Gold, Silver and Profiting from Peoples Predictability! MAP Analysis Part 5

Commodities / Gold and Silver 2012 May 11, 2012 - 07:45 AM GMTBy: Marc_Horn

A cycle is a repeated sequence of events (OR BEHAVIOUR). Until that cycle is broken we can PROFIT FROM PEOPLES PREDICTABILITY. The prime levers to control them are ignorance, greed and fear.

A cycle is a repeated sequence of events (OR BEHAVIOUR). Until that cycle is broken we can PROFIT FROM PEOPLES PREDICTABILITY. The prime levers to control them are ignorance, greed and fear.

Understanding how people behave and react easily allows us to profit from them. THIS IS CRITICAL TO SUCCESFUL TRADING

The reason you are reading this is either you think based on my works that you have read so far there is some validity in my presentation of my interpretation of Elliot’s work, or you are looking for some mistake so you can discredit me, but I am sure when I analyse the views this article will get more than the others much quicker – Why? People have a passion for gold and silver and a POSSIBILTY of quick easy money! People are Predictable.

So do you want to be manipulated and let people profit from you, or are you able to overcome your pride that I have taken you for a free ride that just cost you a bit of time, and change your behavior to break that predictability cycle?

For those that can’t overcome their pride the charts are at the end and those are the ones the rest of us can profit from!

I must admit I have profitability motives, but social ones as well! In my last article I finished with:

PUT PRINCIPLES ABOVE PROFIT – MAKE PRICIPLED PROFITS – That is what sustainable capitalism is where the rubbish should be allowed to fall by the wayside to innovate new ideas to generate new wealth!

I would like to share the experiences that led to this series being published and the manipulation of peoples predictability to demonstrate the presence of cyclical behavior that is common in the markets which highlight many of the pitfalls that result in stupid losses if you don’t understand your trading parameters.

To avoid some peoples’ predictable behavior and to try avoid pride issues in order to keep you open minded I have 4 A levels, and a BSc in Forestry (yip growing trees) I also am a Dive Instructor Trainer, have a commercial diving business and run a concrete block factory. SO I AM ONLY RELATING WHAT I HAVE GAINED AS LIFE EXPERIENCE and MY BASIC COMMON SENSE.

I AM NO EXPERT, but hopefully I will demonstrate using my experiences that X is unknown quantity and a spurt is a drip under pressure and that BULL BAFFLES BRAINS, These are critical to understanding the game! Please take no offence, this is not directed at any single or group of people. It is about modifying behavior for profit!

I overcame my pride of winning a few trades and losing a few trades and lost 30% in two years. I chose to change my behavior and pay for expert advice and lost 50% of what I started out within 6 months! Until again I changed my behavior and chose to open my mind when one day I got instructions to go long by a firm who I will just call Z, and short by another who I will just call M on the S&P. These are well recognized experts, highly recommended and quoted and given air time and press time! Both have the power to influence markets. Have you noticed how after reputable Z’s and M’s, and all other random alphabet letters of the recommendations shoot up as the emails coming into our drop boxes are acted upon because demand increases, and with a limited supply prices go up – basic economics - only to go back down a few days later except for the odd ones - by luck any one can pick a winner!

People assume a duty of care (maybe I am an expert because by flicking a coin I can also get 50% probabilities but more importantly I lost less money in a longer period of time on my own)

The 3P’s I first want to point out here is the failure of duty of care, not only in the industry, but also the complacency and failure of duty of care of those that report it and even those that regulate it! Recommendations are not verifiable facts and as such duty of care includes balanced presentation of alternative views and or opinions. For an extreme example look at the global warming debate – scientists that want to present an alternative view do not get funding nor airtime so how can we the voters that are interested make an informed view to express to our elected representatives either way?

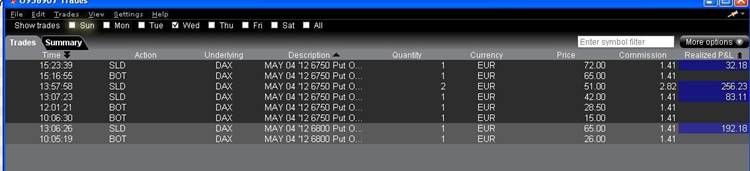

Predictably you will be wondering why I have this trade log put in here – to maintain your attention because I want to retain your attention as I don’t want you to be some one that is predictably profited from! (Not bad hey – calculate the returns yourself 3 out of 4 are winners with clearly defined entry / exit parameters and limited risk– I am sure you would be happy with that in a year let alone 1 morning! I am not interested in job offers! Now back to the 3P’s

In these articles I presented MAP Waves – An Alternative to EW, knowing that I am not the only one that has been taken for a ride by others’ failure of duty of care, and as this is a foundation stone of many experts analysis would get the most attention!

