World Wide Debt, A Graphic Review of the Strategic Investment Conference

Economics / Global Debt Crisis 2012 May 06, 2012 - 08:52 AM GMTBy: John_Mauldin

The US employment numbers came out this morning, and they were disappointing. But disappointing does not begin to describe the situation I read about today in Europe. I have just finished up with my conference in Carlsbad, California and am getting back to the room late. I have to get up in a few hours (4 AM is rather obscene) to fly to Tulsa to see my daughter graduate from university, but wanted to drop you a note as I normally do on Friday night. But given the time and the need for some sleep, tonight I will draw your attention to the writing of a few friends and some of the more interesting charts I saw at the conference. It will be a shorter letter than usual, but we will uncover a few real nuggets; and next week I will be back to a more normal writing schedule.

The US employment numbers came out this morning, and they were disappointing. But disappointing does not begin to describe the situation I read about today in Europe. I have just finished up with my conference in Carlsbad, California and am getting back to the room late. I have to get up in a few hours (4 AM is rather obscene) to fly to Tulsa to see my daughter graduate from university, but wanted to drop you a note as I normally do on Friday night. But given the time and the need for some sleep, tonight I will draw your attention to the writing of a few friends and some of the more interesting charts I saw at the conference. It will be a shorter letter than usual, but we will uncover a few real nuggets; and next week I will be back to a more normal writing schedule.

On May 22 I will be doing a webinar with my conference co-host, Jon Sundt of Altegris Investments, where we will talk about what we heard at the conference and some of the material I covered in my speech. This webinar will be a great way for those not able to attend the SIC conference to get a sense of its scope and depth. Because of the nature of the material, and due to SEC regulations, we will need to limit the webinar to accredited investors. If you have already registered at my Accredited Investor website, you should be getting an invitation. If you have not registered and would like to listen in, you can go to www.mauldincircle.com/ and sign up. The call will be at 11 AM Central Time. (In this regard, I am president and a registered representative of Millennium Wave Securities, LLC, member FINRA.)

Also, I will be in Atlanta May 23 (details at the end of the letter). And now for some "nugget hunting."

April Employment

A few hours after the employment numbers are released, I always get a rather thorough analysis from Philippa Dunne & Doug Henwood of The Liscio Report ( www.theliscioreport.com). Philippa gave me permission to share this with you just this once. While it may be more detail than you are used to, it will help give you a perspective on how much data is actually tracked. I think Philippa and Doug are some of the best at analyzing employment, and their regular reports are a must-read for me. They call the "labor department" in every state and track what is going on at a very deep level, and also follow tax receipts and flows. (Funds and managers who need detailed analysis like this can contact them for a look at their recent work and decide if you should subscribe.) And now to this morning's report:

Though it's likely there are lingering weather influences on this month's disappointing employment report, as there will be in coming months, it appears that the trend is also slowing. That conclusion is bolstered by the decline in our withholding survey, which we believe to be less weather-sensitive than the BLS numbers, and weakness in our survey was not limited to states sensitive to this year's unusual weather.

* April's headline gain of 115,000 was the weakest initial print since last October's 80,000 (now revised up to 112,000). It's considerably below the 146,000 average for the second half of 2011, before the acceleration earlier this year. Looking just at the private sector would make those comparisons a little better, but not much. Manufacturing added 16,000, almost all in durables; retail added 29,000, mostly in general merchandise (largely reversing the losses of the previous two months); professional and business services added 62,000, a third of it from temp firms; education and health added 23,000, well below its recent averages (with health care alone adding just 19,000, at the 20th percentile of gains since 1990); leisure and hospitality, 12,000 (more than accounted for by accommodation and food services, up 27,000). Finance was up just 1,000, and mining and logging were unchanged (low natural gas prices seem to have put an end to the fracking boom).

In the loss column: construction, off 2,000, with nonres leading the way down; transportation and warehousing, off 17,000, mostly from ground transportation; information, off 2,000; and government, off 15,000, almost all of it from local government education (where losses have averaged 8,000 a month for the last year). Almost 70% of job gains came from bars and restaurants, temp firms, and retail, which do not seem the strongest foundations for long-term growth.

* March's gain was revised up by 34,000, and February's by 19,000. Revisions have been fairly strongly upward over the last few months, prompting some talk - but they're actually not as great, in percentage terms, as they were in 1993 and 2005, which were at roughly comparable spots in the recovery/expansion. More than a third of the March revision came from retail, and concentrated in general merchandise; those areas seemed strangely weak last month, so the revisions seem to be righting a wrong rather than uncovering hidden strength.

