Will the Fed and the ECB Put in Place New Financial Accommodation?

Economics / Unemployment May 18, 2012 - 02:16 AM GMTBy: Asha_Bangalore

The Fed and the European Central (ECB) face different policy challenges at the moment but the nature of recent economic developments has raised the probability of both central banks likely to consider another round of monetary policy support, with the Fed having significantly more room to ponder compared with the ECB.

The Fed and the European Central (ECB) face different policy challenges at the moment but the nature of recent economic developments has raised the probability of both central banks likely to consider another round of monetary policy support, with the Fed having significantly more room to ponder compared with the ECB.

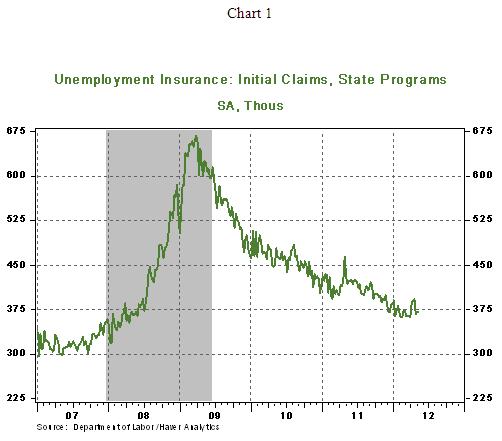

The U.S labor market continues to remain at the top of the Fed’s priority list. Initial jobless claims held steady at 370,000 during the week ended May 12. The two-week average of initial jobless claims at 370,000 is down 14,000 from an average of 384,000 in April. Continuing claims, which lag initial jobless claims by one week, moved up 18,000 to 3.265 million after posting in each of the prior two weeks. The level of initial jobless claims hit a low of 362,000 in the last week of March and is yet to cross this mark. Essentially, today’s report was not a bullish evaluation of the US labor market.

The Fed’s own assessment of the US labor market in the minutes of the April 24-25 FOMC underscores the importance of the labor market in monetary policy deliberations.

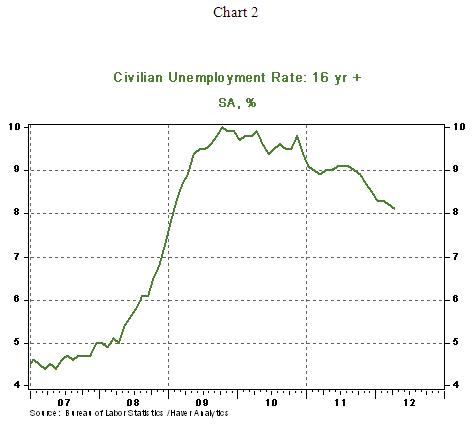

"Labor market conditions had improved in recent months, and the unemployment rate had fallen, but almost all of the members saw the unemployment rate as still elevated relative to levels that they viewed as consistent with the Committee’s mandate. Growth was expected to be moderate over coming quarters and then to pick up over time. Members expected the unemployment rate to decline gradually."

The low-end of the Fed forecast of unemployment rate at the end of 2012 is 7.8%, down marginally from the April reading of 8.1%. (The Fed’s forecast was published prior to the publication of the April employment report).

The minutes of the April FOMC meeting identified two sources of risk to economic growth in the United States : (1) Stress in financial markets due to the banking and debt crisis in Europe was cited as a source of “significant downside risk” and (2) the possibility of a reduction in federal government spending in 2013. Both of these factors were seen as sources of risk that could depress economic activity and reduce hiring by firms. The minutes of the April FOMC meeting included an important statement with regard to future policy action: “Several members indicated that additional monetary policy accommodation would be necessary if the economic recovery lost momentum or the downside risks to the forecast became great enough.” Essentially, the Fed stands ready to step in, if necessary. The next FOMC meeting is on June 19-20.

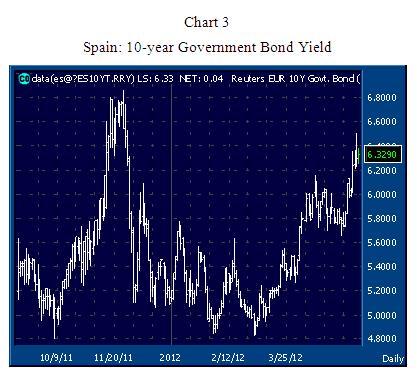

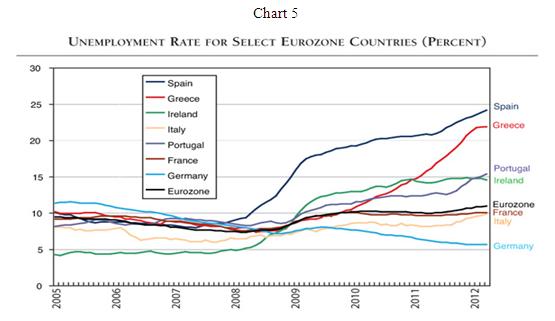

On the other side of the Atlantic, the European Central Bank (ECB) faces the challenge of stabilizing long rates that have shot up once again since the fall of 2011 following the recent political crisis in Greece. Amidst the market crisis, the ECB also has to keep in mind the economic damage from rising unemployment rates in the eurozone, excluding Germany.

Chart 3 and 4 indicate that the 10-year Spanish government bond yield was trading at 6.32% and the Italian 10-year government bond yield stood at 5.98%, respectively, as of this writing. These readings are below the highs touched in November 2011, but nevertheless bonds are trading within reach of matching the November levels, particularly in the case of Spain. The ECB’s LRTO (longer-term refinancing operation) of December 2011 and February 2012 amounting to over one trillion euros helped to bring down Spanish and Italian government bond yields. Will the ECB succumb to market pressures and act again?

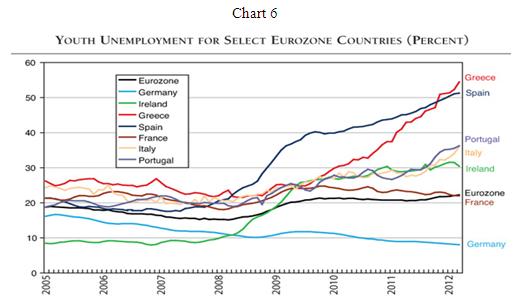

In addition to pressures in the government bond markets, the high unemployment rates (see Charts 5 and 6) among members of the eurozone will haunt monetary policy discussions at the next ECB meeting on June 6.

Source: http://www.aei.org/outlook/economics/international-economy/the-euro-end-game/

Source: http://www.aei.org/outlook/economics/international-economy/the-euro-end-game/

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.