U.S. Trade, Initial Jobless Claims – Mixed Signals

Economics / US Economy May 11, 2012 - 07:49 AM GMTBy: Asha_Bangalore

The trade deficit widened to $51.83 billion in March from $45.42 billion in the prior month. Exports (+2.9%) and imports (+5.2%) of goods and services both advanced in March, but imports outpaced exports. After adjusting for inflation, the goods trade gap increased to $48.9 billion during March from $44.1 billion in the previous month. A large part of the widening of the trade gap was from the non-petroleum component with oil imports accounting for the relatively smaller share. Capital goods excluding autos (+7.8%), autos (+4.8%), and consumer spending excluding autos (+7.8%) were thelarge components of imports. Exports of capital goods excluding autos rose 2.7% in March.

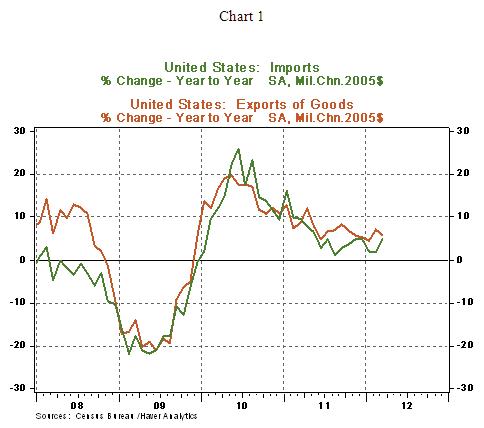

Exports of goods have slowed, while imports of goods moved up somewhat from the past year (see Chart 1). The trade deficit widened vis-à-vis China, Mexico, Japan, Canada, and the euro area. The trade deficit of March could make a small dent to the first quarter estimate of 2.2% growth in real GDP. The downward trend of the growth in exports is indicative of soft economic conditions and suggests that the contribution of exports to GDP is likely to be tepid in 2012.

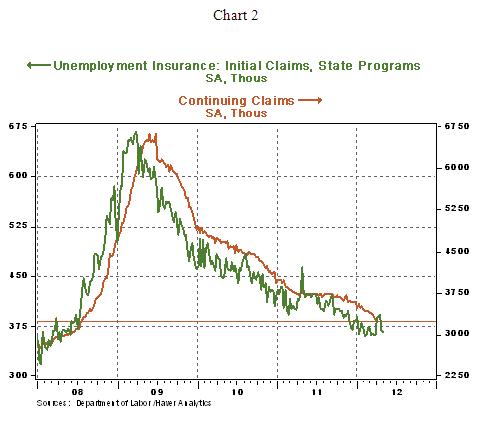

Initial jobless claims inched down 1,000 to 367,000 during the week ended May. The April hike in initial jobless claims put the 4-week moving average at a recent high of 384,000 and is now being erased gradually. The latest 4-week moving average is 379,000. Continuing claims, which lag initial jobless claims by one week, fell 61,000 to 3.229 million, the lowest since July 2008. Labor market conditions are improving but only at a snail’s pace.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.