* With the exception of the six-month measure, diffusion indexes all fell. The general pattern was to reverse the acceleration we saw in the indexes in the first months of the year, suggesting that while the job market is still growing, it's lost some breadth along with momentum.

* The household survey was weaker than its establishment counterpart.

Total employment fell by 169,000 - or 495,000 when adjusted to match the payroll concept. (The yearly gain in the adjusted household measure, 1.5%, has nearly come back into line with the payroll gain, 1.4%, after three months of strong outperformance. This is a reminder not to take these departures too seriously, unless they're sustained for more than a few months.) The employment/population ratio fell 0.1 to 58.4%, 1.0 point below where it was when the recession ended, and where it was in September 1983. There was substantial labor force withdrawal in April, with the participation rate falling by 0.2 point, 2.1 points below where it was when the recession ended.

* The longer-term picture of labor force withdrawal is kind of shocking. Total household employment is down by 4.4 million since the Great Recession began in December 2007, and the number of unemployed is up by 4.9 million. The civilian population is up 9.6 million - but the labor force is up just 447,000. The number classed as not in the labor force is up by 9.2 million - and those not in the labor force and wanting a job is up 1.7 million. In other words, just 5% of the increase in the adult population over the last 4 1/3 years has found its way into employment; the other 95% are not in the labor force.

* The unemployment rate fell by 0.1 point to 8.1%, its lowest level in more than three years. The number of unemployed fell by 173,000 - but the labor force shrank by almost the same amount, 169,000.

Without the labor force shrinkage, the unemployment rate probably would have been unchanged. Within the unemployed, the number of job losers fell - but so did the number of re-entrants and voluntary leavers, suggesting that the increased confidence we saw through those indicators in recent months may be dissipating. With the quit rate down, and the long-term unemployed dropping out of the labor force, the mid-ranges of unemployment duration (from 5-26 weeks) saw an increase, as the extreme short- and long-term durations fell.

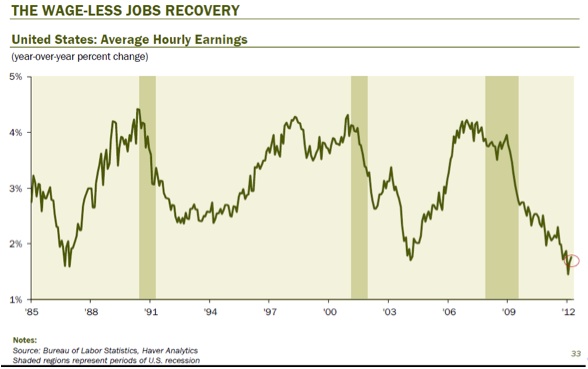

* Average hourly earnings for all workers were up just a penny, which rounds to unchanged in percentage terms. Over the year, hourly earnings are up just 1.8%. Since the all-worker only begins in 2006, we have to use the production worker series for longer-term comparisons.

Except for two brief periods in 1986 and 2006, recent annual gains in nominal wages are the lowest since the series began in 1964. [JFM note: this growth in earnings is considerably lower than inflation and given the rise in fuel and other ordinary expenses (like food) the wage earner is getting hammered,]

* The workweek was unchanged at 34.5 hours, with an 0.1 hour rise in manufacturing offsetting an 0.1 hour fall in services. Aggregate hours were up just 0.1%. Aggregate payrolls - the product of aggregate hours and average hourly earnings - were up 0.3% for the month, and 4.1% for the year. That yearly gain is the weakest since January 2011.

So, a disappointment, if not a crushing one. But the job market is still in a deep hole. At April's rate of job gains, it would take well over three years to return to December 2007's employment level, without adjusting for population growth; at the average rate of the last six months, it would take about two years. Earnings are weak, and the strongest sectors aren't those of which economic miracles are spun. QE3 looks like more of a possibility than it did a few days ago.

(End of excerpt from The Liscio Report)

A Graphic Review of the Strategic Investment Conference

Now let's look at a few charts that caught my eye, out of the several hundred we saw (quite the graphic experience) at my conference. This first one is from David Rosenberg, who was in classic form. I get to be with him again Monday morning in Chicago, where we are on a panel together at the International CFA Conference. This puts a 27-year perspective on how poorly wage growth is doing.

