Russia and Mexico Both Buy Nearly $1 Billion Worth of Gold in March

Commodities / Gold and Silver 2012 Apr 24, 2012 - 06:12 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,638.75, EUR 1,244.68, and GBP 1,014.83 per ounce. Yesterday's AM fix was USD 1,632.00, EUR 1,240.97 and GBP 1,014.42 per ounce.

Gold’s London AM fix this morning was USD 1,638.75, EUR 1,244.68, and GBP 1,014.83 per ounce. Yesterday's AM fix was USD 1,632.00, EUR 1,240.97 and GBP 1,014.42 per ounce.

Silver is trading at $30.85/oz, €23.43/oz and £19.10/oz. Platinum is trading at $1,550.00/oz, palladium at $671.25/oz and rhodium at $1,350/oz.

Gold fell $3.80 or 0.23% in New York yesterday and closed at $1,638.20/oz. Gold has been trading mostly sideways in Asia and within a narrow 8 point spread. In European trading it remains near the close seen in New York yesterday.

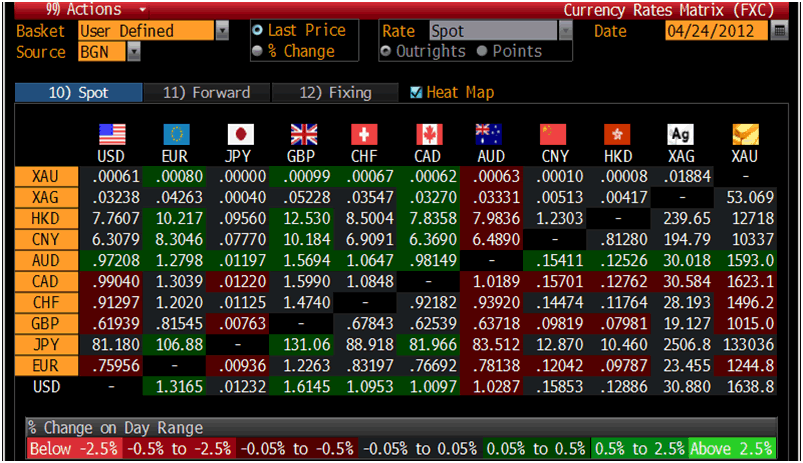

Cross Currency Table – (Bloomberg)

The perfect storm trifecta of bad political and economic news yesterday out of France, Holland and Germany led to risk off and falls in many markets. Gold performed well and was resilient considering the sell off seen in equity markets.

Dutch Prime Minister Mark Rutte speaks in parliament today after tendering his Cabinet’s resignation to break a deadlock over further austerity.

French President Nicolas Sarkozy and Francois Hollande will face off in a 2nd round ballot on May 6th and the prospect of Hollande taking power is making European markets jittery.

The euro region has government debt at 87.2% of GDP last year, which is the highest since the start of the euro in 1999.

Manufacturing data from Europe and China contracted in data released yesterday showing how economic conditions appear to be deteriorating.

With the euro zone political landscape in crisis mode and data showing business contracting many investors are putting their capital in dollars and US Treasuries.

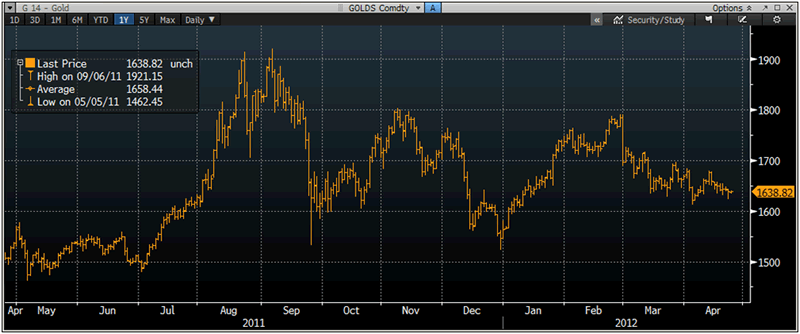

Gold 1 Year Chart – (Bloomberg)

So far gold has not been a prime beneficiary of these risks but this will likely change soon – especially if financial conditions deteriorate which seems very likely.

Gold has recently displayed short term correlations with paper assets such as equities and bonds but these correlations will again be shown to be fleeting as gold’s long term inverse correlation with paper assets will reassert itself in the coming months.

Mexico, Russia and Central Banks Continue Diversifying into Gold

While gold demand from the western investors and store of wealth buyers has fallen in recent months, central bank demand continues to be very robust and this is providing strong support to gold above the $1,600/oz level.

IMF data released overnight shows that Mexico added 16.8 metric tons of gold valued at about $906.4 million to its reserves in March.

Russia continued to diversify its foreign exchange reserves and increased its gold reserves by about 16.5 tons according to a statement by its central bank on April 20.

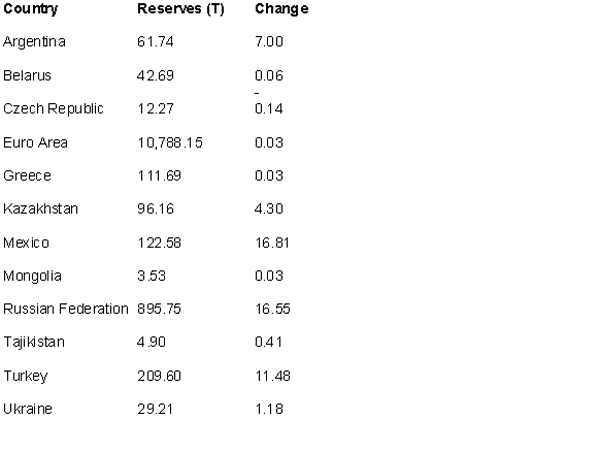

Changes to Gold Holdings in IMF (March) - Reuters Global Gold Forum

Other creditor nations with large foreign exchange reserves and exposure to the dollar and the euro including Turkey and Kazakhstan also increased their holdings of gold according to the International Monetary Fund data.

Mexico raised its reserves to 122.6 tons last month when gold averaged $1,676.67 an ounce.

Turkey added 11.5 tons, Kazakhstan 4.3 tons, Ukraine 1.2 tons, Tajikistan 0.4 ton, and Belarus 0.1 tonnes, according to the IMF.

Ukraine, Czech Republic and Belarus also had modest increases in their gold reserves.

Central banks are expanding reserves due to concerns about the dollar, euro, sterling and all fiat currencies.

There is an increasing realisation amongst central bankers that gold is a less risky alternative to most paper currencies and a recent survey showed that that majority of central bank reserves managers were favourable towards gold.

Signifying the mood of caution among the world’s central bankers, 71% of those polled said gold was a more attractive investment than it had been at the start of last year.

Central banks added 439.7 tons last year, the most in almost five decades, and may buy a similar amount if not more in 2012, the World Gold Council and many analysts believe.

Turkey’s central bank increased the proportion of required reserves that commercial banks can deposit in gold last year. The changes have increased the amount of bullion the country, which owns 209.6 tons, declares in its official reserves.

Gold accounts for about 3.9 percent of Mexico’s total reserves and 9.7 percent of Russia’s, according to the World Gold Council. That compares with more than 70 percent for the U.S. and Germany, the biggest bullion holders, the data show.

The IMF data records the People’s Bank of China data showing that at the end of March China’s gold reserves remained unchanged at 33.88 million ounces.

This seems hard to believe and it remains likely that China is again quietly accumulating gold reserves and the PBOC will announce a material increase in their reserves when they are ready to do so.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.