Gold Still a Long Term Hedge and Less Volatile than Equities

Commodities / Gold and Silver 2012 Apr 19, 2012 - 10:14 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,642.00, EUR 1,249.91, and GBP 1,022.73 per ounce. Friday's AM fix was USD 1,646.50, EUR 1,258.41and GBP 1,030.80 per ounce.

Gold’s London AM fix this morning was USD 1,642.00, EUR 1,249.91, and GBP 1,022.73 per ounce. Friday's AM fix was USD 1,646.50, EUR 1,258.41and GBP 1,030.80 per ounce.

Silver is trading at $31.57/oz, €24.06/oz and £19.69/oz. Platinum is trading at $1,582.50/oz, palladium at $657.20/oz and rhodium at $1,350/oz.

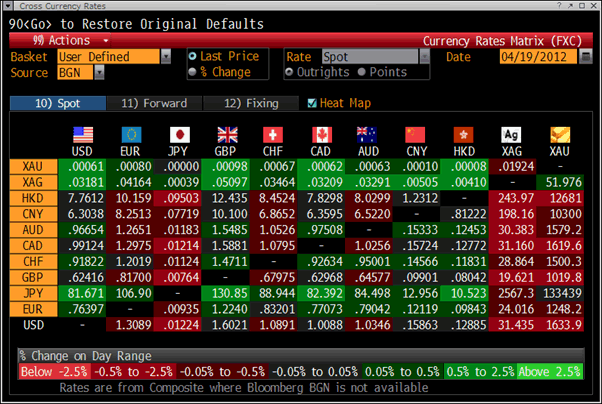

Cross Currency Table – (Bloomberg)

Gold dipped $10.90 or 0.66% in New York and closed at $1,639.30/oz yesterday. Gold initially traded sideways to lower in Asia then started gaining in early European trading.

Gold prices remained steady today after recovering from four sessions of mild losses. Worries that Spain’s debt problems would hurt the euro saw investors move into US Treasuries and German bunds and saw gold supported.

While the Spanish auction was a success this morning leading to increased risk appetite, the risk of contagion remains and this should support gold.

Competitive currency devaluations continue and the BRIC’s are becoming more aggressive in this regard.

Brazil joined India in aggressively cutting interest rates. Brazil cut by 75 basis points to 9%, its sixth straight reduction since August. Official figures show that annual inflation remains quite high at 5.24 percent in March.

Also bullish for gold is China’s central bank statement that “it plans to increase the reverse repo operations and cut the reserve requirement ratio to increase liquidity supply at an appropriate time.”

Data published for market watchers includes the following: 12.30 (GMT) US Weekly Jobless claims, 2.00 (GMT) US Existing home sales for March, 2.00(GMT) Eurozone Consumer Confidence for April, 2.00 (GMT) Philadelphia Fed business activity index for April.

Gold Still a Long Term Hedge and Less Volatile than Equities - WGC

Gold was one of the few asset classes to deliver positive returns last year, and its price appreciation was generally higher in currencies other than the US dollar, the World Gold Council notes in its report on Q4 investment statistics and commentary yesterday.

The World Gold Council notes that over the past 37 years, gold has shown a negative correlation with stocks.

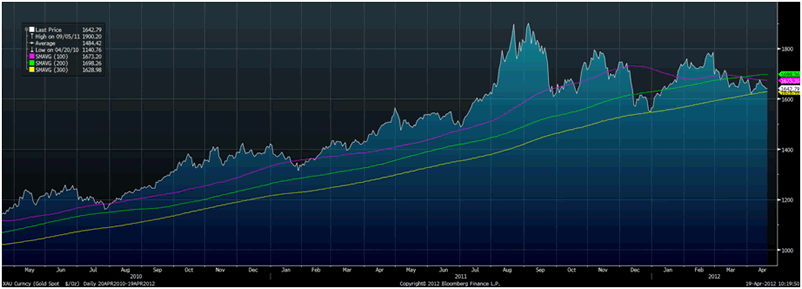

Gold in USD (Simple Day Moving Averages – 100, 200, 300)

“Put simply, gold has not had a significant relationship with equities. The price of gold is driven by a unique set of factors, often quite at odds with those driving other assets, particularly equities. Infrequently these factors coincide, and also equally infrequently, equities and gold will move in the same direction, but not for the same reasons.”

The recent apparent short term correlation between gold and stocks is just that - short term.

Gold’s weakness has been again due to dollar strength and the dollars often strengthen when stocks fall.

In recent years, stocks have tended to fall when the U.S. dollar is rising, and vice versa – and gold tends to move in the opposite direction to the dollar and other fiat currencies.

“While the short-term daily correlation between gold and the S&P 500 might indicate a slightly positive correlation in the recent period, long term correlations remain at or close to zero,” the WGC said in its report. “In other words, the inclusion of the U.S. dollar as an explanatory variable to gold prices makes the S&P 500 beta insignificant.”

Importantly, the long term correlation of gold to equities remains statistically insignificant.

The WGC points out that while gold’s price volatility increased during August and October, it rose less than that of the equity market – illustrated in the S&P 500 volatility – which is what typically occurs during periods of higher uncertainty in financial markets.

As such, while gold prices were not immune to the effects of financial markets swings, its volatility was considerably more stable than that experienced by equities.

While the World Gold Council is an advocacy body for the gold industry, their research is highly rigorous and has yet to be contradicted – even by certain PhD economists who declared gold a bubble at $1,000/oz and said spam was a superior safe haven.

The excellent research can be read here and is a must read for anyone who wishes to protect and grow wealth in the coming years and for all investment providers and advisers who take their fiduciary duty seriously

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.