I could post many more charts which show that the market is far nearer to the beginning of a major event than to a sort of end. Oversold is likely to become much more oversold as panic selling takes hold.

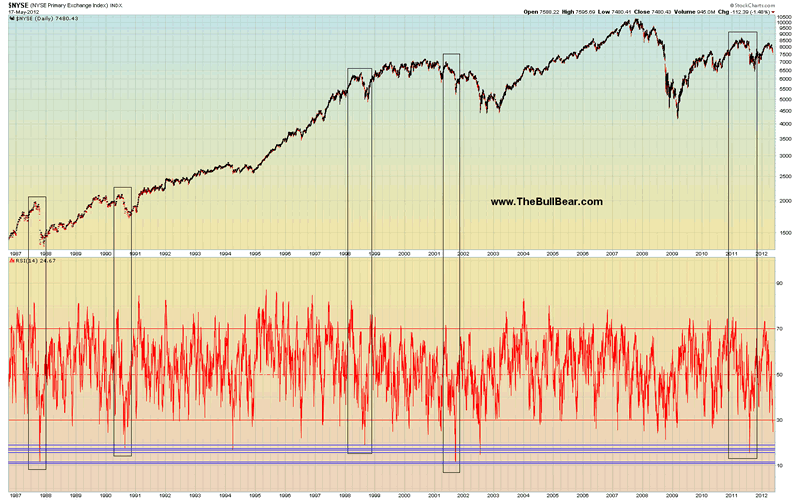

While we could argue that RSI is now well below 30 and therefore oversold, historical precedent shows that it can go much lower:

The incidents when RSI started at 70 and went below 20 led to an average bottom for the indiator of 16. My take is we will see that reading on this decline and it will reflect a serious bearish market event.

In this context, Wall Street will be dumping an enormous new float of a new "darling" stock into the market on Friday. Market participants still largely regard the recent price decline as a buying opportunity and the expectation is that the FB shares will be "snapped up" by eager investors. Recent dip buying behavior has only served to expend what little available cash there is in the market. The Facebook IPO will suck the remaining air out of the room, leaving a vacuum. While the effect may not be immediate, it could take only a few sessions for the real selling to begin. The setup for a Black Monday is there. And I do not mean that metaphorically.

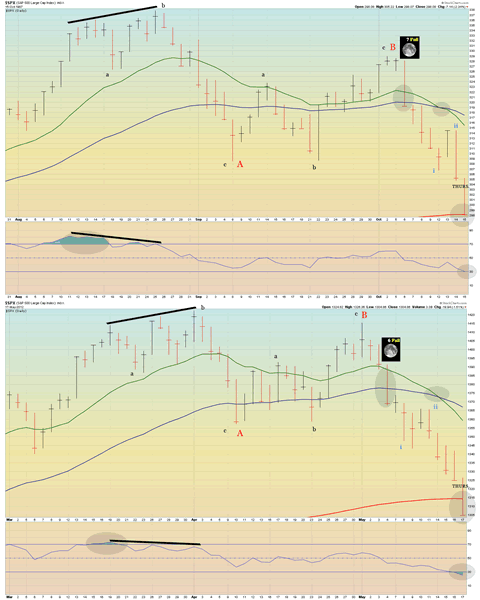

I will leave you with the following chart study comparing the period immediately prior to the Friday before Black Monday 1987 and the period leading up to today, Friday, May 18, 2012:

Day by day, tick by tick, technical event by technical event, the two charts are nearly perfect replicas. Will the fractal echo complete on Friday and Monday?

Any long position under these circumstances is sheer folly. And I'm not saying that. The market is saying it.

There's an elephant in the room and no one wants to acknowledge it.

Go here to read the full BullBear Market Report:

Disclosure: No current positions.

By Steve Vincent

Steven Vincent has been studying and trading the markets since 1998 and is a member of the Market Technicians Association. He is proprietor of BullBear Trading which provides market analysis, timing and guidance to subscribers. He focuses intermediate to long term swing trading. When he is not charting and analyzing the markets he teaches yoga and meditation in Los Angeles.

© 2011 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.