Gold “Buying Opportunity”, Analysts More Bullish On Central Bank Demand

Commodities / Gold and Silver 2012 Apr 27, 2012 - 06:54 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,654.00, EUR 1,250.28, and GBP 1,019.60 per ounce. Yesterday's AM fix was USD 1,648.25, EUR 1,246.22 and GBP 1,017.88 per ounce.

Silver is trading at $30.16/oz, €23.65/oz and £19.29/oz. Platinum is trading at $1,576.25/oz, palladium at $658.75/oz and rhodium at $1,350/oz.

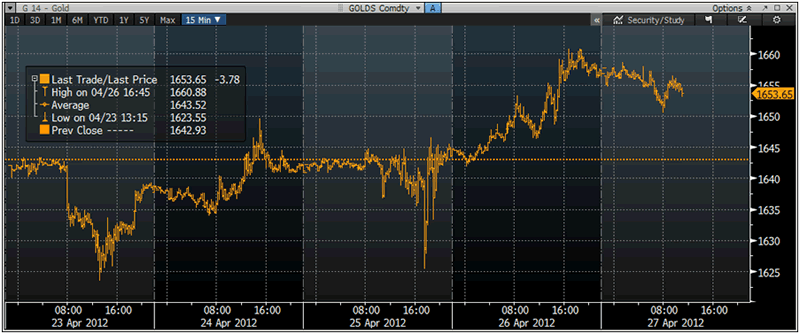

Gold rose $13.80.60 or 0.84% in New York yesterday and closed at $1,657.60/oz. Gold traded initially sideways in Asia then it dipped downward and recovered in early European trading.

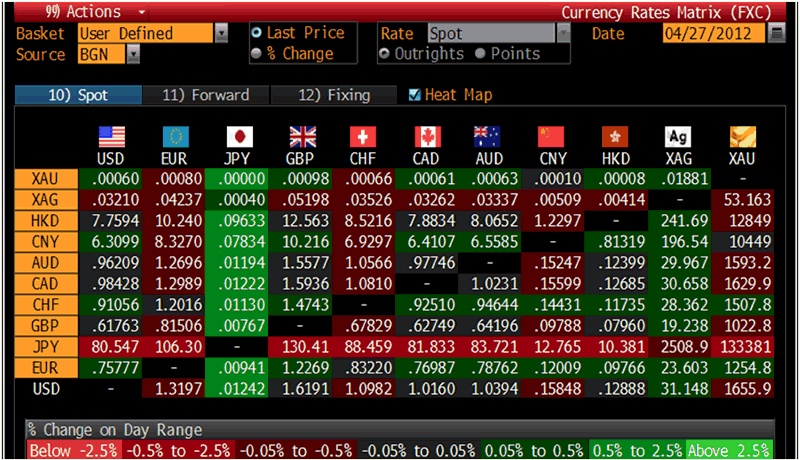

Cross Currency Table – (Bloomberg)

Support for gold is at $1,624/oz and $1,612/oz and resistance is at $1,663/oz and $1,684/oz.

Gold is some 1% higher on the week in USD and EUR and the higher weekly close would aid the poor short term technical picture.

Gold consolidated on the gains seen yesterday as the downgrading of Spain's credit rating added fuel to concerns about the debt stricken euro zone. Spain and Italy’s debt servicing costs rose again this morning and the Spanish 10 year touched 6% again.

Gold’s gains may have been tempered by a stronger dollar after the latest easing move by the Bank of Japan. The BOJ expanded the size of its fund for asset buying by 10 trillion yen to 40 trillion yen.

The BOJ may also extend the duration of government bonds it buys to about three years.

The move saw the yen fall overnight but it has since recovered and is the strongest currency so far today.

While periods of strength can be expected the long term outlook for the yen is poor.

The BOJ looks set to continue debasing the yen for the foreseeable future which will result in the yen falling against gold in the long term. The yen has already fallen by nearly 11% against gold year to date (see chart below).

Gold YTD in USD-White, GBP-Orange, JPY-Pink and EUR-Yellow - (Bloomberg)

Bullion hit a 2 week high at $1,660.60 yesterday despite somewhat better US housing data and the Fed’s somewhat brighter economic outlook.

The Fed’s promise to use more QE should the economy falter is supporting gold.

The global economic picture remains grim, with euro zone economic sentiment falling more than expected in April and the US job market recovery showing signs of a slowdown.

Apple earnings and the tech boom and indeed possible tech bubble remains one of the primary drivers of continuing irrational exuberance and risk appetite.

The poor and deteriorating economic backdrop is gold supportive.

Gold Analysts More Bullish As Debt Crisis Not Over – “Buying Opportunity”

Gold analysts are more bullish after central banks expanded their bullion reserves and hedge funds increased bets on a rally for the first time in three weeks.

14 out of 28 analysts surveyed by Bloomberg expect prices to rise next week and 9 were neutral, the highest proportion in 2 weeks.

Central bank demand and CFTC data is one of the reasons for their positivity on gold.

Mexico, Russia, Argentina and Turkey were some of the many central banks that added over 51.8 metric tons valued at $2.8 billion to reserves in March, IMF data show.

Fund managers raised their long positions by 2.5% in the week ended April 17, according to the CFTC.

Ultra-loose monetary policies of recent years and the problems in the euro zone don’t look like they’re going to end any time soon.

The Fed bought $2.3 trillion of debt in two rounds of QE ending in June 2011. We and other analysts believe that it is only a matter of time before the US embarks on QE3.

The UK saw its first double- dip recession since the 1970s, data showed April 25th, while the IMF predicts the 17-nation euro region will contract.

Gold in USD 1 Week – (Bloomberg)

This week is a fresh reminder of the global nature of the crisis with concerns about the UK, US and Japan remerging alongside Spain, euro and Eurozone concerns.

Gold below its 200 day moving average remains a buying opportunity – especially for people exposed by not having any allocation to bullion whatsoever.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.