The Shortage of Arable Land and the Case for Agriculture and Farmland Investing

Commodities / Farm Land May 14, 2012 - 05:38 AM GMTBy: Submissions

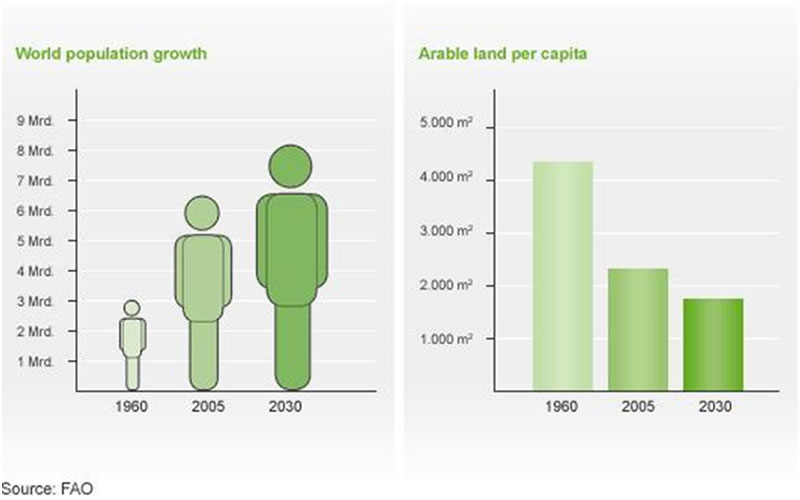

Adam Waldman writes: Whilst farmland investing may seem to some to be a bit of an exotic option, the reality is that there is an increasingly compelling case for adding this asset class to the alternative investments bucket of your portfolio. One of the major reasons for our bullishness on farmland investment is the availability of quality farmland. As the graph below from the UN Food and Agriculture Organization (FAO) clearly demonstrates, the amount of arable farmland has already shrunk and will continue to do so.

Adam Waldman writes: Whilst farmland investing may seem to some to be a bit of an exotic option, the reality is that there is an increasingly compelling case for adding this asset class to the alternative investments bucket of your portfolio. One of the major reasons for our bullishness on farmland investment is the availability of quality farmland. As the graph below from the UN Food and Agriculture Organization (FAO) clearly demonstrates, the amount of arable farmland has already shrunk and will continue to do so.

China has actually been a particular victim of this trend. To take a more specific example of this trend. China currently contains 20pc of the world’s population, but only 7pc of its arable farmland. Unfortunately for the Chinese, China has already been losing arable farmland at an alarming rate. According to this article from the English language China Daily, the amount of arable farmland in China has fallen sharply.

“Acute shortages of reserve farmland and water resources are now the main restraints for the country to ensure its food security, Zhang Ping, minister of the National Development and Reform Commission, said on Thursday while making a report to the top legislature.

“The cultivable land in the country sharply decreased from 130.04 million hectares in 1996 to 121.72 million hectares in 2008 due to rapid urbanization and natural disasters, figures from the National Bureau of Statistics show.

“Also, the current per capita cultivated farmland is about 0.092 hectares, which is only about 40 percent of the global average. Less than 4.7 million hectares in the country can be considered reserve farmland, Zhang told the legislature.”

According to a report from agricultural consultancy Colvin and Co., the Chinese government estimates they need to maintain 120 million hectares for crop production until 2020 in order to be self-sufficient in grain production. Bank of America estimates that China’s arable land has already fallen below the 120 million hectare threshold and could decrease to 117 million hectares by 2015.

Already, China is becoming a net importer of food. According to a report from the US Grains Council, China will import some 1.7 million tons of corn this year, 5.8 million tons next year and as much as 15 million tons in 2014-2015.

The point here is not to overwhelm the reader with facts and figures about China, but to have investors think about the big picture. With US$3.1 trillion of reserves, when China wants or needs something, it goes out and buys it. Food and farmland are no exception. China has already been eyeing farmland purchases in a variety of countries and regions, and has been looking particularly closely at Africa farmland.

How to play the Chinese agricultural interest in purchasing farmland as well as the broader macro-economic perspective of shrinking arable farmland globally? Simple economic principles of supply and demand dictate that when there is an increasing shortage of an asset combined with growing demand for it, the prices of that asset are likely to go up. Hence, direct ownership of farmland in locations such as Africa – which is now increasingly possible for individuals – is certainly one option. Sub-Saharan Africa holds 60% of the world’s remaining uncultivated land suitable for farming and has seen a particular surge of interest from both Chinese state owned companies as well as Persian Gulf Sovereign wealth funds, reflecting these nations' concerns for their food security. Private equity and hedge funds are also diversifying into farmland investments in Africa.

The second option is to own agricultural stocks, especially in the fertilizer sector, as fertilizer will be crucial to obtaining the greatest yields from shrinking agricultural land. For example, Yara of Norway (Norway:YAR), which is one of the world’s largest producers of nitrogen fertiliser and has an excellent distribution network. For those interested in organic food, which is increasingly an important sub-sector of agriculture, Cranswick (CWK) of the UK is an excellent fit.

Finally, the third option is also the option of investing in commodities futures ETFs that track the prices of different commodities in the agriculture sector, for which there are many different options available.

If we had to choose, the purest exposure to the agricultural land theme is farmland investment itself, although many agriculture stocks also capture this trend reasonably well. We are probably somewhat less enamored of the third option as direct commodity prices are increasingly move up and down based on short-term speculation by hedge funds and other large investors.

Any way one chooses to invest in agriculture, however, will quickly find that upon studying the sector that the shrinkage of cultivatable farmland is a clear global macro-trend worth following.

Adam Waldman is the Marketing Director at GreenWorld BVI. GreenWorld specializes in real asset alternative investments such farmland and forestry. All of GreenWorld’s investments have low enough minimums that they are accessible by individual investors. The aim is to allow retail investors to access such stable, "hard asset" alternative investments that pay high current income and also offer excellent opportunity of long-term capital gains.

By Adam Waldman

Copyright © 2012 Adam Waldman - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.