Manipulative Gold ‘Fat Finger’ Or Algo Trade Worth 1.24 Billion USD

Commodities / Gold and Silver 2012 May 01, 2012 - 10:50 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,661.25, EUR 1,253.02, and GBP 1,024.70 per ounce. Yesterday's AM fix was USD 1,662.50, EUR 1,256.61 and GBP 1,021.44 per ounce.

Gold’s London AM fix this morning was USD 1,661.25, EUR 1,253.02, and GBP 1,024.70 per ounce. Yesterday's AM fix was USD 1,662.50, EUR 1,256.61 and GBP 1,021.44 per ounce.

Silver is trading at $30.85/oz, €23.37/oz and £19.10/oz. Platinum is trading at $1,570.00/oz, palladium at $677.60/oz and rhodium at $1,350/oz.

Gold rose $3.80 or 0.23% in New York yesterday and closed at $1,666.10/oz. However, there were more peculiar goings on in the gold market which saw one massive sell order knock prices lower, prior to gold gathering itself and moving higher.

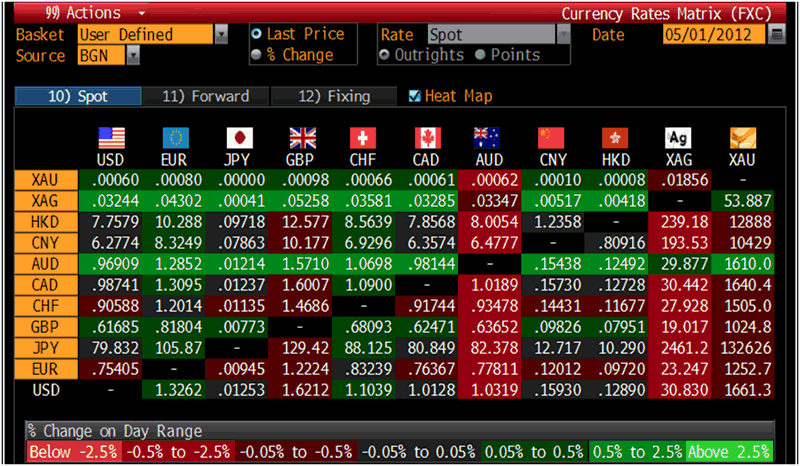

Cross Currency Table – (Bloomberg)

Bullion traded sideways in Asia before slight weakness and has dipped marginally in early European trading.

Gold may complete its 6th day of price increases, its best run since August, as business activity in the US expanded at its slowest pace since November 2009, creating demand for gold as a heading instrument and a safe haven.

Gold’s technicals are mixed after April’s slight loss (-0.2%) meant that gold has now had 3 consecutive monthly losses - the first since 2000.

However, gold has a bullish outside reversal week last week and the higher quarterly close of a 6.7% gain in Q1 2012, and 11 consecutive years of annual gains mean that the long term technicals remain favourable.

Bullion is now 6.5% higher this year and heading for its 12th straight annual advance as demand continues as a hedge against inflation and central banks continue to debase fiat currencies.

Fed Chairman Ben Bernanke said April 25 that he’s prepared to “do more” if needed to spur the economy.

Investors are watching weekend elections in France & Greece and a European Central Bank meeting on Thursday, after data showed that Spain sank into recession in the first quarter.

Palladium hit its highest price in 6 weeks and is trading near $686.75/oz.

Manipulative Gold ‘Fat Finger’ Or Algo Trade Worth $1.24 Billion

The gold market was briefly shaken by an unusually large early morning sell order, which triggered a brief trading halt in gold futures and left traders questioning whether the transaction was a mistake and the motivation of the seller.

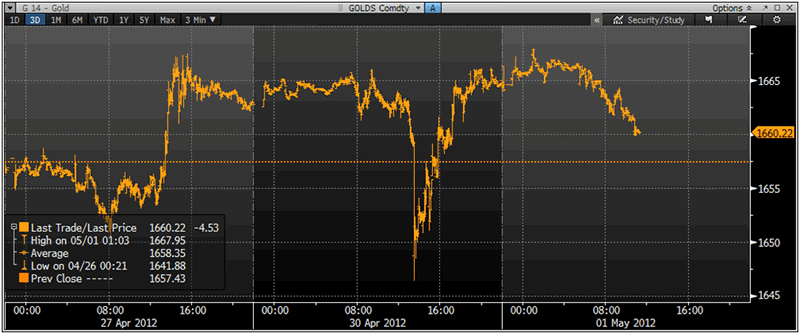

Gold 3 Day Chart – (Bloomberg)

Gold fell $14 in one minute despite no breaking financial and economic news and despite no movement in the dollar, oil, equity or bond markets.

