Gold COT Report, Speculators Can Win Against Producers By...

Commodities / Gold and Silver 2012 Apr 29, 2012 - 05:29 AM GMTBy: Marshall_Swing

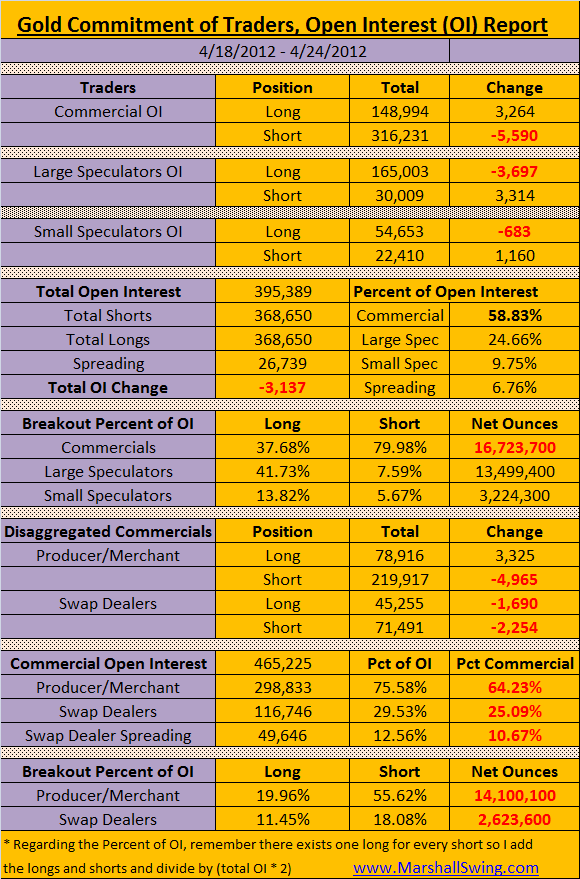

Commercials bought 3,264 longs and covered a whopping -5,590 2,669 shorts to end the week with 58.83% of all open interest and now stand as a group at 16,723,700 ounces net short, a decrease of close to -1,000,000 net short from the previous week.

Large speculators were absolutely trounced and gave up -3,697 longs and picked up a whopping 3,314 shorts for a net long position of 13,499,400 ounces, a decrease of about 700,00 ounces from the prior week.

Small speculators faired better in the scourging and only lost -683 longs and 1,160 shorts for a net long position of 3,224,300 ounces a decrease of a less than 200,000 ounces from the prior week.

The beating the large speculators took on their longs was devastating.

I want to remind you they have been holding those longs for quite some time as they have not picked up longs in several weeks but at higher prices so these longs were bought some time ago. Fear crept into their sell stops, I am sure. The producer/merchant had already calculated the level those longs were at and knew EXACTLY how much to drop price to effect their desired results.

The small speculators picked up a bunch of shorts and they are going to lose some money since we now know the commercials added 3,264 longs. Price has risen about $20 since the pit close on Tuesday so this process of shaking out those shorts may already be over. But, the tremendous short position the large speculators added was far more devastating to them. If the commercials have in fact finished the destruction of the speculator shorts at this level, expect the price to fall this coming week. That is my bet that they accumulated shorts all the way up while the little guys divested their short positions and may have gone long only to be stopped out soon.

Tne only way to be successful in these markets is to either think like a producer merchant or buy long and stay long with liberal stops. If the speculators did that, they could win this battle as the producer merchant could get SHORT changed. See you next week!

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.