I predicted that, (as I am with this article that by adding gold and silver into the title that it should get more reads than the previous ones quicker) that I could manipulate people into reading my first 2 articles by claiming it was an alternative to Elliot Waves. I was amazed by the number of views and even more amazed that the second one made the featured articles.

I predicted that it would go unchallenged because of extremism. You can ask my wife! My 10:80:10 rule.

10% Extremist - I doubted that any expert would comment because they cannot admit they are wrong about there being a definable probabilistic end to corrections (certainly not in public because that would cause a mass of legal cases!) and overcome their pride that maybe they have overlooked – or more likely intentionally overlooked the underlying principles of EW (possibly so that they can always quote back to the stuff that is correct and hope no one pulls out the rubbish, which is highly probable because the press brainwash only one side of the story – whatever their paymasters allow - oh and are they in bed with vested interests and governments? Not sure maybe ask one of the Murdoch’s!)

So here is another great marketing opportunity for those I have offended so far– balanced professional press (not a chance because those that control power need to keep the public under their empty promises you have to keep them ignorant by restricting quality education to those that can afford it so you get plenty of indebted slaves to keep you in your lifestyle by easy brain washing and a legal system that only protects you if you can hire the best lawyers!)

80% Not very interested or too simple – can’t be this easy.

10% Extremist - That went to my blog to see if there was anything else and the 10% of the experts that overcame their pride and were open minded enough to explore alternatives. Plus I imagine a few that were skeptical and wanted to see if there were some hot tips for a quick buck!

I had been a long time follower of cycles especially the K wave, and got into other cycles and came across Alan Andrews works and immediately recognized them as a visual representation of frequency and time – i.e. cycles, which resulted in the above trades, but the road was fraught with further 3P’s!

I joined a course that advertises everything that you need to trade with the Andrews and Babson techniques. So I thought fantastic, expensive but I can quickly learn everything and shortcut putting it together myself and become like Alan Andrews as advertised and make $5000 into $50,000 in 6 months according to their video. Great recoup those losses quick and make some money!!! My son was visiting and I had received access (which is all you get if you read the wording carefully!) to the videos and I proudly said this is magic. My son did not even bother to watch the first 5 minutes when he pointed out that the guy not only was drawing random lines for demonstration, but on the video continuously deleted them and redrew them until he found a fork that showed what he wanted to demonstrate!

Not wanting to lose my pride (predictable), especially to my smart ar#$% son! I defended myself (predictable) and once he left spent many hours trawling the net which is a wealth of information and constantly requesting my mentor on which pivots must I use to draw the forks from. No response or just random avoiding the question answers! Fortunately by this time I was seeing patterns for fork combinations that were predictive but better repeatable, all of which I submitted during the interaction to enter discussion to try answer the question of which pivots to use and boost my ego (predictable) when I was right. I had already given him most of my research and when the mockery started (predictable) it rang an alarm bell (not always predictable). He started to see it and I was threatening his status as god, and worse so were others beginning to see it(predictable). Being a capitalist I thought well maybe I can work with him and make some money out of it! Fortunately people behave predictably and so from then on I was careful about what I sent, including disinformation (predictable). I then privately breached the subject assuming he would give me some benefit from my work, and eventually emailed him a quick demonstration of the potential with the above copy of my trade log – proof of the pudding is in the eating!

His response was requesting I show him how using my system how I would have picked last October and the 3 December lows! I know I am just a stupid amateur but seriously!! Predictably he had 2 options – make me an offer or try public humiliation. I told him he already had the information just go through the emails. Greed predictably drove him to use my most current disinformation which he copied to another course member for moderation, and sent this to the group to totally follow the second predictable option! Unpredictably for him I did not do what most would naturally do – react to defend my pride!

On one forum I questioned how can the market change from bear to bull to bear, and I am talking Elephant in the room and higher than you think swings! in under 24 hours and was told recommendations are not made on that forum on short term trades??? and I should keep my comments to questions relating to the presented forecast! Then predictably totally unrelated posts started to appear about amateur forecasters after my first two articles! I then asked if off topic posts were again allowed or was that restricted to some members following my rebuke which predictably brought the first extremist (no one likes to be first!) which brought out the 80% who predictably felt the need to defend the presented view, and predictably the number of members on line more than doubled to see what was going on. I am sure some of the other 10% extremists objectively actually read what I had to say, but predicatively they feel they might be attacked if they comment against the crowd and also become labeled an extremist! So far they predictably have failed to overcome their pride. Hopefully predictably soon that will be overcome when another extremist like me starts to raise the questions I have raised and then they will revert to sensible open minded discussion for the benefit of the group rather than putting pride over principles! Had they acted objectively and rationally all members would have benefited from the discussion including myself!

