Stocks Bear Market Focus Point: Bull Trap confirmed – Six weeks is a long time for a Banker

Stock-Markets / Stocks Bear Market May 14, 2012 - 02:05 AM GMTBy: Garry_Abeshouse

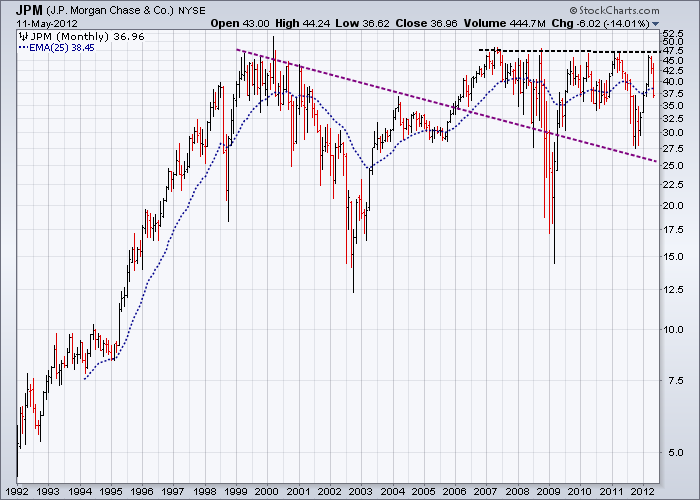

Recent ““errors, sloppiness and bad judgment” by JP Morgan have shown the world that the D-Word genie, after sleeping off its last travail into an “unsuspecting” financial world has escaped again, to wreak havoc on our loving and ever too trusting bankers. Of course this begs the obvious question – if the highly technically advantaged JP Morgan can stuff up their dealings with derivatives so easily, surely this can happen to others as well – which beggars the question of who shall be next? The very nature of greed combined with huge amounts of cheap money, the continuing lack of open and honest disclosure and targeted and effective regulation, means that it is only a matter of time before history repeats itself. And as long as governments lack the will to enforce these measures, you can be sure that bankers will continue to find ways to persevere with their high risk ways.

Recent ““errors, sloppiness and bad judgment” by JP Morgan have shown the world that the D-Word genie, after sleeping off its last travail into an “unsuspecting” financial world has escaped again, to wreak havoc on our loving and ever too trusting bankers. Of course this begs the obvious question – if the highly technically advantaged JP Morgan can stuff up their dealings with derivatives so easily, surely this can happen to others as well – which beggars the question of who shall be next? The very nature of greed combined with huge amounts of cheap money, the continuing lack of open and honest disclosure and targeted and effective regulation, means that it is only a matter of time before history repeats itself. And as long as governments lack the will to enforce these measures, you can be sure that bankers will continue to find ways to persevere with their high risk ways.

History repeating itself

I am sure that the MarketWatch headline shouting “S&P cuts outlook on J.P. Morgan Chase to negative, citing risk management”, creates nervous echoes in most of us of 2007 and 2008.

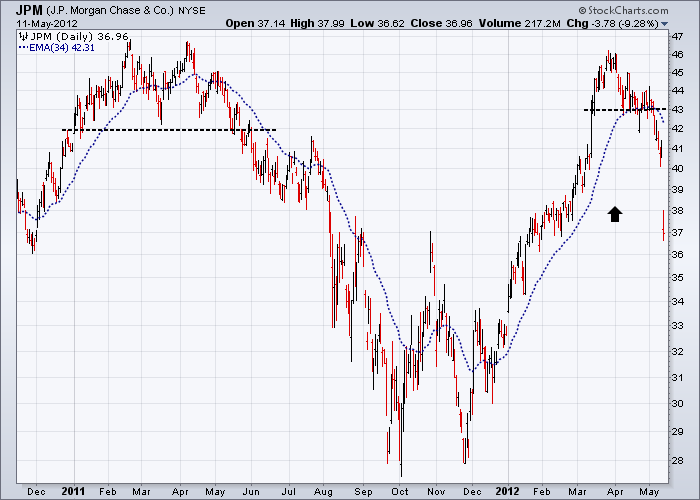

Robert Reich has quickly come out swinging, suggesting that JPM has been sitting on this debacle for at least 6 weeks before officially telling anyone - and the charts below appear to agree with his assessment.

There are many questions that we could be asking JPM in order to find out if they are telling the truth, the whole truth and nothing but the whole truth about the amounts involved.