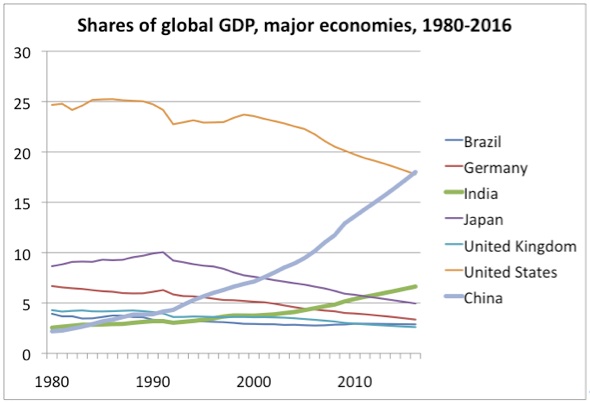

Next we have a chart shared with us by Niall Ferguson, showing how the US and Japan (and to some extent Germany) have seen their share of world GDP fall relative to China and India. He argued (as did several speakers) that the relative growth in the world is moving from Europe, Japan, and the US to the emerging markets. This is estimated data through 2016 from the IMF.

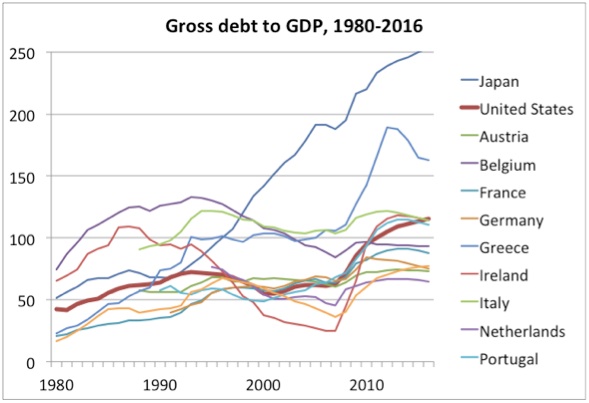

The following chart is also from Niall and shows gross government debt-to-GDP. This may be difficult if you are not looking in color, but the US (when all debt is counted) does not look all that much better than some of the problem countries in Europe.

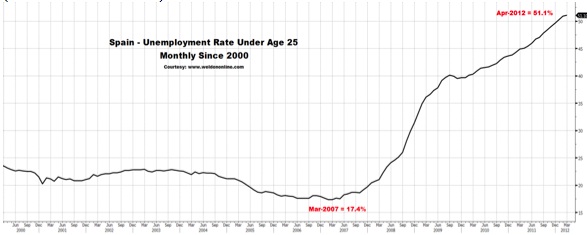

And while I was checking email between speakers, I opened Greg Weldon's latest note, where he looks at European unemployment. Greg is my favorite slicer and dicer of data. What caught my eye was not just the horrific condition of unemployment among Spanish youth, but the data which followed about unemployment among youth across a wide range of European countries. This is the stuff from which civil unrest springs in hot summers. ( www.weldononlime.com)

"We are monitoring the BROAD rise in Youth Unemployment Rates, across the EU (this March, versus March of last year):

--- Bulgaria ... 32.8% ... up from 26.7%

--- Portugal ... 36.1% ... up from 27.6%

--- Denmark ... 15.1% ... up from 13.7%

--- Ireland ... 30.3% ... up from 28.7%

--- Cyprus ... 28.8% ... up from 18.8%

--- Hungary ... 28.8% ... up from 25.4%

--- Netherlands ... 9.3% ... up from 6.9%

--- Poland ... 26.7% ... up from 25.7%

--- Slovenia ... 16.5% ... up from 16.3%

"The Summer of 2012 could easily become the Summer of Social Dissent in the EU..."

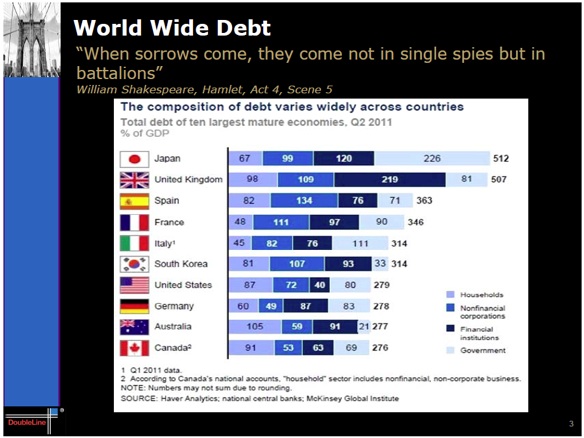

Jeffrey Gundlach of Doubleline spoke Friday morning and really impressed me with the breadth of his presentation. This slide has a LOT of implications.

A Little Over 31 Years

I will close with this personal note. Many of my readers know that my daughter Melissa recently had her thyroid removed and is dealing with getting her hormones balanced, which is not fun and takes a rather long time. It is as much art as science. And while going through that, she is trying to change careers, working on becoming a copywriter (which a number of aptitude tests showed that she would be good at and, most importantly, enjoy – something Dad has always known). Since writing is something I know a little about, I am offering her a few thoughts here and there. I told her to send me something every day she writes. I don't care what it is, just write, and let's then talk about the process. A few days ago I got this note, which I pass on to you.

