OMC Meeting: Nature of Economic Data Will Dictate Next Policy Step

Interest-Rates / US Interest Rates Apr 26, 2012 - 05:38 AM GMTBy: Asha_Bangalore

Forward guidance for monetary policy of a low federal funds rate through late 2014 was retained, with a 9-1 vote in favor of this stance. President Lacker of the Richmond Fed dissented as he “does not anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate through late 2014.”

Forward guidance for monetary policy of a low federal funds rate through late 2014 was retained, with a 9-1 vote in favor of this stance. President Lacker of the Richmond Fed dissented as he “does not anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate through late 2014.”

The outcome of the April 24-24 FOMC meeting needs to be examined under three separate segments – the policy statement, highlights of press conference, and forecast.

The Fed’s policy statement contained several minor but important modifications which suggest a marginal upgrade of the U.S. economy compared with the March policy statement. The comparison presented below leads one to conclude that the Fed is bit more optimistic about the economy today vs. its opinion about the economy at the March meeting.

Economy

April 25 - Expanding moderately

March 13 - Expanding moderately

Labor Market

April 25 - Labor market conditions have improved in recent months; the unemployment rate has declined but remains elevated

March 13 - Labor market conditions have improved further; the unemployment rate has declined notably in recent months but remains elevated.

Housing Market

April 25 - Despite some signs of improvement, housing sector remains depressed

March 13 - Housing sector remains depressed

Inflation

April 25 - Inflation has picked up somewhat, mainly reflecting higher prices of crude oil and gasoline. However, longer-term inflation expectations have remained stable

March 13 - Inflation has been subdued in recent months, although prices of crude oil and gasoline have increased lately. Longer-term inflation expectations have remained stable.

Forecast

April 25 - The Committee expects economic growth to remain moderate over coming quarters and then to pick up gradually

March 13 - The Committee expects moderate economic growth over coming quarters.

Global financial markets

April 25 - Strains in global financial markets continue to pose significant downside risks to the economic outlook

March 13:- Strains in global financial markets have eased, though they continue to pose significant downside risks to the economic outlook

At the press conference, Bernanke reiterated to a large extent his remarks on prior occasions when he has noted that Fed would step in and take appropriate action if economic conditions weaken or inflation numbers come in lower than levels consistent with price stability.

Sheila Bair, former head of the FDIC, holds the opinion that there is a bond market bubble in place and the Fed should declare victory and take necessary actions to deflate the bubble. This issue was raised at the press conference today. Chairman Bernanke indicated that it is premature to declare victory, given current economic conditions. He noted that low interest rates reflect the accommodative stance of monetary policy, weak economic conditions, low inflation expectations, and safe haven status of Treasury securities. He went on to say that as the economy gathers momentum, interest rates would advance to reflect these developments and investors should take their cues from the future trend of interest rates.

He was asked to substantiate about the Fed’s preference for a 2.0% inflation rate and why it was not willing to raise it. Bernanke stressed that the credibility of the Fed is the most important asset which cannot be compromised and pointed out that raising the level of inflation reduces the flexibility of the monetary policy options available to the Fed.

Bernanke restated his views about the reasons for a decline in the labor force participation rate as both structural and cyclical, with the latter being the predominant factor.

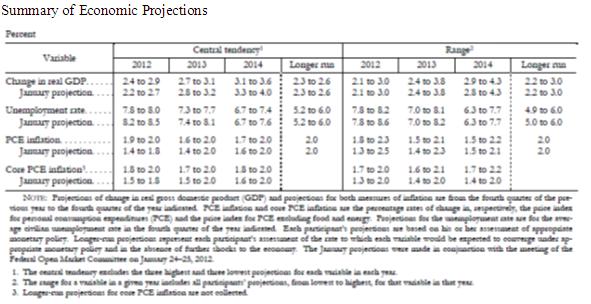

The Fed’s forecast of the economy shows a larger increase in real GDP, a lower unemployment rate, and higher inflation for 2012 (see table for details) compared with its projections in January 2012.

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20120125.pdf

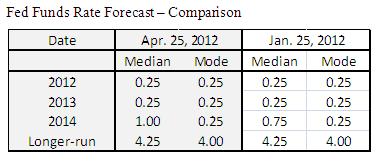

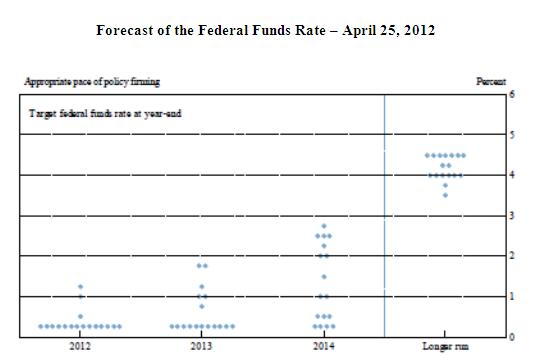

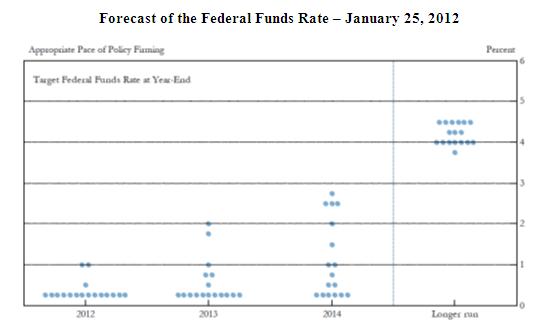

The Fed published its own forecast of the target federal funds rate for the years 2012 -2014 and for the longer-run. There is no attribution for the forecasts and all seventeen members of the FOMC (voting and non-voting members) provided their projections, see charts below Essentially, 11 members do not expect a tightening of monetary policy until 2014 and the forecast ranges from 0.25% -2.75% at year-end 2014. The median of the target federal funds rate forecast shows a 25 bps increase to 1.00% in 2014 vs. the January projection (see table), while the median and mode for other years were left unchanged. It should be noted that although 17 members provide the forecast, only 10 of them are voting members of the FOMC.

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20120425.pdf

Source: http://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20120125.pdf

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.