Bundesbank Confirms German Gold Held By US, UK and French Central Banks

Commodities / Gold and Silver 2012 May 15, 2012 - 07:47 AM GMTBy: GoldCore

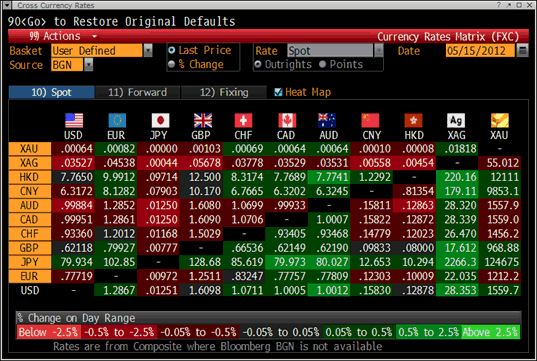

Gold’s London AM fix this morning was USD 1,559.00, EUR 1,213.61 and GBP 969.95 per ounce. Yesterday's AM fix was USD 1,563.00, EUR 1,213.79 and GBP 972.62 per ounce.

Gold’s London AM fix this morning was USD 1,559.00, EUR 1,213.61 and GBP 969.95 per ounce. Yesterday's AM fix was USD 1,563.00, EUR 1,213.79 and GBP 972.62 per ounce.

Gold fell $22.70 to close at $1,558.60/oz in New York yesterday. Gold edged up in early Asian trading to $1,560/oz prior to renewed selling that saw the price fall and gold briefly pierced below support at $1,550/oz prior to a slight bounce higher in early European trading.

Cross Currency Table – (Bloomberg)

Support remains at $1,550/oz and below that level could see gold test strong support at $1,523/oz and $1,533/oz – the lows in December and September 2011 respectively.

Lower bullion prices triggered a “flurry of activity in the physical market” according to Reuters, with purchases from jewellers in the world’s largest buyer India and also Southeast Asia keeping premiums for gold bars steady at $1.20 to London prices in Singapore.

A physical dealer in Singapore told Reuters that "jewellers have been buying a lot. At the moment supply is a bit tight for immediate delivery. Refiners can't deliver immediate gold because there's a sudden surge in demand. We're seeing demand from India, Thailand and Indonesia.”

However, the dealer told Reuters that the market is not “short of physical gold bars right now.”

Sharp increases in mining costs mean gold will need to reach $3,000 an ounce in five years for the industry to stay profitable, the World Gold Council said yesterday. Mining costs have increased significantly in recent years and cost of production alone suggests that gold will have to rise to much higher levels in the coming years. Otherwise, many mining companies will go bankrupt creating an even bigger supply crunch.

Bundesbank Confirms German Gold Held By FED, BOE and Banque De France

Germany's Bundesbank confirmed yesterday that the German gold reserves are held overseas by the Federal Reserve, the Bank of England and the Banque de France.

There has been a lack of clarity and transparency regarding the German gold reserves, as there are with many other nations gold reserves, and this had led politicians and journalists seeking transparency.

The Bundesbank has previously resisted calls for a more transparent accounting of the German gold reserves.

Some Germans are concerned about the risk of contagion in the eurozone and the risk that the single currency could fall apart. They wish to know that the German gold reserves are secure and can be relied upon in the event of a currency crisis.

The Bundesbank said it has complete confidence in valuations and the security of its gold holdings at other central banks and said that "there is no doubt about the integrity and the reputation of these foreign central banks where the gold is held."

Gold in USD – Daily (1 Year)

Germany's central bank has the world's second largest holdings of gold after the United States, about 3,400 tonnes of gold valued at nearly 140 billion euros, according to the Bundesbank.

The German parliament, the Bundestag, has been examining the accounting of German gold reserves at the Bundesbank. The parliament's Budget Committee, one of the most powerful committees in the German parliament, had requested a critical report by the Federal Audit Office.

"The decision has been unanimous," the paper quoted the Christian Social Union budget expert Herbert Frankenhauser. The newspaper report alleged "account cheating" regarding the German gold reserves.

According to a Bild report, the federal auditing office complained of "inadequate diligence of the accounting of the gold reserves, which are stored in some foreign countries. Repatriation of the gold reserves is encouraged.”

The Bundesbank confirmed that it, like many central banks, keeps part of its reserves in vaults at foreign central banks and said some of its gold is held at the Federal Reserve Bank of New York, the Banque de France and the Bank of England.

It declined to say how much gold in total is held overseas or how much gold is stored with the Federal Reserve, Bank of England and Banque de France.

The Bundesbank statement said it had complete confidence in the integrity of the central banks where the gold is held.

"From these central banks, the German Bundesbank annually gets confirmation of the gold holdings in troy ounces as a basis for its accounting," the Bundesbank’s statement said.

Central banks, particularly smaller ones with inadequate security or military resources to protect gold reserves, have traditionally kept some or all of their gold at foreign central banks, particularly the Federal Reserve, for security reasons.

However, the risk of contagion and a global financial crash has led to anxieties about leaving gold reserves with foreign powers and concerns that in the event of a currency crisis or international monetary crisis, emergency measures could lead to gold reserves being nationalised or expropriated in order to support currencies such as the dollar.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.