Gold and Silver Stocks Held Back by Bearish Stock Markets

Commodities / Gold & Silver Stocks Jan 22, 2008 - 08:07 PM GMTBy: Greg_Silberman

Juniors will move once a stock market bounce gets underway: Whilst we spend most of our time talking about Gold in US Dollars we often fail to recognize that this is truly a global business.

Juniors will move once a stock market bounce gets underway: Whilst we spend most of our time talking about Gold in US Dollars we often fail to recognize that this is truly a global business.

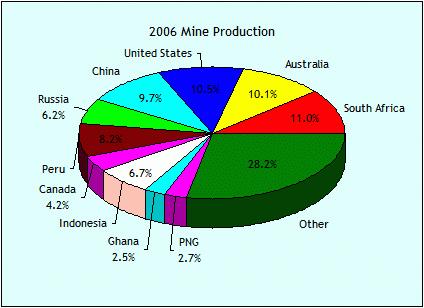

Chart 1 - 2006 Gold Production courtesy Gold Links

The Gold Sheet Links show South Africa as the top Gold producer in 2006, USA second and Australia closely third. Put another way, nearly 90% of Global production is not denominated in US Dollars. That is 90% of the cost of mining is denominated in local currency -- energy and labor being the largest components -- and revenues to defray these expenses should be viewed in local currency as well.

Based on the following charts, margins in local currencies have been improving in the Gold mining business:

Chart 2 - Gold (top) is higher in Aussie Dollars and Oil costs (below) are lower

Chart 3 - Same with Gold and Oil in South African Rands

Chart 4 - And same again in Canadian Dollars

Not only do these positive economics affect current producers but also smaller near-term producers and explorers as well. The fact is, any company with access to Gold ounces in the ground becomes potentially more economically profitable.

So why have we seen a disproportionate upward revaluation in large producers relative to smaller producers and explorers? Will this trend continue and what is the catalyst that will make it stop?

We read with interest commentary that small Gold companies will not be able to raise funds because of the current credit crunch. This argument does not ring true with us since in our own experience banks are more than willing to lend to profitable businesses albeit at a higher cost.

The reason for the underperformance is quite simply an increase in perceived risk premium as a result of a bearish stock market environment.

Chart 5 - small cap GSS only took off 2 months after the HUI in 2001

In 2001 Golden Star Resources had a $25m market cap - not unlike many juniors today. We highlight GSS because it had a spectacular run up in the ensuing year [we own GSS]. However, whilst the large cap HUI index had been rallying strongly since November 2000, GSS didn't really got going until late January.

The reason was because the S&P (below in green) had been falling rapidly between November 2000 and January 2001. Once the S&P bounced in early 2001, albeit a nascent dead cat bounce, it provided enough impetus to send small cap miners higher for 3 months before a correction set in.

This is not unlike the present situation:

Chart 6 - small cap miner Gold Reserve (GRZ) has failed to rally with the HUI

Rightly or wrongly, when stocks in general are falling smaller cap miners will garner a higher risk premium along with the rest of the market and will underperform the HUI (red rectangle)

We believe a situation similar to 2000/2001 is unfolding today and once the stock market bounces off its oversold levels the juniors will catapult higher. All that's required is patience and nerves of steel!

More commentary and stock picks follow for subscribers…

By Greg Silberman CFA, CA(SA)

Profession: Portfolio Manager and Research Analyst

Company: Ritterband Investment Management LLC

e-Mail: greg@goldandoilstocks.com

Website: blog.goldandoilstocks.com

I am an investor and newsletter writer specializing in Junior Mining and Energy Stocks and small caps listed in the US, Canada and Australia.

Please visit my website for a free trial to my newsletter http://blog.goldandoilstocks.com

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Greg Silberman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.