Gold Turns Negative Year to Date, But Bull Market is Not Over

Commodities / Gold and Silver 2012 May 14, 2012 - 09:06 AM GMTBy: GoldCore

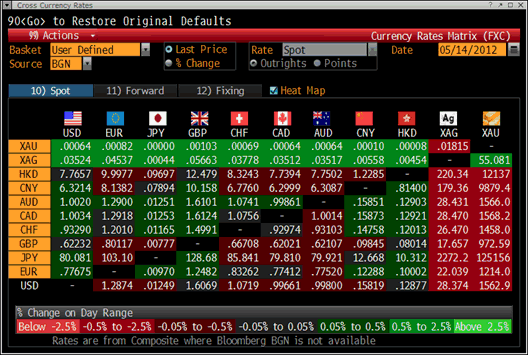

Gold’s London AM fix this morning was USD 1,563.00, EUR 1,213.79 and GBP 972.62 per ounce. Friday's AM fix was USD 1,580.75, EUR 1,221.69 and GBP 980.98 per ounce.

Gold’s London AM fix this morning was USD 1,563.00, EUR 1,213.79 and GBP 972.62 per ounce. Friday's AM fix was USD 1,580.75, EUR 1,221.69 and GBP 980.98 per ounce.

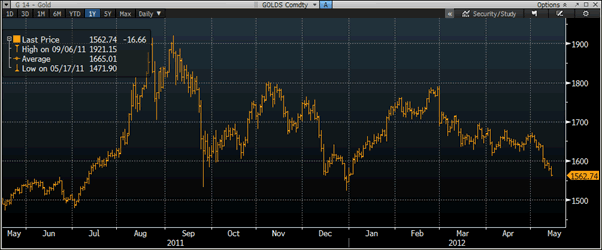

Gold fell $12.70 to close at $1,581/oz in New York on Friday. Gold has fallen again today and has now erased the gains for the year. Gold edged up in early Asian trading as bargain hunters lifted prices from four month lows, but gains were capped and prices gradually fell and falls continued in European trading.

Cross Currency Table – (Bloomberg)

Support is at $1,550/oz and a close below that level could see gold test strong support at $1,523/oz and $1,533/oz – the lows in December and September 2011 respectively.

Greece looks certain to leave the single currency – something that was denied could ever happen by policy makers, central bankers etc. for many months. A Greek exit from the eurozone would damage confidence in the single currency bloc but not necessarily be ‘fatal’, Irish central bank chief and ECB policymaker Patrick Honohan said over the weekend.

“Things can happen that are not necessarily imagined in the treaties... it is not necessarily fatal but it is not attractive”, Honohan said.

For Greeks who have left their life savings in euros in Greek banks it might prove fatal to their finances as capital controls are suddenly introduced and their savings are forcibly converted to the Greek drachma overnight. It is estimated that the drachma could quickly devalue by between 20% and 50%.

Spanish 10-year bond yields have surged to over 6.29% leading to concerns of contagion which is leading to sell offs in most markets including gold. However, gold's recent correlation with risk assets will again be short term and buyers should again focus on the long term and gold's proven long term diversification, wealth preservation and safe haven qualities.

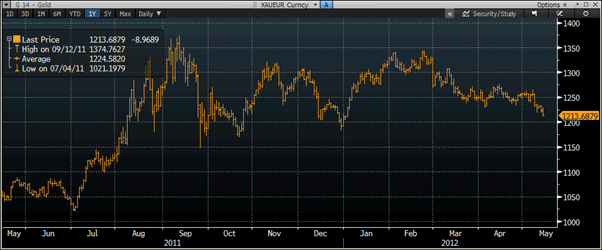

While gold is now negative year to date in dollar terms, it remains 0.7% higher in euro terms. This shows that recent gold weakness is primarily due to the recent bout of dollar strength.

Gold in USD – Daily (1 Year)

Money managers in gold futures and options have cut their net long positions by 20%, CFTC data showed Friday. The plunge means that bullish gold bets are at their lowest level since December 2008 (92,498 contracts), as speculators aggressively unwound their bullish bets in the precious metal after recent price falls.

Gold in Euros – Daily (1 Year)

Bullish silver bets on a silver rally tumbled 32% to 7,159, the biggest decline since late December. This is bullish from a contrarian perspective.

In the physical market, jewellery makers and speculators took advantage of last week's drop in prices according to Reuters and there are reports of physical buying interest and indeed “tight supplies” in the physical market.

Gold prices dropped 3.7% last week and silver fell 5.1% to $28.89/oz. The smart money, especially in Asia, is again accumulating on the dip.

Demand for jewellery and bullion in India has dipped in recent weeks but should resume on this dip – especially with inflation in India still very high at 7.23%.

Also of interest in India is the fact that investment demand has remained robust and gold ETF holdings in India are soon to reach the $2 billion mark.

Gold in GBP – Daily (1 Year)

Morgan Stanley has said in a report that gold’s bull market isn’t over despite the recent price falls.

Morgan Stanley remains bullish on gold as it says that the ECB will take steps to shore up bank balance sheets, U.S. real interest rates are still negative, investors have held on to most of their exchange traded gold and central banks are still buying gold.

Weak hands are again being shook out of the gold market but it remains prudent to retain an allocation to gold and those who do so will be handsomely rewarded in the coming months and years

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.