Gold Silver and Bear Raid Breaks Momentum

Commodities / Gold and Silver 2012 Apr 18, 2012 - 09:27 AM GMTBy: Jesse

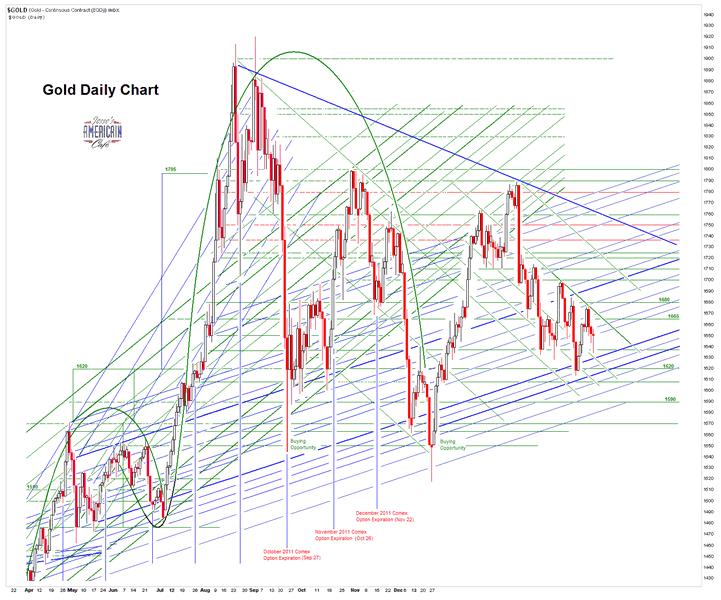

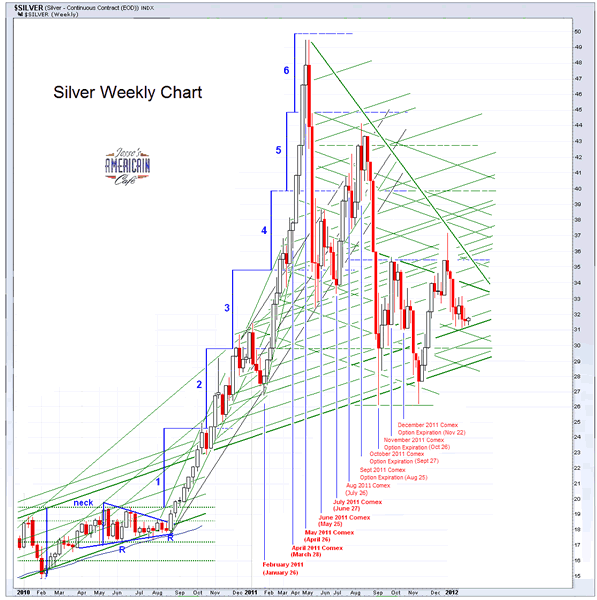

The paper money munchkins and metal bears are making their stand for gold at $1650 and silver at 32. That seems fairly obvious. They will hold it until they cannot, and then will fall back to defend a slightly higher price level. I like to think of it in American football terms. The bulls are going for a first down, and the bears are trying to hold them back.

The paper money munchkins and metal bears are making their stand for gold at $1650 and silver at 32. That seems fairly obvious. They will hold it until they cannot, and then will fall back to defend a slightly higher price level. I like to think of it in American football terms. The bulls are going for a first down, and the bears are trying to hold them back.

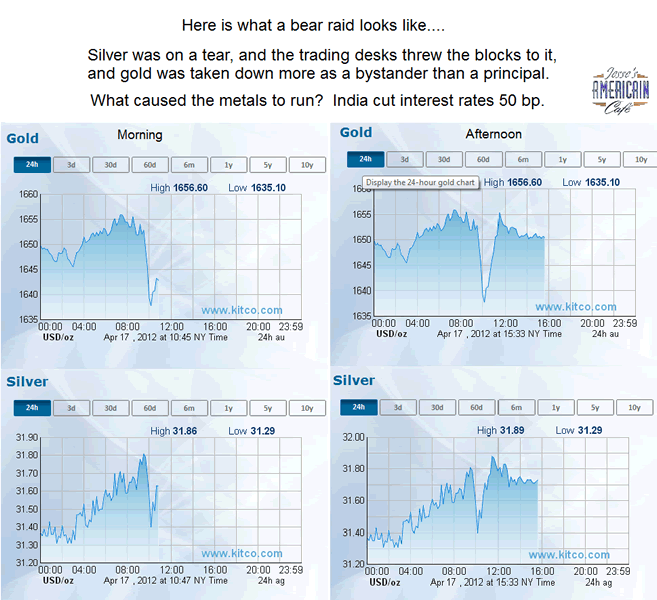

Silver came in this morning with some serious momentum, and so we saw a fairly quick and sharp bear raid. See the first chart. Yes, the bear raid 'failed' but it broke the upward momentum which was the point.

Silver registed for delivery at the Comex is down to historically low levels again. They will have to be replenished before the next big delivery month.

Some of the commentators are remarking on the unusually low open interest in gold at Comex. While that could be a bullish or bearish indicator depending on how you wish to twist it, it could also very well indicate that the players are shunning the US futures market and so volume is down. Before these scandals work themselves out I expect it to fall much lower.

India cut its interest rate by 50 basis point, and this was most likely the fundamental reason for the rally in commodities and stocks.

It looks like the metals and stocks are moving together again, so one might put the long metal short stocks hedge back on again.

http://jessescrossroadscafe.blogspot.com

By Jesse

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2012 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.