Post-Financial Crisis – How do the Major Economic Players Stack Up?

Economics / Global Economy May 10, 2012 - 09:38 AM GMTBy: Asha_Bangalore

The global financial crisis broke out in August 2007 and the U.S. economy plunged into a severe recession in December 2007 and the recovery commenced in June 2009. The financial crisis touched nearly all major economies across the world. Where do the major economies of the world stand as the fifth anniversary of the crisis is not too distant? If progress is measured in terms of real gross domestic product, the U.S. economy ranks behind Canada in the G7 (USA, France, Germany, Italy, UK, Canada, and Japan) but it is ahead of the euro area.

The global financial crisis broke out in August 2007 and the U.S. economy plunged into a severe recession in December 2007 and the recovery commenced in June 2009. The financial crisis touched nearly all major economies across the world. Where do the major economies of the world stand as the fifth anniversary of the crisis is not too distant? If progress is measured in terms of real gross domestic product, the U.S. economy ranks behind Canada in the G7 (USA, France, Germany, Italy, UK, Canada, and Japan) but it is ahead of the euro area.

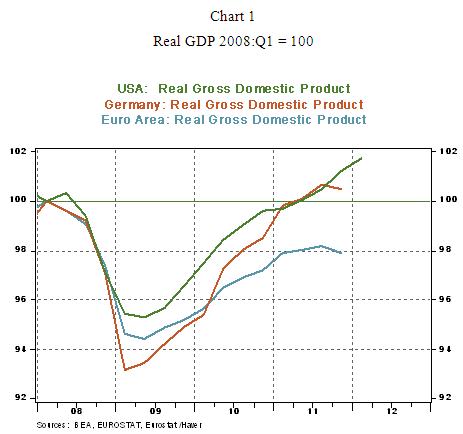

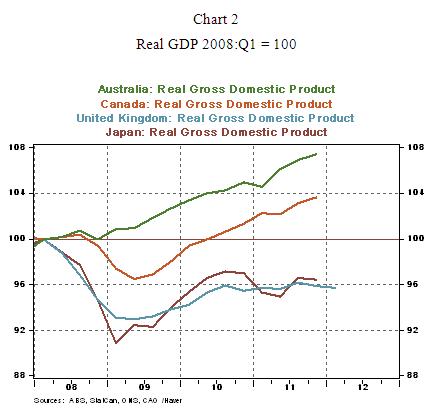

Charts 1-4 are index charts where real GDP in 2008 is set equal to 100. Real GDP of the US economy has advanced 1.78% (see Chart 1) from the first quarter of 2008, while that of Germany has risen only 0.5% and the composite euro area real GDP remains 2.0% below the level posted in the first quarter of 2008. Recent economic developments in Germany and Europe (non-euro and eurozone segments) point to further economic weakness and not economic growth. Of the other members of the G7, the Canadian economy shows an impressive performance with a 3.6% gain in real GDP (see Chart 2) but the United Kingdom and Japan are grappling with sharp declines in real GDP (see Chart 2). Australia’s economy escaped a recession, posted strong growth (see Chart 2) and raised the official policy rate in 2010 but has eased monetary policy more recently.

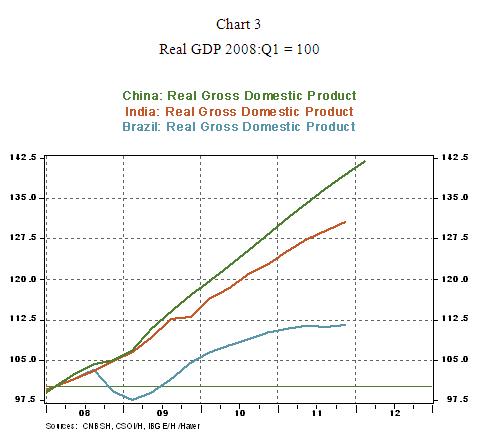

Moving over to the BIC nations, needless to say, China’s economic expansion stands out with a 42% expansion of real GDP since the first quarter of 2008, followed by India (+31%) and Brazil (+11.6%). The bottom line is that growth in the United States has overtaken other advanced nations affected by the financial crisis. The seeds of self-sustained growth have been planted in the United States and the economy is projected to move forward despite the turmoil brewing in Europe.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.