Portugal Bailout, One Year Later: Were You Prepared in Advance?

Interest-Rates / Eurozone Debt Crisis Apr 26, 2012 - 02:40 PM GMTBy: EWI

Make no mistake: The stakes for financial and economic survival in Europe are high. Seemingly everyone -- from investment bloggers to financial television hosts -- has something to say about the European debt crisis.

Make no mistake: The stakes for financial and economic survival in Europe are high. Seemingly everyone -- from investment bloggers to financial television hosts -- has something to say about the European debt crisis.

But with so many divergent opinions to choose from, which ones should you trust?

That's where Elliott Wave International's global-market analysis team comes in. Our analysts cut through the noise of endless talking heads with an independent perspective. By focusing on objective Elliott waves and other technical indicators, they equip you to stay one step ahead of Europe's financial turmoil.

Case in point: Just over one year ago in late March 2011, mainstream analysts conjectured about the probability of a Portuguese bailout. Many people had opinions, but no one was talking about the most important indicator, namely that Portugal's borrowing costs had just crossed a critical threshold. No one, that is, except EWI European market analyst Brian Whitmer.

Here's what he told his readers in the April 1, 2011, Global Market Perspective (emphasis added):

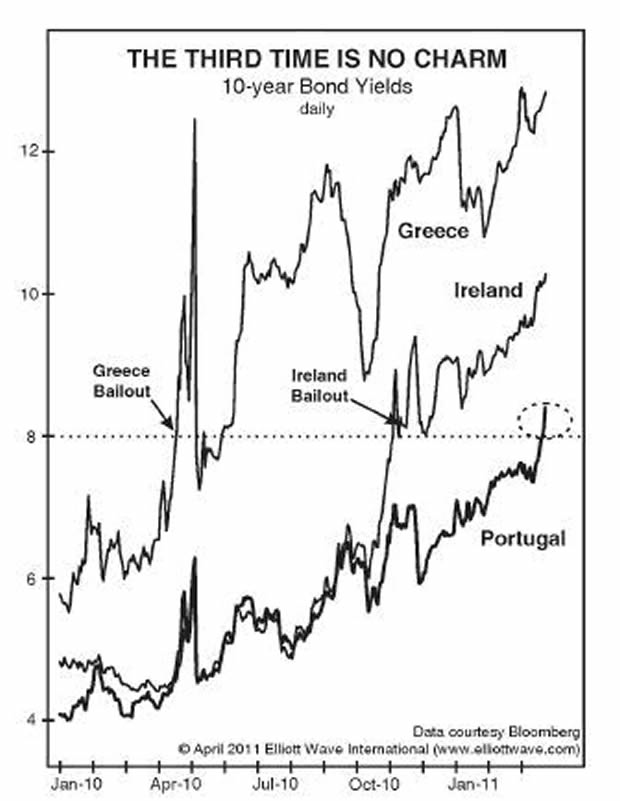

Observe the horizontal line on this chart of 10-year borrowing costs in Greece, Ireland and Portugal. It's no magic number, but 8% seems to be the proverbial straw that breaks the camel's back. As the arrow on the left shows, Greek authorities activated their bailout package on April 23, 2010, two days after 10-year yields crossed 8%. In Ireland, bond yields surpassed 8% on November 10, 2010, and Irish authorities activated their bailout the following week. Mark your calendar, because Portuguese yields made the treacherous crossing two days ago. The implication is that the continent's third sovereign bailout in less than a year has become a near certainty.

A "near certainty," indeed. Just five days after Whitmer published this analysis, Portugal's government officially requested a bailout, and, one month later, it got one.

You see, EWI's global analysts like Whitmer don't follow the talking heads nor do they rely on fundamentals -- both of which can be misleading. Instead, they examine objective evidence and charts -- like this one -- to deliver crystal-clear, forward-thinking analysis.

Get FREE Access to the Report on the European Debt Crisis Now you can take control of your financial future with the prescient, objective insights of EWI's global analysis in a special FREE report. The European Debt Crisis and Your Investments equips you to get ahead of what is yet to come. You get 11 chart-filled articles loaded with our insights into the European debt crisis -- plus a special excerpt from Robert Prechter's New York Times bestseller Conquer the Crash. |

This article was syndicated by Elliott Wave International and was originally published under the headline Portugal's Bailout, One Year Later: Were You Prepared in Advance?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.