Euro-zone Collapse, And Yet Another PIIGS Bites the Dust

Stock-Markets / Financial Markets 2012 Apr 20, 2012 - 06:41 AM GMTBy: Adam_Brochert

To all those who say that deflationary collapses cannot happen in paper monetary systems, I ask you: don't the PIIGS-ies of Europe count? Because they're all falling, one right after the other, like dominoes. Today, the Spanish stock market ($SMSI) closed below its spring, 2009 lows. Here's a 5 year weekly chart through today's close:

To all those who say that deflationary collapses cannot happen in paper monetary systems, I ask you: don't the PIIGS-ies of Europe count? Because they're all falling, one right after the other, like dominoes. Today, the Spanish stock market ($SMSI) closed below its spring, 2009 lows. Here's a 5 year weekly chart through today's close:

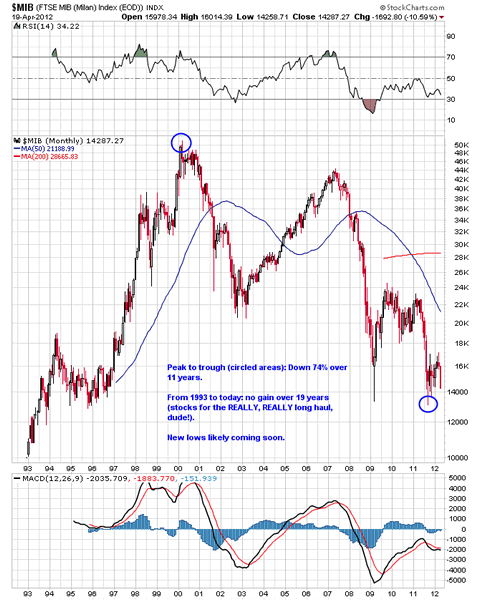

Spain joins Greece, Portugal and Italy in slow motion deflationary stock market crashes. Italy (Milan [$MIB] Index) did a peek-a-boo below the spring, 2009 lows in 2011, and then had a weak rebound. It looks set to break to new lower lows soon. Here's a 20 year monthly chart of $MIB thru today's close:

These are modern-day examples of deflationary stock market collapses right in front of our eyes. Those who say the bankstaz would never let it happen just don't want to face reality. Bankers can profit from both deflation and inflation. Who do you think is going to buy up the assets in these European countries for pennies on the dollar (after they print themselves up some fresh new money)? Now, I don't suspect that the larger economies with their own printing presses are going to go this route quietly, but Japan sure doesn't seem to have the inflationary central banksta rescue thing down so far after 22 years.

Unlike many Gold bulls, I don't see stocks as a better play than cash or US bonds here. I am not a buy and hold investor of these asset classes (that's what Gold is for), but I don't expect the US bond market to crater any time soon with a global recession in the works. I also really like the US Dollar right now as a trade. I know it's blasphemy for a Gold bull to talk of US Dollar strength (relative to other paper currencies), but that's what I see coming.

Will Gold survive a US Dollar rally? Is it remotely possible? Of course. Not every US Dollar rally causes a 2008-style meltdown. All currencies are sinking relative to Gold, simply at different rates (trampoline jumping is what I like to call it). The bears in the PM sector are out in force and I even watched a recent interview (hat tip to John Rubino at dollarcollapse.com for the link) talking about the Gold "bubble" collapsing with a book to back it up (an "author" sound more authoritative than a "blogger," eh?) - here's the link for those interested in hearing the other side of the debate.

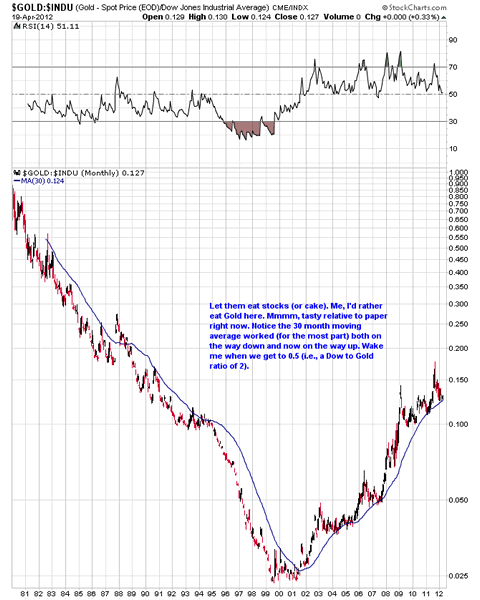

Me? I'll stick with Gold. It's a no-brainer for the long term. Short-term? Sure, we can correct more. I would love a dip below $1600 to shake out a few more weak hands while Gold stocks take one more dive before starting a new cyclical bull market. But these are short-term, casino-related concerns, not the big picture. The big picture is shown below, a monthly chart of the Gold to Dow ratio ($GOLD:$INDU) from 1980 thru today's close:

Its stocks, real estate, cash, bonds or hard assets. I'll take cash in a secular economic contraction/Kondratieff winter/economic depression. However, I prefer cash that cannot be debased by decree, so I'll stick with Gold. I want to be like a banksta with the money left over to buy assets for pennies on the dollar some day when the house of cards finishes falling. The nice thing about Gold is that this will work in both a deflationary or hyperinflationary poop storm. Those who say Gold isn't a good hedge against deflation haven't studied their history. One of the hallmarks of a depression is that the purchasing power of Gold rises, which has been happening since 2000. The Gold to Dow ratio is only one example. Try the Gold to real estate ratio (in most parts of the world), Gold to commodities ratio or Gold to bonds ratio. They all add up to the same thing: Gold continues to trump other asset classes and this trend is nowhere near completion. And yes, I am aware of what happened to Gold in the fall of 2008. For anyone asking: are you aware that Gold was back at $1000/oz by February of 2009 (i.e. net flat during the deflationary crash) while stocks kept right on going lower into their March lows?

Having settled the long term (in my own mind, at least), I still enjoy the short term. Short term tactics are technically based, not fundamentally based. Trading is a tough game and 95% of traders fail. I like the game and have learned to be quite good at it, but it is not for everyone. I will go long or short any asset class if I think there is money to be made when trading (for example, I have a short position in Gold stocks right now). As for investing, however, you couldn't get me to touch paper cash, bonds, most real estate, or most common stocks with a ten foot pole. I'll become a paperbug again, but only once we have reached reasonable historical metrics to support such a move (e.g., how about a dividend yield for the average common stock in the 7-10% range?).

Right now, my subscribers and I are waiting to buy the next low in the precious metals patch, which is certainly close to being here. If this pending low isn't "THE" low, it won't matter to me from a trading perspective, because I can still make a lot of money trading "a" low. If you are crazy enough to try to trade with a portion of your capital, consider trying my low-cost subscription service. A one month trial is only $15. If you're too smart to take that kind of risk, then hold onto to your shiny, precious, edible Gold until the Dow to Gold ratio hits 2 (and we may well go below 1 this cycle).

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.