How to Handle an Economic Implosion, Conquer the Crash Collection

Stock-Markets / Financial Crash Apr 20, 2012 - 12:55 AM GMTBy: EWI

I came across some research on the subject of worry. Here's how it was presented:

I came across some research on the subject of worry. Here's how it was presented:

Things People Worry About:

- things that never happen - 40%

- things which did happen that worrying can't undo - 30%

- needless health worries - 12%

- petty, miscellaneous worries - 10%

- real, legitimate worries - 8%

Of the legitimate worries, half are problems beyond our personal ability to solve. That leaves 4% in the realm of worries people can do something about.

I thought about our gigantic national debt and weak economy. These seem to fit into both subcategories of "real" worries. You can't do much as an individual to solve the nation's debt and economic problems, yet you can prepare for a worsening economic downtrend.

Do we see evidence for an economic turn for the worse?

Well, consider that the evidence is so overwhelming that it took 456 pages of the second edition of Robert Prechter's book, Conquer the Crash, to cover it. And since that book published, Prechter has consistently devoted his monthly Elliott Wave Theorist to the facts and evidence behind his forecast.

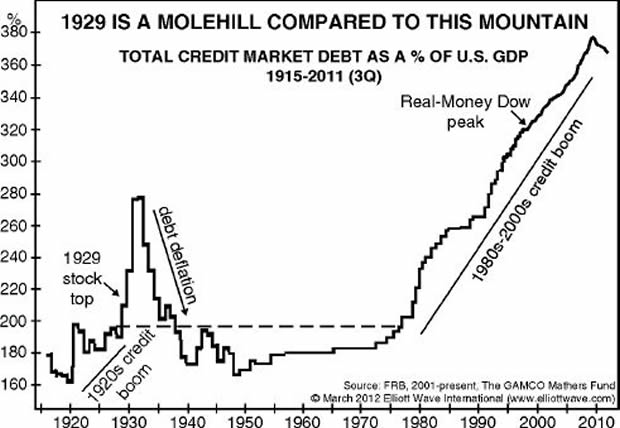

Here's a chart from the book that was updated by Elliott Wave International in March 2012:

The downturn from 2008 is critically important, as it shows that after an almost unbroken 60-year climb, the contraction is underway. It surely has much further to go, because it is still a third higher than it was at the outset of the last debt deflation in 1929.

-- The Elliott Wave Financial Forecast, March 2012

The rating agencies are well aware of what the above chart means. You probably know that Standard & Poor's downgraded U.S. debt from the nation's long-standing triple-A to AA+. Now, another rating agency has taken their rating even lower:

Rating firm Egan-Jones cuts its credit rating on the U.S. government to "AA" from "AA+" with a negative watch, citing a lack of progress in cutting the mounting federal debt.

-- CNBC.com, April 5

Robert Prechter's bestseller, Conquer the Crash, provides practical information about what you can do to protect your finances in the coming economic implosion. And right now, Elliott Wave International is offering 8 lessons from Conquer the Crash in a free 42-page report that covers:

- What to do with your pension plan

- How to identify a safe haven

- What you should do if you run a business

- A Short List of Imperative "Dos" and Don'ts"

- And more

In every disaster, only a very few people prepare themselves beforehand. Discover the ways you can be financially prepared and safe.

Get Your FREE 8-Lesson "Conquer the Crash Collection" Now >>

This article was syndicated by Elliott Wave International and was originally published under the headline How to Handle an Economic Implosion. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.