Gold “Bargain of Lifetime” As Gold Standard Inevitable, $10,000/oz Looms

Commodities / Gold and Silver 2012 Apr 26, 2012 - 07:37 AM GMTBy: GoldCore

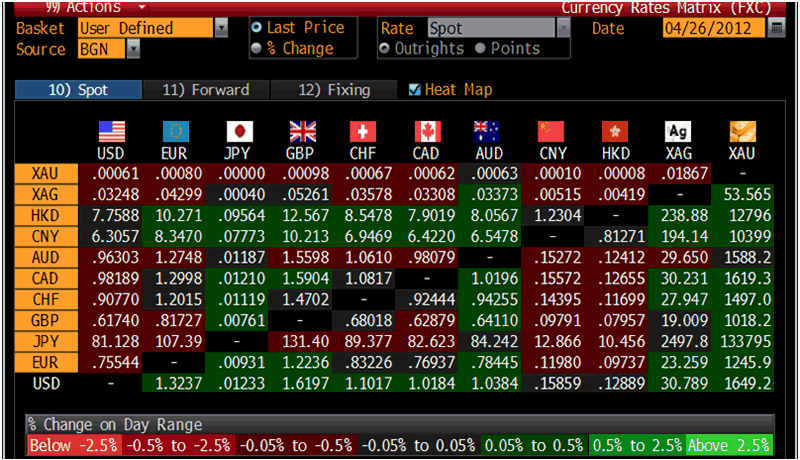

Gold’s London AM fix this morning was USD 1,648.25, EUR 1,246.22, and GBP 1,017.88 per ounce. Yesterday's AM fix was USD 1,641.25, EUR 1,241.49 and GBP 1,019.54 per ounce.

Gold’s London AM fix this morning was USD 1,648.25, EUR 1,246.22, and GBP 1,017.88 per ounce. Yesterday's AM fix was USD 1,641.25, EUR 1,241.49 and GBP 1,019.54 per ounce.

Silver is trading at $30.85/oz, €23.45/oz and £19.14/oz. Platinum is trading at $1,563.00/oz, palladium at $658.75/oz and rhodium at $1,350/oz.

After moves down and then up, gold finished $2.60 or 0.16% higher in New York yesterday and closed at $1,643.80/oz. Gold fell some $10 as the FOMC meeting commenced prior to going positive.

Gold gradually eked out gains in Asian and early European trading prior to seeing some weakness.

Cross Currency Table – (Bloomberg)

Support for gold is at $1,612/oz and resistance is at $1,663/oz and $1,684/oz.

Gold climbed on Thursday on concerns that the Fed could employ more QE in a further attempt to stimulate the economy. The Fed said that the economic conditions "are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014”.

Continuing ultra loose monetary policies and negative real interest rates continue to support gold.

The Fed has already engaged in 2 rounds of asset purchases near a massive $2.3 trillion, to drive down interest rates and in a vain attempt to stimulate the US economy. QE helped push up both equity and commodity prices by providing cheap money to investors who placed it in riskier assets.

Thus, QE is leading inflation pressures and there is a risk that the Fed, like other central banks, continues to underestimate the risk of inflation.

Bernanke said US monetary policy was "more or less in the right place" even though the central bank would not hesitate to launch another round of bond purchases if the economy were to falter.

Investors will examine efforts by Europe to solve the debt crisis after ECB President Mario Draghi called for a "growth compact" but put the blame on euro zone governments to sort out their economies.

The eurozone debt crisis is far from resolved and the next stage of the crisis could be even more volatile than the recent Greek saga.

Gold Standard Inevitable, Possibly Within Year - $10,000/oz Looms

Reuters TV have interviewed John Butler who says a return to the gold standard is "inevitable" possibly as soon as within the year and $10,000/oz gold is on the cards.

Jamie McGeever interviews Butler in the Goldsmith Hall in London about his opinions propounded in his new book, ‘The Golden Revolution : How to Prepare for the Coming Gold Standard.’

Butler has 18 years’ experience in the global financial industry, having worked for European and US investment banks in London, New York and Germany.

The book says that the era of paper currency is coming to an end and a return to a gold backed dollar is basically inevitable.

McGeever starts the interview by saying that far from gold being expensive at $2,000/oz, gold may be “the bargain of a life time” especially “if the world returns to some form of gold standard.”

Butler says that this “could happen as early as next year” due to BRIC nations dissatisfaction with the dollar reserve standard, “they will start to move formally back to gold”.

There are many ways that this can happen according to Butler including one country becoming a first mover, surprising the world and the United States, by pegging its currency to gold

He points out that Russia may be the country who could do precisely that.

This could lead to a run on the US dollar and financial assets and could see the dollar lose 20% in 24 hours as investors pour into real assets such as oil and gold. This could lead to a depression in the U.S.

There could be a Bretton Woods style “crisis meeting” where the U.S. decides it must reinstate the gold standard or else the dollar “may lose its reserve status entirely.”

Gold at $5,000/oz should happen and possibly over $10,000/oz in that scenario as gold will be a “de facto monetary asset in cross border balance of payments transactions”.

Reuters’ McGeever acknowledges how the “gold market is tiny” compared to “trillions and trillions of dollars worth of cash and assets sloshing around the world financial system.” He asks how can countries back “all of that” against such a “tiny and finite amount of gold?”

Butler responds by saying that “the amount of gold is finite by weight or volume, it is not finite by price.”

If gold is going to be remonetised it is entirely reasonable that “gold’s price will rise by an order of magnitude.”

Butler correctly points out that if gold were to rise to over $10,000/oz then in fact what you would have is a market capitalisation of gold, as it were, vis-à-vis the money supply and credit volume generally which is in line with a longer term comparison – it implies stability.

It is another must watch video and shows how consciousness regarding the value of gold as a finite asset and currency is gradually shifting with obvious ramifications for all who wish to protect and grow their wealth in the coming years.

Far from gold being a speculative bubble, as suggested by less informed economic experts and financial advisors, it may remain undervalued at below $2,000/oz and may be destined to reach much higher levels as gold reasserts itself as the global currency par excellence

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.