Gold and Silver COT (CFTC – Commitment of Traders)

Commodities / Gold and Silver 2012 Apr 22, 2012 - 06:17 AM GMTBy: Submissions

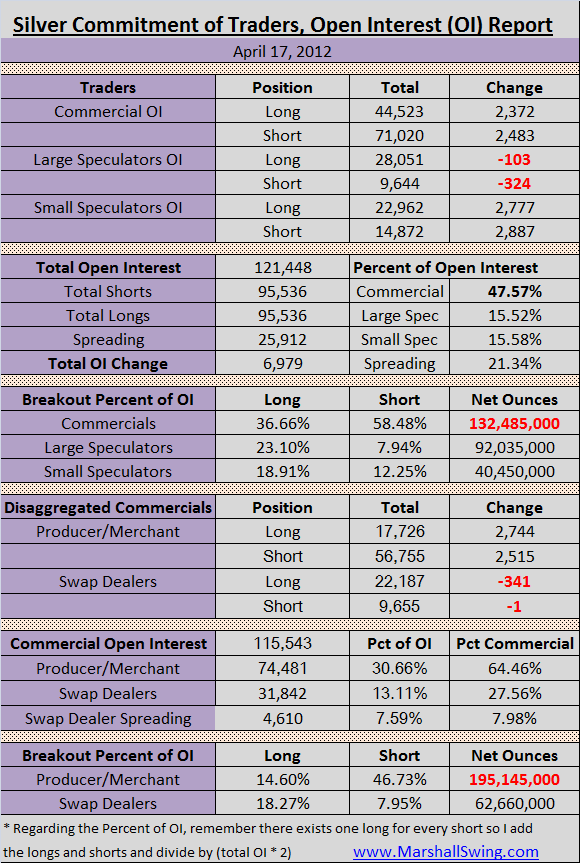

Marshall Swing writes: Commercials added 2,372 longs and 2,484 shorts to end the week with 47.57% of all open interest 132,485,000 ounces net short, a small increase of 555,000 ounces.

Large speculators netted only -103 contract longs and covered -324 shorts for a net long position of 92,035,000 ounces, a increase of almost 1,105,000 ounces from the prior week.

Small speculators bought 2,777 longs and accumulated 2,887 shorts for a net long position of 40,450,000 ounces a decrease of over 550,000 ounces from the prior week.

In the disaggregated Commercials, the Producer/Merchant is short 195,145,000 ounces while the Swap Dealers are long 62,660,000 ounces.

It is certainly going to be interesting to find out what some of the the small speculators are thinking by adding this huge amount of shorts. Remember the small speculators are many players as compared to the other categories. Obviously some of them are betting on a near future price drop in the silver metal. Note that now the shorts of the small speculators far outnumbers the shorts of the long speculators. The small have amassed 14,872 short contracts and are really sticking their necks out on the line. We may be about to witness a rise in the silver price to shake out those shorts followed by a quick drop to scare away their longs. What are our little guys thinking?

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.