Asian Gold Buying on Roubini Dip

Commodities / Gold and Silver 2012 May 09, 2012 - 06:25 AM GMTBy: GoldCore

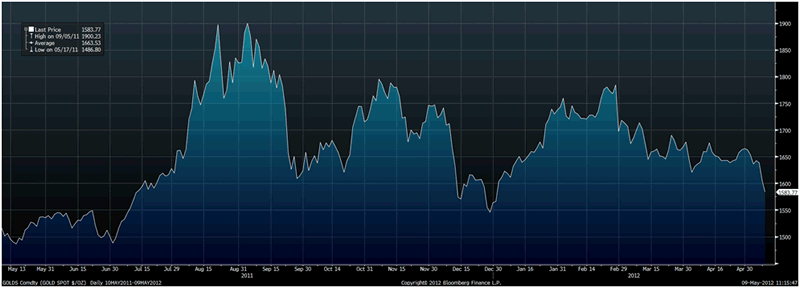

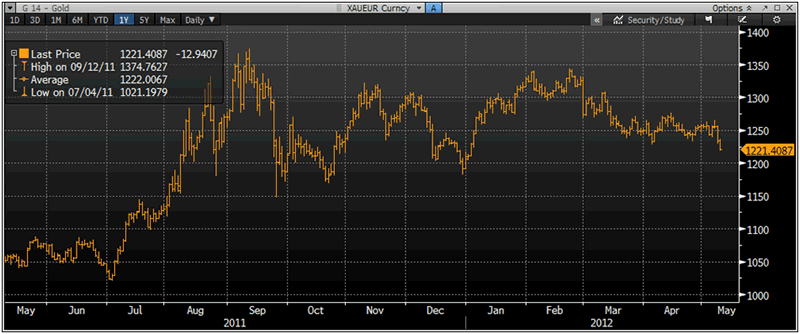

Gold’s London AM fix this morning was USD 1,585.50, EUR 1,221.87, and GBP 984.17 per ounce. Yesterday's AM fix was USD 1,627.00, EUR 1,250.77 and GBP 1,008.99 per ounce.

Gold’s London AM fix this morning was USD 1,585.50, EUR 1,221.87, and GBP 984.17 per ounce. Yesterday's AM fix was USD 1,627.00, EUR 1,250.77 and GBP 1,008.99 per ounce.

Silver is trading at $28.77/oz, €22.27/oz and £17.92/oz. Platinum is trading at $1,506.75/oz, palladium at $613.20/oz and rhodium at $1,300/oz.

Gold dropped $31.90 or 1.95% in New York yesterday and closed at $1,606.80/oz. Gold gradually fell again in Asian and European trading and looks set to test support at $1,580/oz.

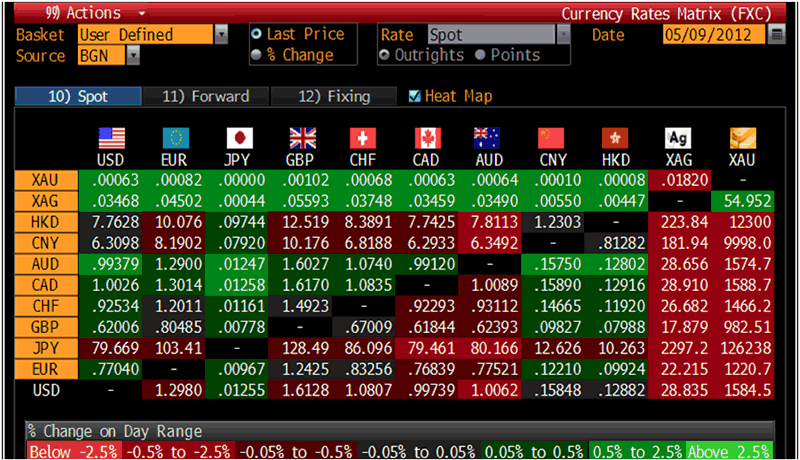

Cross Currency Table – (Bloomberg)

Gold hit a 4 month low today despite deepening worries that the political upheaval in Greece may sink the country into chaos and endanger the euro zone's efforts to end the debt crisis – possibly leading to contagion and or a monetary crisis.

Some decent demand from South East Asia has been reported at the $1,600/oz level and there are also reports from Reuters of a “semi-official buyer of gold” emerging “on dip below $1,600/oz”.

Gold’s weakness yesterday may have been again due to dollar strength and oil weakness - oil is now below $97 a barrel (NYMEX). It may also have been due to wholesale liquidation which created a new bout of "risk off" which has seen global equities and commodities all come under pressure.

However, gold’s weakness yesterday was also contributed to by more unusual trading activity. As trading in New York got underway, there was an unusually large bout of selling with some 6,000 gold futures contracts sold in minutes and this led to gold's initial $10 fall to the $1,615/oz level.

Momentum driven algorithm trading may have then led to follow through selling and the initial sell off may have emboldened tech traders to sell more leading to the falls below $1,600/oz.

Given strong store of wealth demand from the Middle East and China (as seen in figures yesterday), long term buyers will use this sell off to again accumulate bullion.

Greece’s problems coupled with France’s election of socialist candidate Francois Hollande as President creates a disruption of old Franco German alliances. Hollande and the socialist victory in France will likely be positive for gold as he favours looser fiscal and monetary policies in the EU.

Spot gold hasn’t seen these levels since early January and the next level of support for gold is $1,580/oz and then $1,545/oz – the low on December 29th 2011.

(Bloomberg)

As has been the case in the early stages of nearly all bouts of sharp risk aversion in recent years the initial beneficiaries have been the dollar, US debt and German Bunds, while gold was more correlated with the euro and riskier assets.

However, gold’s correlations with risk assets have been short term in recent years. Gold has fallen less than other risk assets, based and then recovered and seen sharp recovery gains soon after the initial falls.

These recovery gains are often seen while equity and commodity markets have continued to fall. Similar patterns may be seen in markets again in the coming days and weeks and short term gold weakness should again be used to ease into an allocation to gold.

Nouriel Roubini has again taken to Twitter to engage in his semi annual bout of name calling and frequent suggestions that gold is a bubble and that gold will fall in price. He has been doing so since gold rose above $1,000/oz in 2008.

Overnight he tweeted how “Gold getting close to fall below 1600. In which caves are the gold bugs hiding...?”

Nouriel Roubini @Nouriel

Gold getting close to fall below 1600. In which caves are the gold bugs hiding...?

This continues the recent meme regarding gold investors and store of wealth bullion buyers being ‘bugs’, people or animals who ‘hide’ in ‘caves’ or are “uncivilised” people.

Attacking the ball and not the man is a way to avoid engaging in real debate regarding the merits of gold as a diversification and as an academically and historically proven safe haven – one that has protected people both throughout history and again in recent years.

It is interesting that Roubini has not written a paper on gold nor has he conducted an interview about gold or written an article about gold in recent years. He confines his simplistic, ill informed anti gold comments to Twitter where he can be brief and not have his faulty thoughts and logic examined.

From a contrarian perspective, Roubini is a gift as his name calling and anti gold comments almost always coincide with an intermediate low in the gold price.

Prudent diversifiers are advised to buy this latest dip - what could be termed the ‘Roubini dip’ - as many have done overnight and this morning – including store of wealth buyers in Asia and central bank monetary diversification buyers.

XAU/EUR 1 Year Chart – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.