Were We Wrong About the U.S. Dollar? Is it Safer than Gold?

Commodities / Gold and Silver 2012 May 03, 2012 - 09:34 AM GMTBy: Jan_Skoyles

As figures are released this week which cast yet more negative light on the US economy we ask why is the US dollar not suffering much as a result? Were wrong about the dollar? Is it a safer safe haven than gold investment?

As figures are released this week which cast yet more negative light on the US economy we ask why is the US dollar not suffering much as a result? Were wrong about the dollar? Is it a safer safe haven than gold investment?

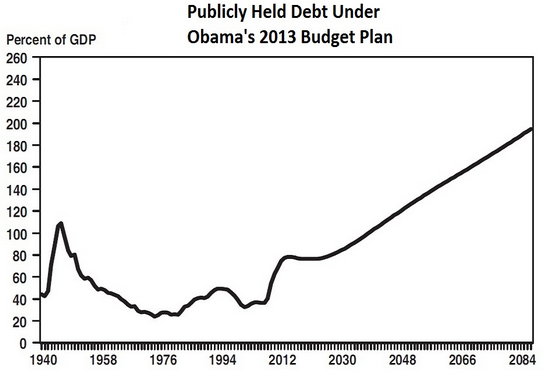

This week figures were released to show that US debt is now at a record $15.962bn, or 101.5% of GDP. One wonders if President Obama, or in fact any potential sovereign leader out there has any idea how to solve this without printing yet more money and issuing yet more debt.

In a new paper by Reinhart and Rogoff they prove, in the inimitable words of Zerohedge, that ‘insurmountable debt is suicide.’

– We identify 26 episodes of public debt overhang–where debt to GDP ratios exceed 90% of GDP–since 1800. We find that in 23 of these 26 episodes, individual countries experienced lower growth than the average of other years. Across all 26 episodes, growth is lower by an average of 1.2%.

– If this effect sounds modest, consider that the average duration of debt overhang episodes was 23 years. In 11 of the 26 high debt overhang episodes, real interest rates were the same or lower than in other periods.

American citizens should be wondering how much longer this can go on for. Who would want to invest in a country which is in such an economic mess? And has little chance of recovery in the next two decades. Who would choose to buy dollars when it looks like the system is set to crumble at any moment?

The safe-haven

A quick glance back in at modern history, whether Russia in 1998 or Taiwan in 1997, shows what happens when there is a major economic downturn a country. Citizens and investors turn to stronger currencies.

So are the markets turning their attentions from the US dollar to other currencies?

Not exactly; it’s all very well saying that we shouldn’t be putting our money into US dollars as it’s been so heavily debased, inflated etc. etc. but each time the heat under the euro is increased, the dollar appreciates in value.

All this despite some currencies appreciating against the US dollar in the meantime; ‘When the euro crisis reached a boil last summer, the US dollar was still the world’s go-to currency. The Singapore dollar, Norwegian krone and Chilean peso all fell at least 10% against the US dollar,’ as Eric Fry wrote earlier this week.

Since the 1970s there have been more currency crises across the globe than in any other time in history. During each currency crisis in a country savvy individuals traded their local currencies for the US dollar. The US dollar was seen as a sure bet; something which maintained, if not appreciate, in value.

Wrong about the dollar

It seems strange that the very currency which led us into this global crisis is still the one to which we turn to look after our wealth. As Bill Bonner asked some time ago, if you were an Asian or European investor are you going to put your money in a French bank or Spanish bonds? No, you are likely to want a US Treasury bond.

So what gives? Have we been wrong all these years about the dollar? Will the dollar always be King?

It may well keep its crown, but unless it’s one made of gold then it won’t be one of a currency leader.

Americans are also still likely to want US Dollars. During a correction, such as we are witnessing here, everything goes down. But people still have bills to pay. At the moment the Federal Reserve is holding the economy fairly steady on a choppy ocean. The danger is, when will US citizens know when is the right time to give up their green notes?

Whilst the US dollar has gained the most against rival currencies it recent weeks. The only major rival it hasn’t gained against is gold; it has lost 6.8% of its value.

Of 75 global currencies, there are only 6 which have gained against gold. The currencies (the Chilean Pesos, Colombian Pesos, Hungarian Forint, Mexican Pesos, Polish Zloty and Russian Rubles) however are all from countries where individuals are looking for somewhere safe to place their money and do not intrinsically trust their domestic tender.

Like the dollar, all are potentially open to debasement by the central banks. Making the decision as to where to put your cash when your country is facing hyperinflation or (quelle horreur) deflation, extremely difficult and fraught with risk.

Boring gold

Whilst the gold price has proved to be pretty boring over recent months, it is still performing significantly better than the US dollar, with zero chance of its debasement against the dollar which has lost a quarter of its value since 2000.

The fundamentals which maintain one’s faith in gold and over time feed into the gold price are no clearer than in the United States. The debt to GDP ratio is over 100% and there is no sound leadership prepared to try something other than money printing. Unfortunately the strength of the dollar rests on an economy which is about to hit tipping point.

The gold price may well remain flat for the coming few months, but you can be as sure as anything that this won’t be the case for debt to GDP ratios or the CPI. As always, gold is sure to prevail.

As Jeff Clark writes, ‘Even in the crash of 2008, gold still ended the year with a 5% gain. And with the amount of currency dilution we’ve undergone since that time, it seems more likely gold will rise in any economic contraction than fall. Indeed, if the response of government to a recession is more money printing, precious metals will be a critical asset to have in your possession.’

Protect yourself from bankers and politicians. Buy gold bullion safely and securely with The Real Asset Company.

Jan Skoyles contributes to the The Real Asset Co research desk. Jan has recently graduated with a First in International Business and Economics. In her final year she developed a keen interest in Austrian economics, Libertarianism and particularly precious metals.

The Real Asset Co. is a secure and efficient way to invest precious metals. Clients typically use our platform to build a long position and are using gold and silver bullion as a savings mechanism in the face on currency debasement and devaluations. The Real Asset Co. holds a distinctly Austrian world view and was launched to help savers and investors secure and protect their wealth and purchasing power.

© 2012 Copyright Jan Skoyles - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.