For instance we could ask:

a. What is the full extent of these losses - is it really just a measly $2 billion or is it more like $5 billion, $10 billion or even $20 billion or more?

b. To what extent are other institutions affected?

c. Are these ‘errors of judgment’ all showing up on-balance sheet or is some of it off-balance sheet?

d. Is it possible that this event could evolve into a “Grey Swan Event”, something I alluded to in previous commentaries?

e. If so, wouldn’t this be a great time for the powers that be to bring out one of their “temporary rabbit-out-of-a-hat fixes” to shore up market confidence yet again?

f. Would it help to ask the Murdoch press for assistance?

g. Perhaps they could hack a few phones to get more information?

h. All of the above

Short term outlook

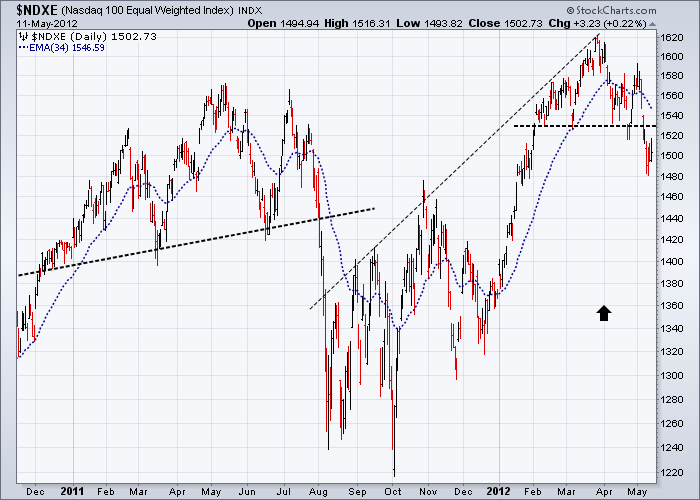

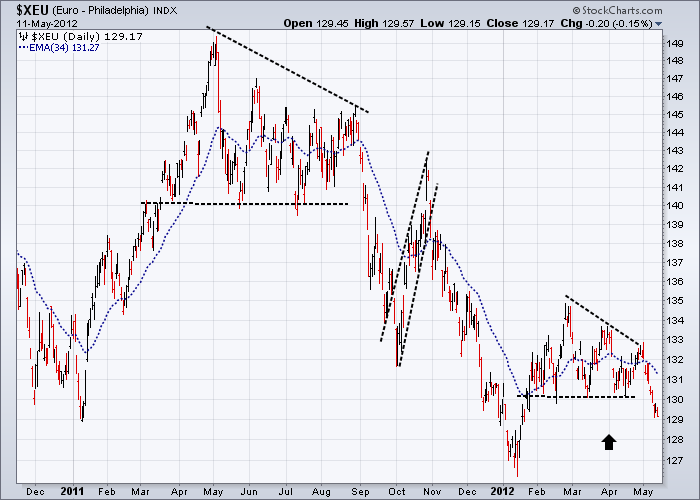

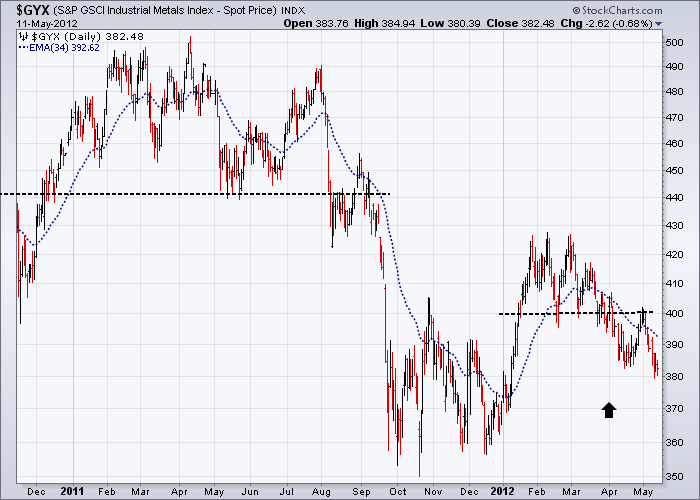

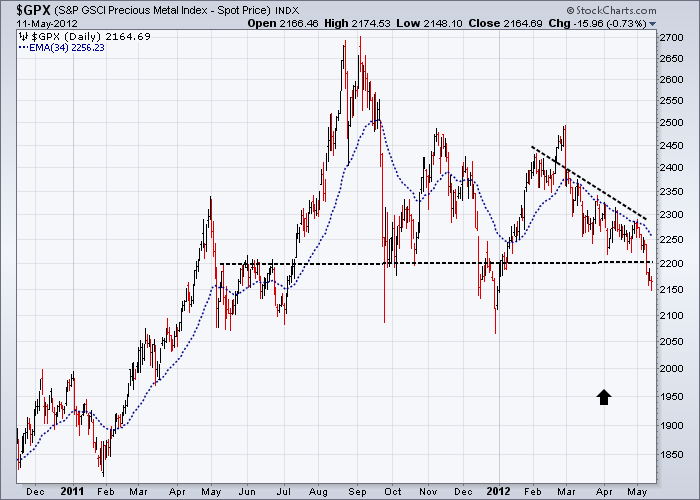

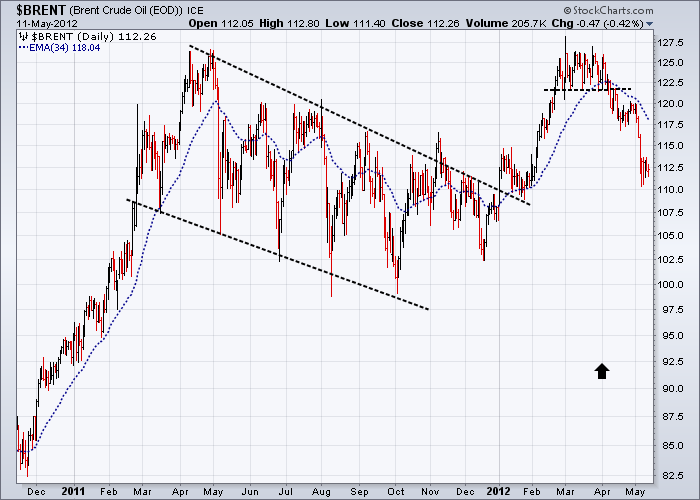

Whether coincidence or not, there was a significant downturn at the beginning of April, suggesting the hedge funds probably began to short most of the world’s financial markets in earnest about that time or earlier. You can easily see from the daily charts how the Industrial Metals Spot Index peaked first in February, then progressively the Euro, Precious Metals and Oil peaked in March followed by the banks and other equities peaking in late March and early April.

Despite being a classified as a permabear, and I am still in good company in this regard, some market indicators such as gold, oil, copper and the Euro are hanging on to short term support zones and trend lines from where they are still in a position to affect a short rally. And the way the USD and US T-Bonds are edging up relative to some of their resistance lines, this also suggests that if short rally is going to happen, then it is more likely to happen sooner rather than later. And the longer there is a delay, the harder it will be for this rally to form.

Complementing this view as I just mentioned, is the very noticeable shorting presence of the large hedge funds in the equity market – apparent from the relentless deterioration in many of the chart patterns over the last three months – well illustrated in previous market commentaries, as well as in the daily charts below.