There was only the insignificant personal income and spending numbers – which came in slightly better than expected and could not justify such quick falls.

CME Group Inc's Comex division recorded an unusually large transaction of 7,500 gold futures during just one minute of trading. The sale took out blocks of bids as large as 84 contracts in one fell swoop and cut prices down $15 to $1,648.80 a troy ounce.

The sharp losses triggered a 10-second trading halt in June-delivery gold futures, CME told Dow Jones Newswires Tatyana Shumsky.

"The market was given a short period to recalibrate and ... it was for 10 seconds," a CME spokesman said. "It only happened in gold futures, in the June gold contract."

Gold traders buzzed with speculation that the transaction was an input error - a so-called "fat finger" trade. "Or a Gold Finger as it might be known in the bullion market," traders at Citi joked in a note to clients.

The massive size of the transaction - 750,000 troy ounces worth more than $1.24 billion – led to speculation that it was either a mistake by a trader or that an entity wished to manipulate the market lower.

Such large trades have frequently been seen at month and quarter beginning and ends. Yesterday was the last trading day of the month. They have also been seen when Ben Bernanke has been making important statements regarding the dollar and the outlook for the US economy.

The nature of the massive sell order, one of many seen in recent months, suggested that the seller was not motivated by profit and may have had other motives. Such large trades are rarely conducted amid very thin trading volumes.

Trading yesterday was expected to be quiet as market participants in China and Japan were out on holiday and many European traders were preparing for May Day holidays today.

"No one who has the account size and the money to trade thousands of gold contracts would do it in one transaction; that's just stupid," said one trader.

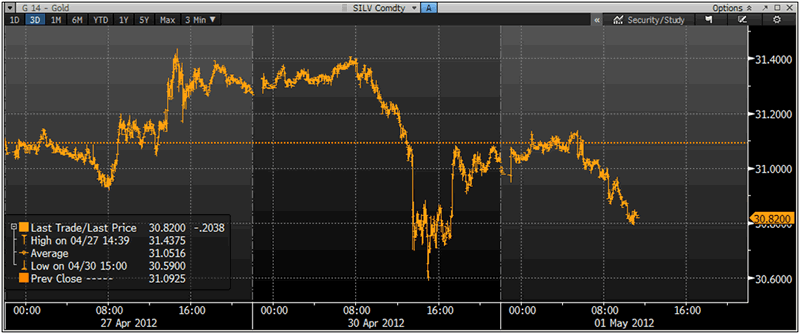

Silver 3 Day Chart – (Bloomberg)

It seems likely that the seller was either a large hedge fund or institution as the collateral required to purchase 7,500 contracts is high. The seller would have had to have deposited $ 75.9 million in cash with a broker.

There was a suggestion in the Reuters Global Gold Forum that the selling may have been due to algorithm trading or computer driven.

The trade could be as a result of the shift to electronic trading. Computer trading systems are vulnerable to input errors, as they do not ‘question’ the order before executing the transaction.

By contrast, when most order flow would pass through the Comex floor where human traders processed the deals, potential errors stand higher chances of being intercepted and there is a higher level of transparency.

"You would definitely [verify a trade this big] before you executed it," said one Comex floor broker.

However, the trade is unlikely to have been a keystroke error as silver also saw substantial selling at the same time and similar price falls.

This suggests that the seller wished to see gold and silver prices lower. Some traders suggest that there may be High Frequency Trading (HFT) programmes that can see where stop loss orders are placed and sell in order to force stop loss selling – then buying back and thus making a quick profit.

It will further fuel allegations that certain Wall Street banks, either alone or in conjunction with the Federal Reserve and US Treasury, are intervening in and manipulating prices in the precious metal markets.

The Gold Anti Trust Action Committee (GATA) and other knowledgeable market participants have alleged that this is continuing to be done in order to maintain faith in the US dollar and the US capital markets.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.