"Dad, I wrote this today for my blog:

"Research and Development

"My father is a complicated man. At least, that's my go-to reply when the generic question of "What does your father do?" is asked of me. This question always makes me pause for a moment, because in all honesty, I've never had a full understanding of what he actually does. It's not that he doesn't have an official title of occupation, it's that he has about 50 different ones (give or take a dozen). It's become easier in these past few years to just reply "genius" or "financial guru," and let his website do the talking… but I am still at a loss for words when discussing my father.

"The question of what my dad did for a living was constant in my early years. It was often probed by friends coming over to our house, as I typically lived in a home with at least one more story than those of my peers. Whatever he did, it was clearly working. The challenge was to pinpoint one of the many jobs that he appeared to have as the one he actually did. Depending on the moment of inquiry, the answers ranged from politics to finance to communications to author to editor to blah blah blah, etcetera, etcetera. In my early teens, I asked him for a definitive way to describe what he actually did. I was ready for a tedious explanation of what a day in the life of dad entailed. I was caught off guard a bit when he replied with a simple, all-encompassing job title: Alligator Wrestler. He went into detail as to why he thought of himself as such, but that was all good-old-boy Texas talk that few would appreciate. The title itself, while obviously metaphorical, was enough to satisfy my need for a blanket explanation. I still tell people he's an Alligator Wrestler to this day. It's a quick, easy response that suits my sarcastic nature.

"However, I found myself once again at a loss for words on how to answer the question this past Saturday. Only this time, it was about what I did. I ran into an old co-worker, and we shot the s___ for a bit. He was managing the bar I was at, and it came time for me to divulge what I was currently doing. My head began to swarm with everything I'm doing, and I struggled to nail one thing down as what I do. 'Student' was almost right, but then I'd have to get into the technicalities of what I'm studying – and admit I'm not actually in school. 'Writer' seemed appropriate, but then that would lead to the question of what I've written, and then I come off looking like a dreamer. 'Web copy specialist' works, since I have the certificate, but I'm still not profiting from it at the moment. How do I just tell him that I am studying and reading daily about how to become a successful copywriter, while also house sitting for my sister, while also dog sitting for that disgusting beast of hers, while still having days of complete lethargy and brain-fog that frustrate me to tears while my body continues adapting to my thyroidectomy, while trying to help my mother out by selling a few things she has hoarded, while maintaining my alcoholism, while trying to be a good girlfriend to someone who deserves so much more than my erratic state of late, while searching for an apartment, while writing this blog that no one knows I write and even fewer read, while I am just generally trying to get my life together for the first time?

"Instead of unleashing all that on my old friend, I took a cue from my father and replied with a simple, all-encompassing job title: Research and Development. He looked a bit impressed and asked how long I had been in that particular field.

" 'A little over 31 years now…'

Somehow, and maybe this is just me being Dad, I think she will have a career as a writer.

New York, Atlanta, Philadelphia, and Austin

I fly to Dallas in a few hours and then on to Tulsa, where my daughter Abigail graduates from ORU with a degree in public relations. She says to tell everyone that we get together at Los Cabos in the evening. She will be celebrating graduating, as will I and most of her siblings. I must confess I will not miss paying tuition.

Then Sunday afternoon it's on to Chicago, where I have dinner with David Rosenberg, Barry Ritholtz (of The Big Picture blog) and Anatole Kaletsky of GaveKal, who will all be on a panel with me Monday morning. James Montier, now of GMO, is scheduled to join us as well. An afternoon of meetings and interviews, a dinner sponsored by Bloomberg, and then back home on Tuesday for a week before going to New York for a few days for some speeches.

Then, as I noted at the beginning, I will be in Atlanta on May 23rd with my good friend Cliff Draughn of Excelsia. If you would like to attend the luncheon, you can go to www.excelsia.com and learn more. I hope to see you there!

Then I am home for a few weeks until I leave for Philadelphia for long-time partner Steve Blumenthal's CMG Annual Advisor Forum, June 4-5. Details to follow, but if you are an investment advisor you should consider coming. You can call CMG at 610-989-9090.

It really is time to hit the send button. I am still basking in the glow of the conference and the warmth of the attendees. One professional said he had been to over 400 conferences and this was the best yet. I must agree. The speaker line-up was top-notch. The panel debates were great.

Have a great week. Chicago is shaping up to be a very cool few days, and I really can't wait to get home.

Your hoping to get enough sleep tonight to stay awake and work on the plane analyst

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.