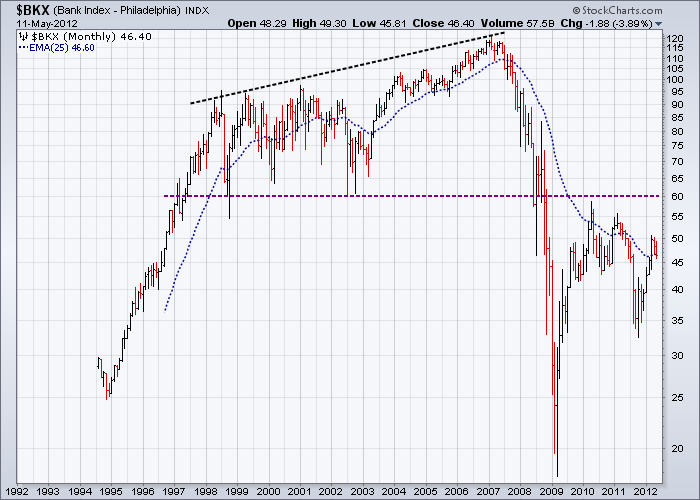

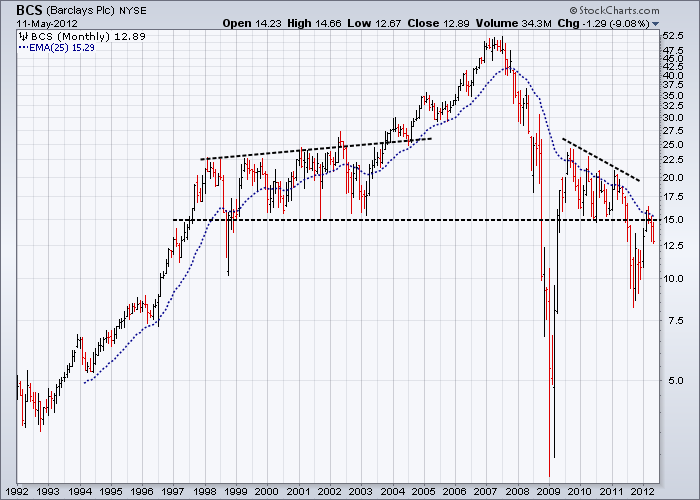

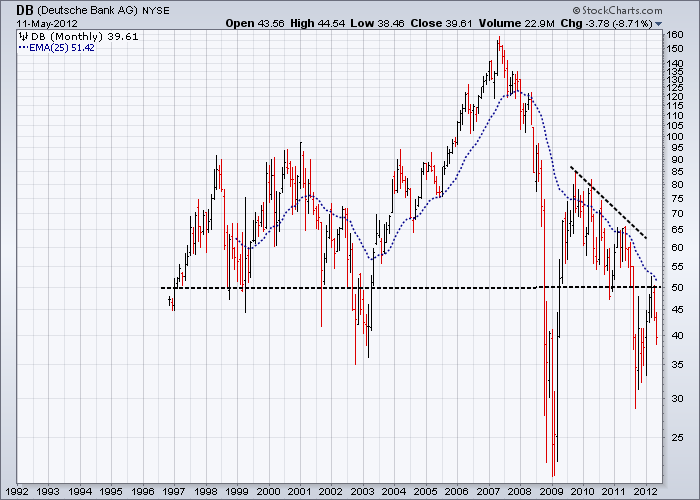

I have selected monthly charts of the KBW US Banks Index, JPM, Barclays and Deutsche Bank, whose longer term technical weaknesses clearly underline the precarious nature of the world’s financial system. Only time will tell whether the JP Morgan’s fiasco will trigger immediate further falls or not. But the way world events have been unfolding in combination with the evolving chart patterns over recent weeks, continues to reinforce my view that the worst is yet to come.

There is of course a very long narrative sitting not so quietly behind the JPM debacle. It suggests that is not unreasonable in the current circumstances, to think that perhaps the main reason for bear markets to exist is to force bankers out of their narcissism and into the real world. We live in hope.

Note the KBW Bank Index is a semi-equal weighted index, with JPM making up 8.18% of the Index as at May 10th 2012. There are 24 US based banks in this index with weightings varying from 1.00% to 8.18%.

The Nasdaq 100 Equal Weighted Index contains zero banks and finance stocks, so is an excellent market leader index to compare with other indices.

Daily Charts

Monthly Charts

USA Bank Index

USA

United Kingdom

Germany

This time a final word, dated May 6th 2012. Rare common sense from economist Paul Krugman concerning those revolting Europeans:

“One answer — an answer that makes more sense than almost anyone in Europe is willing to admit — would be to break up the euro, Europe’s common currency. Europe wouldn’t be in this fix if Greece still had its drachma, Spain its peseta, Ireland its punt, and so on, because Greece and Spain would have what they now lack: a quick way to restore cost-competitiveness and boost exports, namely devaluation.

As a counterpoint to Ireland’s sad story, consider the case of Iceland, which was ground zero for the financial crisis but was able to respond by devaluing its currency, the krona (and also had the courage to let its banks fail and default on their debts). Sure enough, Iceland is experiencing the recovery Ireland was supposed to have, but hasn’t.

Yet breaking up the euro would be highly disruptive, and would also represent a huge defeat for the “European project,” the long-run effort to promote peace and democracy through closer integration. Is there another way? Yes, there is — and the Germans have shown how that way can work. Unfortunately, they don’t understand the lessons of their own experience.”Till next time.

Garry Abeshouse

Technical Analyst.

Sydney

Australia

I have been practicing Technical Analysis since 1969, learning the hard way during the Australian Mining Boom. I was Head Chartist with Bain & Co, (now Deutsch Bank) in the mid 1970's and am now working freelance. I am currently writing a series of articles for the international "Your Trading Edge" magazine entitled "Market Cycles and Technical Analysis".

I specialise in medium to long term market strategies.

© Copyright Garry Abeshouse 2012

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.