I am not after poor you – my skin is thick enough!

I am trying to give you real examples of what has happened to me in my quest to make some easy money like I imagine many of us are here for – in the hope that you too don’t get duped the way I have been. I am lucky enough that I have some money! There are many that have lost their savings, retirement and dreams of a happy future and have through no fault of their own had those dreams taken away from them through their predictable behavior by being manipulated into making stupid investments, not only through outright disinformation, but often just through the simple failure of duty of care, a fundamental basis of law which we entrust our regulators to control!

A central banker once very long ago said to me – follow the money! At the time I did not understand what he meant!

I have presented in my opinion a strong and substantiated case which if you apply them will give you better results than the vast majority of experts can give you, and I am sure if you try it in addition with the techniques you are already using you will improve your results!

Hopefully many analysts will get over their pride and start to fulfill their duty of care, as well as publishers by offering alternative views and informative debate.

Thanks Nadeem for your maintenance of FREEDOM OF SPEECH on this site. Don’t let ANY government take that away!

I suppose if I go to America I may get arrested without any rights now that Obama signed the law in January! My extremist views may be deemed anti state because I criticized regulators, which means I criticized the state – Oh not to worry Obama said he would not use the law??? Well why sign it then???. Don’t let the British tail be waged by the American dog!!

Someone posted the panic cycle here a while ago– become familiar with it!

In the previous part I copied the 3P’s of what happens as waves form and the stupidity of 3P’s of where people put their protective stops!

Don’t fall into the traps of the 3P’s. Separate emotion from analysis.

So back to gold and silver (many people claim to be the most manipulated metal on earth) which is probably what got some of you to read this! You be the judge!

Analysts have started to whinge and wine about High Frequency Trading and the PPT (market manipulation to the rest of us) and that is why their methods are producing bad results!

Below I have shown yesterday’s low was made at the ideal wave target, at the intersection of the MLL and the latest ML! This is irrespective of the poor economic data and all the news over recent weeks!

You can see that once D3 (purple pivot) was in, the new 4H trend and normal wave trading range was established! Can it drop below the bottom blue line once 4H -4 is in? of course. Those that have read this MAP Analysis series will know why!

Using the same methods Alan Andrews used early last century and applying them methodically as described goes to show we have not changed, and are just as predictable as we were then!

We have learned nothing from history! The 3P’s! and still we are duped by the government propaganda that they can direct the economy! When will we wake up? What more evidence do you need that it is time to change behavior for the common good!

Looking at many charts I am not sure whether we will have long enough for inflation to take off as Nadeem’s extremist view presented so long ago which predictably has been mocked by many, even openly when you tried to discuss them elsewhere, but unfortunately still is extremist because of the propaganda and the 80% that are still in denial, or, whether the sovereign debt crisis will implode first, or, we get the next Hitler with the growing nationalistic sentiment and peoples rejection of austerity. The Germans still have a social memory of hyperinflation so be open minded that printing money is not going to get us out of this mess, but as Nadeem said – they will capitulate.

History shows us and this time is not going to be different!

I predict soon someone here will be the extremist that builds up enough courage and posts the first comment to get discussion going because time is running out, and I predict once analyst overcome their hurt pride they will provide a better quality of analysis to their paying customers.

I also predict that I may have ruffled some bigger feathers here! So hopefully big brother does not shut me down. If they do…. Go over my previously posted charts – the pivot combinations to Profit from Peoples Predictability is all there! Help keep the internet free of censorship and government control so that extremists like myself can express our views for public debate. They will predictably do what they can to keep power

Help stop share pumping and manipulation: trade indices

Help reduce volatility:

Mr. regulator - as public companies are traded on public markets make them publish their results publically a minimum of 1 monthly in arrears, we have tools called computers now which were not around 100 years ago!!!!! Another potential marketing opportunity?? Live 24 hour on line market – a bit like ebay I suppose?

Mr. Government why can’t you do the same, and while you are about it change the format of the countries P&L and Balance sheets in accordance with international accounting standards so that we can see the scale of the mess we are in and that it can be verified by those that take an interest???? After all you are spending our money!

For more information of how I do what I do http://mapportunity.wordpress.com/ . Comments and discussions very welcome!

The statements, opinions and analyses presented in this site are provided as educational and general information only. Opinions, estimates, buy and sell signals, and probabilities expressed herein constitute the judgment of the author as of the date indicated and are subject to change without notice.

Nothing contained in this site is intended to be, nor shall it be construed as, investment advice, nor is it to be relied upon in making any investment or other decision.

Prior to making any investment decision, you are advised to consult with your broker, investment advisor or other appropriate tax or financial professional to determine the suitability of any investment.

© 2012 Copyright Marc Horn - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.