Silver and Gold Daily Bulletin/COT Review for period 4-26 to 5/8/2012

Commodities / Gold and Silver 2012 May 16, 2012 - 01:24 AM GMTBy: Marshall_Swing

I must first apologize to my readers for this report being so late this week as the JP Morgan debacle has garnered my full attention.

I must first apologize to my readers for this report being so late this week as the JP Morgan debacle has garnered my full attention.

Silver plummeted $-1.471 this past reporting period and gold drove $57.90 into the ground but do you know how they got there?

Let's look under the hood...

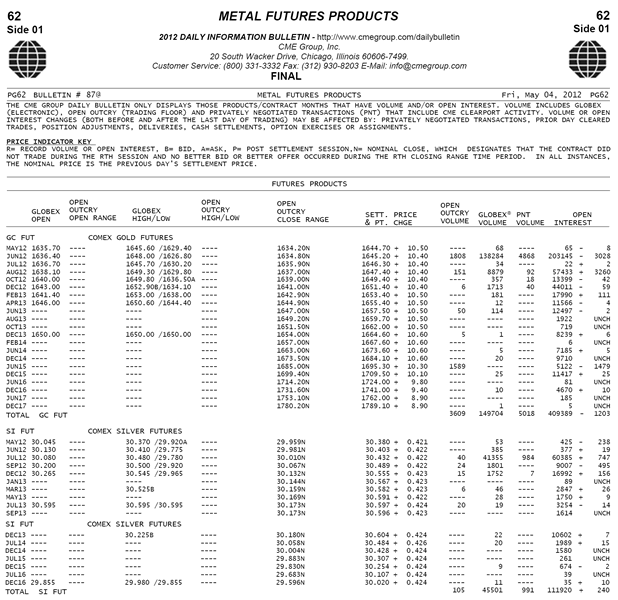

Here is the CME Daily Bulletin report from May 4h the most significant day of last week for you to see the most active volume delivery month (MAVDM) and the 2nd most active volume month (2MAVDM). See if you can spot the the MAVDM and 2MAVDM in this full report:

If you decide you would like to monitor these reports on a daily basis to gain technical knowledge for following trading on the COMEX gold and silver futures and options, here is where you find the reports: http://www.cmegroup.com/tools-information/build-a-report.html?report=dailybulletin

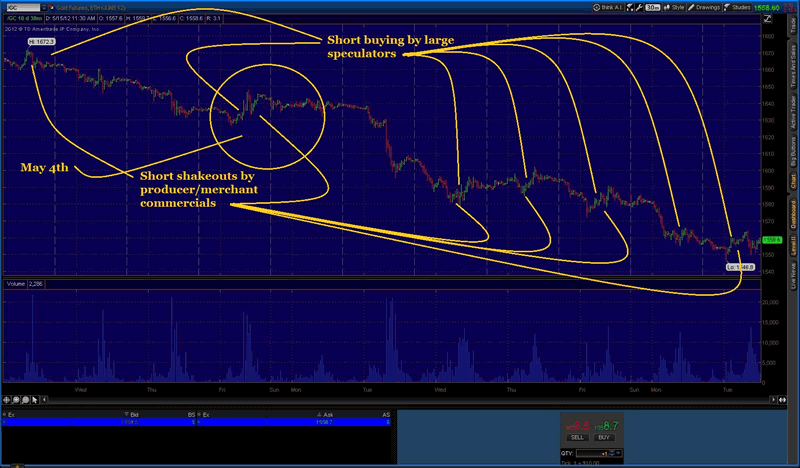

Here is the gold chart for May 4th:

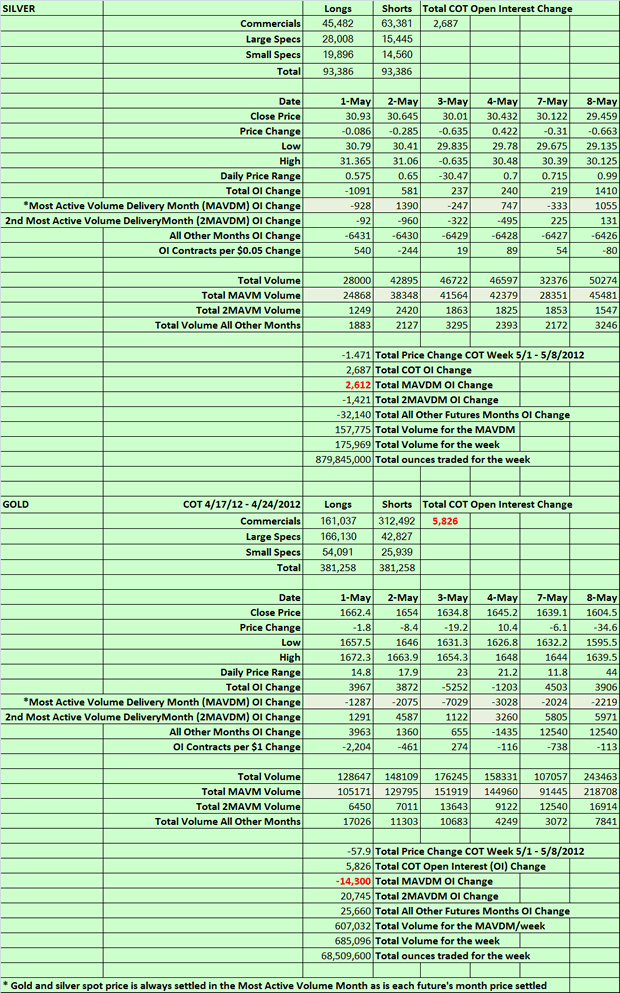

My CME daily bulletin aggregation spreadsheet is below, for reference, for the rest of this report.

