What to Make of the Manic Depressive Stock Market?

InvestorEducation / Learn to Trade May 03, 2012 - 02:05 PM GMTBy: EWI

The stock market: one week it acts like Dr. Jekyll, the next week it's Mr. Hyde.

The stock market: one week it acts like Dr. Jekyll, the next week it's Mr. Hyde.

That shift can even occur in the course of a single session.

These dramatic fluctuations appear to be impulsive; and we know that impulse does not flow from cold reason. Even so, the Efficient Market Hypothesis would have us believe that investors are constantly applying reason and logic to reach some objective market pricing, via the latest news or measure of stock market valuation.

The February 2010 Elliott Wave Theorist provides insight:

The Efficient Market Hypothesis (EMH) and its variants in academic financial modeling...rely at least implicitly but usually quite explicitly upon the bedrock ideas of exogenous cause and rational reaction. Stunningly, as far as I can determine, no evidence supports these premises...

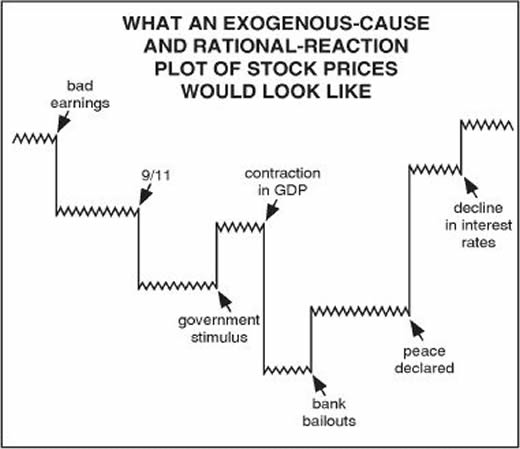

EMH argues that as new information enters the marketplace, investors revalue stocks accordingly. If this were true, then the stock market averages would look something like the illustration shown [below].

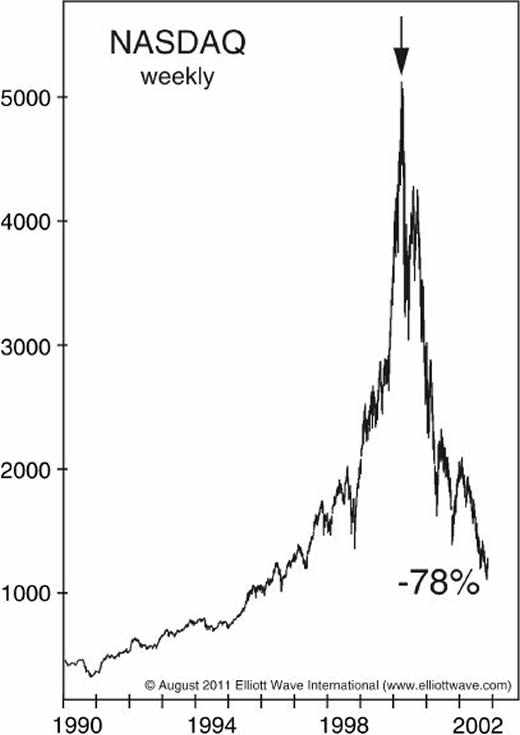

We know that the market does not unfold in the way illustrated above. But we do know that the market has unfolded like this:

So in 2000, did a sudden burst of logic lead investors to realize that the NASDAQ was over-valued?

No. Technology stocks had absurd price/earnings ratios long before the NASDAQ top.

The NASDAQ's abrupt switch from Hyde to Jekyll stemmed from investors' collective unconscious. Consider the gazelle that runs in panic because others are: it does not pause to rationally survey the landscape. It explodes in a burst of speed that reaches 90 km/hr within seconds.

Decades ago, multimillionaire stock market operator Bernard Baruch said

...the stock market is people. It is people trying to read the future. And it is this intensely human quality that makes the stock market so dramatic an arena, in which men and women pit their conflicting judgments, their hopes and fears, strengths and weaknesses, greeds and ideals.

This psychology of the marketplace unfolds in waves. That is what we study.

Want to learn what REALLY drives the markets? The FREE 50-page Independent Investor eBook will challenge conventional notions about investing and explain market behaviors that most people consider "inexplicable." You'll learn how extreme market psychology affects the markets, with some eye-opening charts that provide shocking evidence of the real forces at play in the markets. We promise to show you a whole new way of thinking about investing. Download the FREE 50-Page Independent Investor eBook Now >> |

This article was syndicated by Elliott Wave International and was originally published under the headline The Manic-Depressive Stock Market: What to Make of It. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.