On May 4th, we see the price of gold rose $+10.40 during the trading day's 24 hours. We see in the MAVDM lost -14,300 contracts, for the week, dropping out of the spot price calculation. Of those contracts 3.260 went into the 2MAVDM on May 4th and -1,435 left the total open interest entirely. Of the 3,028 lost in the MAVDM it is unknown how many actually went to the 2MAVDM or were purchased to wage the price war in that category.

On the week most of these were due to speculator short coverings while commercials snapped up the majority of those shorts accumulated by a couple of hedge funds in the large speculator category contributed to the unsuccessful bid for the commercials to trip all the speculator shorts that were accumulated. The few speculator are hanging tough in their shorts, I believe, and in for the long haul. But they are making a serious mistake if that is all they are going to do.

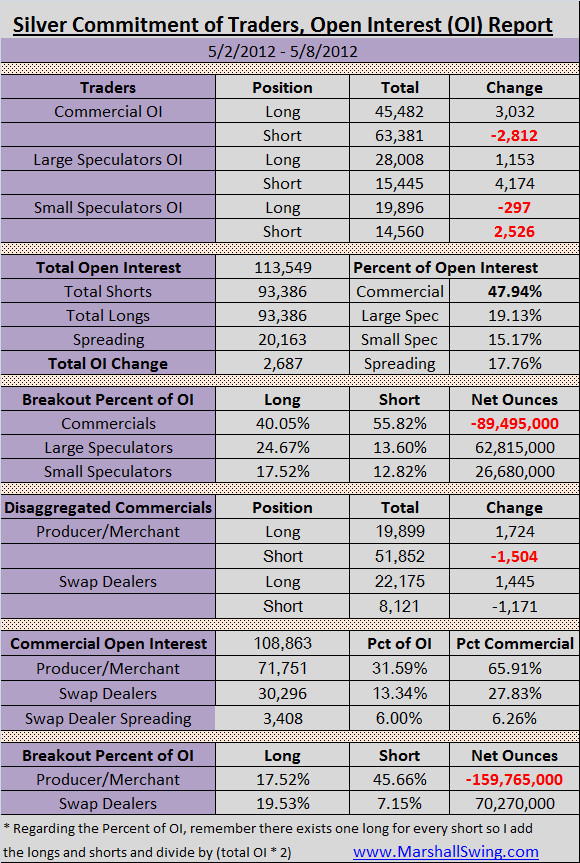

Notice also in the silver COT table below the large and small speculators picked up about 7,400 shorts. We will see if they are able to retain their positions in the coming weeks. They also picked up some longs but may be stopped out of them already as we'll see next week

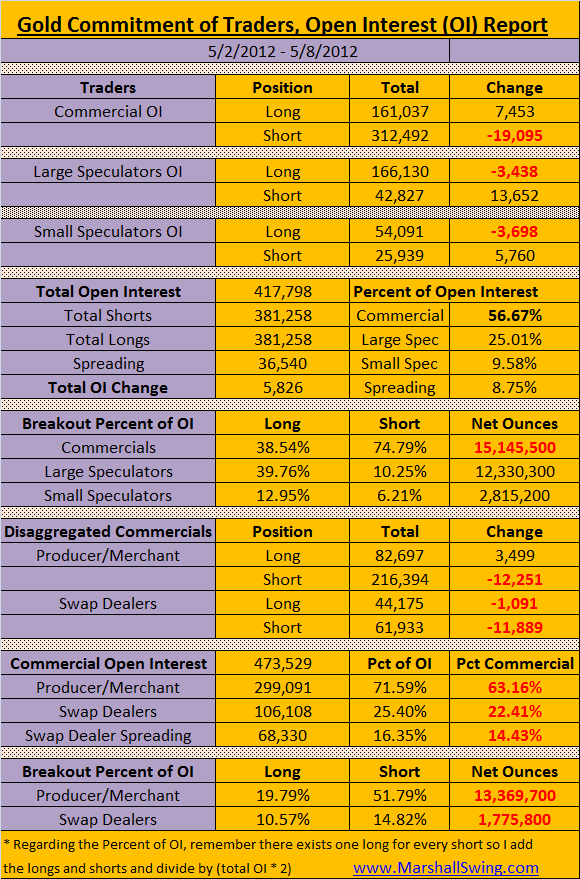

See my various articles on the manipulation practices of the producer/merchant commercials at my website: www.MarshallSwing.com

And we see that played out in the silver chart for that day:

I leave you to the rest of the numbers! If you have general questions, you can reach me at www.MSwing@MarshallSwing.com Answers will be posted on the website for all to see.

See you next week,

See you next week!

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.